Record mining power keeps rising while miner earnings fall. Higher costs leave many miners short on cash, so they sell more bitcoin.

Bitcoin’s mining network keeps hitting new highs, but miner earnings are dropping fast. With more competition and higher expenses, many miners now sell part of their bitcoin to stay afloat.

This is due to record computing power, weaker revenue per unit, and rising operating costs that make it harder for miners to hold their coins.

RECOMMENDED: Crypto Crash Reset: Is This The Moment For Bitcoin, XRP, And Solana To Lead The Rebound?

Bitcoin Hashrate Keeps Rising While Hashprice Drops

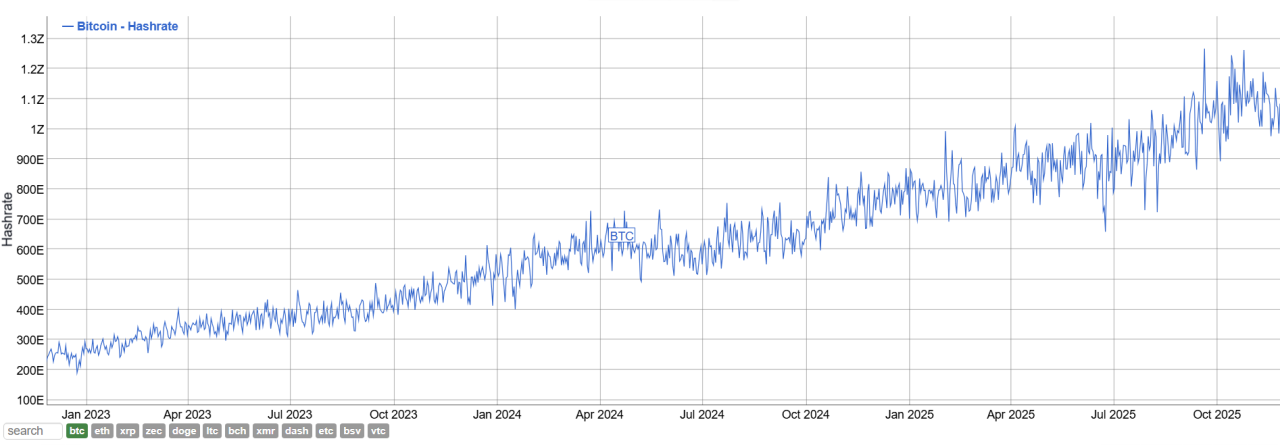

Bitcoin’s hashrate reached about 1,082 EH/s, which shows how much computing power miners add to the network. More machines mean tougher competition for the same block rewards.

As a result, Bitcoin hashprice, which measures how much miners earn per unit of computing power, slipped below $40 per PH/s. This is one of its weakest points in years.

When hashprice falls this low, miners bring in less money even though their energy use stays the same. Hashrate also grew about 5% in a single month, which tightened margins further and pushed weaker operators to consider selling part of their bitcoin holdings.

RECOMMENDED: Bitcoin Outlook For December: Will It Reclaim $100,000?

Bitcoin Mining Costs Keep Climbing And Squeeze Profit Margins

Electricity, repairs and new equipment already make mining expensive. Recent estimates put the average production cost above $111,000 per BTC for many miners. Over the last two months, miner revenue also dropped about 35%.

This combination stretches payback times for new ASIC machines and reduces cash available for daily operations. When cash flow tightens, Bitcoin miners turn to their reserves. Some also rely on credit, which increases short-term obligations and leads to even more selling when due dates approach.

ALSO READ: Bitcoin Price Forecast: Can It Hit $150,000 in 2025?

Miner Selling Adds Extra Pressure To The Market

On-chain data shows Bitcoin miner reserves falling as more coins move to exchanges.

When large amounts of bitcoin enter the market at once, it adds supply and can speed up short dips in price.

These selling waves often explain sharper corrections during times when miner margins weaken, even if overall demand stays steady.

RECOMMENDED: Will Bitcoin Break Out in November? What ETF Flows and CPI Trends Reveal

Conclusion

Miner selling today comes from tight economics rather than panic. Higher competition, shrinking earnings and heavier costs push miners to sell more bitcoin, and those flows can influence short-term price swings.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower