Bitcoin’s record highs, rising institutional adoption, and clearer regulation signal strong long-term potential, making now a compelling entry point.

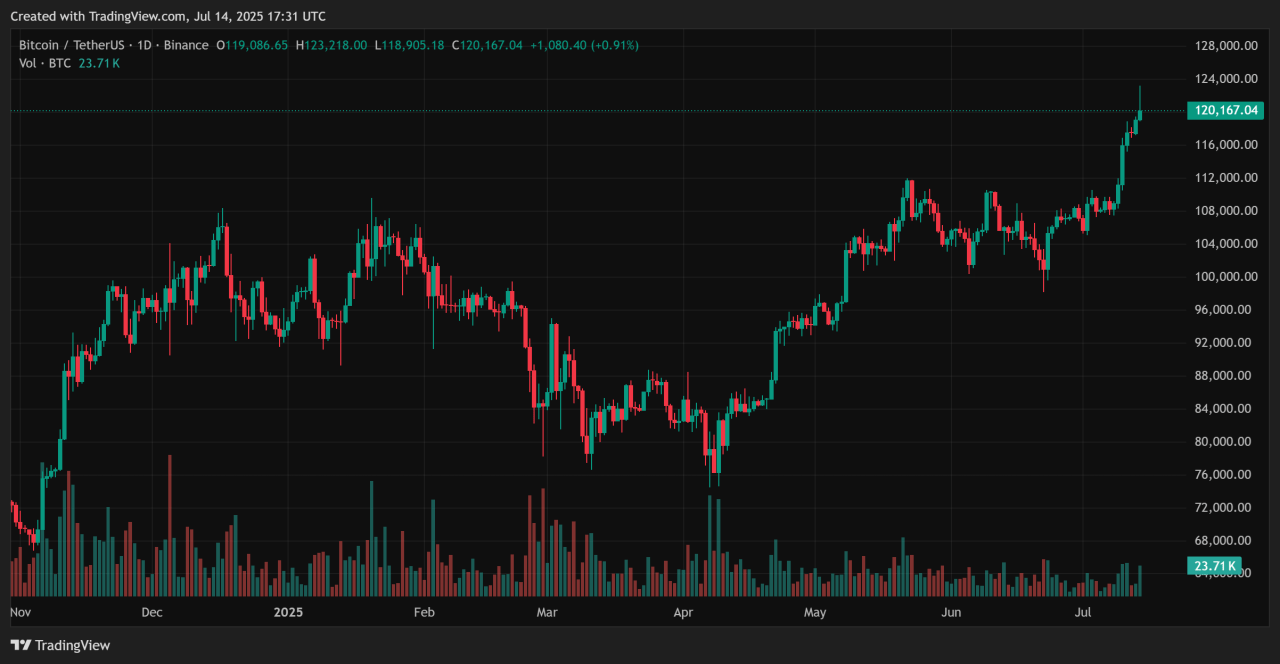

Bitcoin just notched new all-time highs near $123,000 in mid‑July 2025 largely due to institutional demand and record ETF inflows. With a 25‑30% YTD gain and volatility cooling to multi‑year lows, many now view Bitcoin as a mature financial asset, not just a speculative token.

Let’s explore investing in Bitcoin now is still a good idea.

Growing Institutional and Corporate Support

Financial giants like BlackRock, Fidelity and others have launched spot Bitcoin ETF products, funneling billions into BTC, over $3.4 billion just in early July and $51 b since January. BlackRock’s fund alone holds 700K+ BTC (~$84 b).

At the same time, corporate treasury strategies intensified: public companies now control ~847K BTC, a 23% increase in Q2. This flood of institutional capital strengthens Bitcoin’s standing as digital gold and validates it as a core portfolio asset.

Evolving Regulatory and Macro Backdrop

U.S. lawmakers are advancing major crypto legislation – GENIUS and CLARITY Acts alongside a ban on CBDCs – bringing clearer rules and legitimacy.

President Trump’s March executive order also established a strategic bitcoin reserve, positioning BTC alongside gold in national reserves.

Meanwhile, easing interest rates and economic pressures drive demand for macro hedges – and Bitcoin is benefiting.

Outlook for Continued Growth

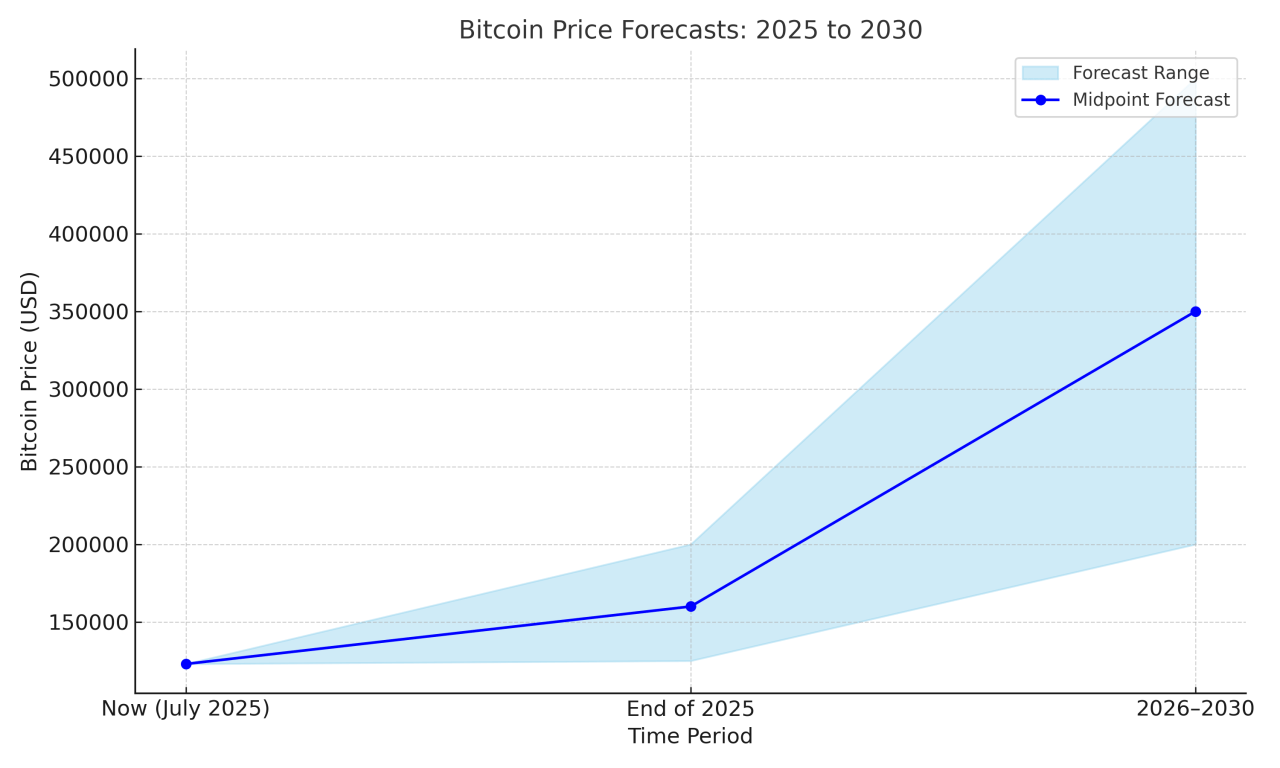

Top analysts see room to run. Near‑term forecasts place Bitcoin between $125K–$160K, with some models aiming $200K by year‑end.

Longer‑term projections remain bullish: Bank of America calls it an “institutional” currency, and forecasts range from $200K to $500K by 2026–30. With rising correlations to broad markets, Bitcoin increasingly behaves like a mainstream investment.

Conclusion

Yes, Bitcoin’s past explosive returns may not replicate, but its transition into a stable, institution‑backed asset with regulatory clarity and macro drivers provides a stronger foundation for long‑term growth.

If you haven’t yet invested, consider a strategic, small allocation – using dollar‑cost averaging – to ride the institutional Bitcoin adoption wave and secure exposure to this emerging macro hedge.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)