KEY TAKEAWAYS

- Institutional ETF flows have moved real capital into Bitcoin, increasing potential for sizable, rapid price swings tied to fund flows.

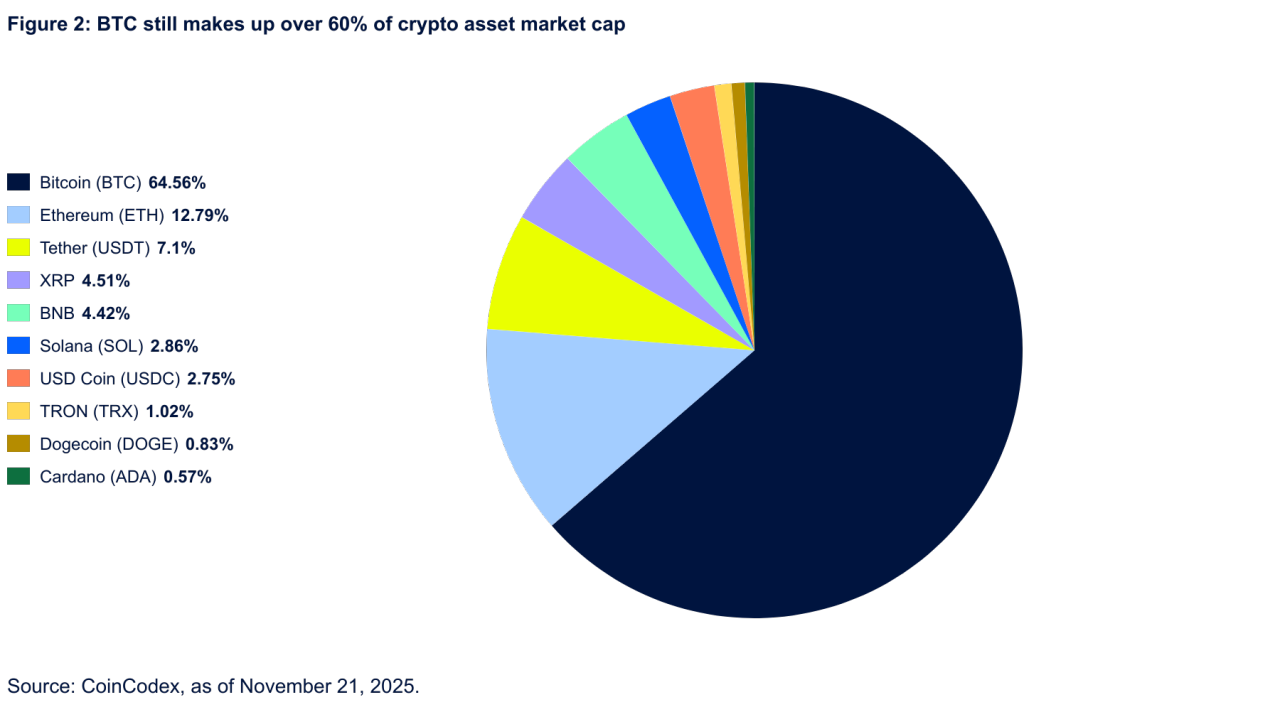

- Total crypto market liquidity concentrates in a few large tokens; that concentration magnifies both rallies and corrections.

- Layer-1 and Layer-2 adoption remain primary technical indicators to watch for outsized gains in application tokens.

- Infrastructure tokens (oracles, bridges, indexers) tend to outperform when on-chain activity and TVL rise.

- Position size and liquidity rules matter: allocate smaller amounts to higher-volatility mid-caps and keep stop rules in place.

Here is investing Haven’s rundown of the top 12 Cryptocurrencies with explosive potential for 2026.

Institutional liquidity, on-chain adoption, strong tokenomics, and clear catalysts drive explosive crypto gains, balanced through disciplined allocation and risk management.

The crypto market sits at roughly $3.05 trillion in total market cap, with Bitcoin accounting for about $1.75 trillion and Ethereum about $357 billion.

Institutional products for Bitcoin collected roughly $103 billion in ETF AUM during 2025, and trading liquidity concentrated in a handful of large tokens shapes price moves.

This shows there is opportunity for huge gains in crypto and with the right strategy you can increase your investment exponentially.

In this article we look at the top cryptocurrencies to buy with explosive potential.

The Top Cryptocurrencies With Explosive Potential

1. Bitcoin (BTC)

Bitcoin is the largest crypto by market cap and remains the primary institutional vehicle for crypto exposure. In fact, Bitcoin’s share of total crypto value frequently sits above 60%.

We may see an explosive move from Bitcoin in 2026 after the pull back at the end of 2025.

U.S. spot Bitcoin ETFs reached roughly $103B in AUM in 2025, which increased institutional holdings and made large, fast flows more common.

That concentration of capital means BTC often leads major market moves and absorbs big buys or sells with less slippage than smaller tokens.

Reasons To Buy Bitcoin In 2026

- Deep liquidity lets large players move meaningful capital without crushing order books.

- Regulated ETF access creates recurring demand from institutions and funds.

Reasons To Avoid Bitcoin

- Macro selloffs or ETF outflows can produce sharp declines despite liquidity.

RECOMMENDED: 5 Reasons To Buy Bitcoin (BTC) Today

2. Ethereum (ETH)

Ethereum supports the largest smart-contract ecosystem; DeFi TVL and rollup activity grew strongly after the Dencun-era upgrades.

Upgrades that prioritize rollups and economic clarity increase usable capacity and can shift fee dynamics, which affects ETH staking economics and demand. Watch L2 activity and major upgrade timetables for precise catalysts.

Ethereum could see some explosive movement in 2026 if overall Cryptocurrency sentiment improves.

Reasons To Buy Ethereum In 2026

- Widespread developer activity across DeFi, NFTs, and L2s creates measurable on-chain demand.

- Protocol upgrades reduce long-term friction and can raise ETH’s utility.

Reasons To Avoid Ethereum

- Fee spikes still occur under heavy demand; short-term user churn can hit application tokens.

- Competition from fast L1s may slow some marginal growth.

RECOMMENDED: 5 Reasons to Buy Ethereum (ETH) Today

3. Solana (SOL)

Solana offers very high throughput and low transaction costs.

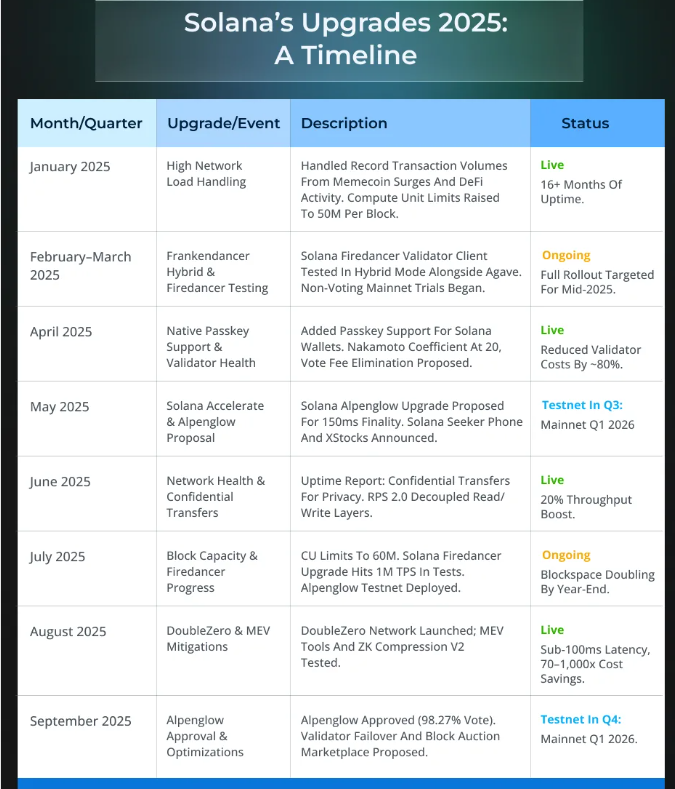

In 2025 Solana rolled out major client and validator improvements designed to increase resilience and throughput; those technical steps aim to cut validator costs and support higher institutional use.

Solana’s ecosystem shows strong NFT, gaming, and payments activity when uptime stays high.

Reasons To Buy Solana in 2026

- Low fees and fast settlement attract consumer apps and high-frequency on-chain use.

- Technical upgrades seek to address past stability limits and boost capacity.

Reasons To Avoid Solana

- Past outages and centralization concerns raise execution risk for mission-critical apps.

- Sentiment swings on performance can cause quick user flight.

RECOMMENDED: Is Solana A Good Investment Right Now?

4. XRP (XRP)

XRP focuses on cross-border payments and settlement.

The long-running SEC legal dispute concluded with settlements and regulatory clarity in 2025.

This cleared a major problem and enabled new institutional products such as spot XRP ETFs.

Those developments created a clear, tradable catalyst that shifted demand dynamics for XRP.

2026 could be an explosive year for XRP and we are bullish with our XRP price forecast for 2026.

Reasons To Buy XRP in 2026

- Regulatory resolution removed a material legal risk and opened institutional channels.

- ETF listings reduce friction for large buyers and can lift liquidity.

Reasons To Avoid XRP

- Token distribution and concentration remain questions for some investors.

- Adoption in cross-border corridors still requires partner integrations.

RECOMMENDED: 5 Reasons to Buy XRP

5. Binance Coin (BNB)

BNB serves utility roles within the Binance ecosystem for fee discounts, staking, and BNB Chain dApps.

Binance maintains active token burn programs that tighten supply, while the firm simultaneously works through global regulatory reviews and compliance initiatives.

BNB reacts strongly to exchange-level news because its core utility links to Binance’s product set.

2025 was explosive for Binance coin and this trend could continue into 2026.

Reasons To Buy Binance Coin in 2026

- Built-in utility inside a large trading and product ecosystem supports recurrent demand.

- Periodic token burns reduce circulating supply over time.

Reasons To Avoid BNB

- Regulatory or reputational issues tied to the exchange can quickly depress BNB.

- Heavy dependency on one corporate entity concentrates operational risk.

RECOMMENDED: 5 Powerful Reasons to Buy BNB in 2025

6. Chainlink (LINK)

Chainlink supplies oracles and cross-chain messaging that connect real-world data and systems to blockchains.

In 2025 Chainlink moved into larger institutional integrations, including CCIP work with major financial infrastructures and partnerships that enable tokenized real-world assets.

Those integrations broaden utility and can push demand if token usage rises with on-chain tokenization.

Chainlink’s charting structure coming in 2026 looks bullish and could prove to be explosive according to our latest price prediction for LINK.

Reasons To Buy Chainlink in 2026

- Central infrastructure role makes Chainlink a repeated buyer target for projects that need reliable data.

- Institutional integrations increase the addressable market for oracle services.

Reasons To Avoid Chainlink

- Oracle demand does not always translate directly to token demand; on-chain usage must grow.

- Competing oracle solutions could capture niche use cases.

RECOMMENDED: 5 Reasons to Buy Chainlink (LINK) in 2025

7. Cardano (ADA)

Cardano is a proof-of-stake blockchain built with a strong focus on research, security, and long-term sustainability.

Instead of rushing upgrades, the network rolls out changes in clear stages, adding features like on-chain governance and better tools for developers.

Recent data shows a steady rise in smart contracts, native tokens, and total value locked, pointing to gradual but real usage growth.

ADA is also widely staked, with a large share of supply locked in the network, which helps support demand.

Reasons to buy Cardano (ADA) In 2026

- Predictable upgrades and formal governance lower the risk of sudden protocol changes.

- Growth in tokenized assets and staking participation supports long-term network activity.

Reasons to avoid Cardano (ADA)

- App usage and developer momentum still trail faster Layer-1 chains, limiting short-term upside.

- The slow, research-first approach can delay rapid adoption and price acceleration.

RECOMMENDED: 5 Reasons To Buy Cardano

8. Avalanche (AVAX)

Avalanche is a high-performance blockchain known for its subnet architecture, where teams can launch their own independent blockchains with custom rules, fees, and validator sets while staying connected to Avalanche’s secure ecosystem.

This flexibility appeals to gaming studios, enterprises, and niche DeFi builders looking for tailored performance or regulatory compliance.

Avalanche’s DeFi ecosystem has seen meaningful TVL growth into the billions, and network activity metrics like transactions and active addresses have climbed.

AVAX also features fast finality, low fees, and EVM compatibility, making it attractive for developers migrating from Ethereum.

Reasons to Buy Avalanche (AVAX) In 2026

- Subnets let projects optimize throughput and costs for specific apps, which can accelerate real adoption.

- Strong DeFi integrations and incentive programs have helped raise TVL and ecosystem engagement.

Reasons to Avoid Avalanche (AVAX)

- Subnet fragmentation may spread liquidity thin and create user experience friction.

- Competition from other Layer-1s and modular chains could pressure market share.

RECOMMENDED: 5 Compelling Reasons to Buy Avalanche (AVAX) in 2025

9. Polkadot (DOT)

Polkadot is a multichain blockchain platform that connects many independent blockchains, called parachains, through a central Relay Chain that provides shared security and seamless cross-chain messaging.

Projects win parachain slots in auctions by committing DOT, giving them space to run custom blockchains optimized for specific use cases like DeFi, gaming, or NFTs.

Polkadot’s interoperability features let assets and data move securely between parachains, and the network now hosts 100+ active parachains with TVL north of $10 billion.

Reasons to Buy Polkadot (DOT) In 2026

- Parachain auctions lock in capital and committed liquidity, signaling strong project backing and ecosystem growth.

- Cross-chain messaging (XCM) enables composable apps that natively access assets and functionality across multiple blockchains.

Reasons to Avoid Polkadot (DOT)

- Slot scarcity and auction costs can raise barriers for builders and slow broader ecosystem expansion.

- Technical complexity and the multi-chain stack can delay developer onboarding and mainstream adoption.

RECOMMENDED: 5 Compelling Reasons to Buy Polkadot (DOT) in 2025

10. Sui (SUI)

Sui is a next-gen Layer-1 blockchain built around an object-centric data model and parallel transaction execution, enabling thousands of transactions to run at the same time with sub-second finality and very low fees ideal for games, NFTs, DeFi, and consumer-grade dApps.

Its native Move language and horizontal scaling architecture help developers create interactive, composable assets and real-time experiences without bottlenecks seen on older chains.

Sui has also launched grants and tooling programs to attract builders and grow its ecosystem beyond speculative use.

Reasons To Buy Sui (SUI) In 2026

- High throughput and low fees support gaming, microtransactions, and fast user experiences.

- Developer grants and expanding tooling can accelerate real dApp launches and onboarding.

Reasons To Avoid Sui (SUI)

- Theoretical performance must convert into sustained user activity for token growth.

- Bridges and cross-chain functions are still maturing, adding execution risk.

RECOMMENDED: 5 Reasons to Buy Sui (SUI) Before the Next Bull Run

11. Aptos (APT)

Aptos is a high-performance Layer-1 blockchain built around the Move programming language and a parallel execution engine that lets many transactions run at once, helping it scale far beyond older networks.

Move – originally developed for Meta’s Diem – emphasizes safety and resource control, reducing common smart-contract bugs while improving developer productivity.

Aptos supports low-fee, sub-second finality and sustained throughput in real usage, with millions of monthly users and billions of total transactions processed, plus strong growth in DeFi and stablecoin activity.

Its ecosystem has expanded to 330+ projects and significant grant funding, making it a compelling platform for consumer Web3 products.

Reasons To Buy Aptos (APT) in 2026

- Move language and developer-friendly tooling help teams build faster and more securely.

- Substantial ecosystem funding and wallet/infra support fuel real dApp growth.

Reasons To Avoid Aptos (APT)

- Competing Move-based chains and major L1s crowd the same developer audience.

- Early ecosystem momentum could stall if user growth slows.

RECOMMENDED: 5 Reasons To Buy Aptos In 2025

12. Hedera (HBAR)

Hedera is a high-performance public ledger powered by the Hashgraph consensus algorithm, designed for fast, low-cost, predictable transactions ideal for real-world enterprise workloads.

The network can handle up to abut 10,000 transactions per second with finality in 3-5 seconds and fees often around $0.0001–$0.001, making micropayments and high-volume data logging economical.

HBAR fuels transactions, smart contracts, and token services, and can be staked to help secure the network.

Hedera’s governance council includes major global companies, providing stability and commercial pathways into tokenization, supply chains, and decentralized services.

Reasons To Buy Hedera (HBAR) In 2026

- Enterprise partnerships and governance provide direct commercial routes for tokenized services and predictable cost structures that suit business SLAs.

- High throughput with low, stable fees supports scalable use cases like payments, IoT, and asset tokenization.

Reasons To Avoid Hedera (HBAR)

- Perceptions of permissioned governance may limit appeal in open decentralized dApp sectors.

- Enterprise integrations often require long lead times before meaningful on-chain demand materializes.

RECOMMENDED: 5 Important Reasons Consider When Buying Hedera (HBAR)

How To Identify Cryptos With Explosive Potential

Market Metrics And Liquidity

Start with measurable market data. Market capitalization and trading volume give a quick picture of size and liquidity; larger volume means deeper order books and less slippage when buying or selling.

A reasonable market cap paired with strong daily volume suggests the project isn’t illiquid or dormant.

Total Value Locked And On-Chain Activity

Look at on-chain metrics that reflect real usage. Total Value Locked (TVL) measures how much value users have committed to a protocol’s smart contracts. When TVL rises over time, it shows growing user trust and financial activity.

Similarly, higher counts of active addresses and transactions show rising network engagement rather than idle speculation.

Developer Activity And Project Progress

Check the code repository for frequent updates, commits, and feature releases. Projects with consistent engineering work tend to launch features that attract users and sustained demand.

Frequent developer commits and clear progress on roadmaps indicate an active team.

Tokenomics And Supply Dynamics

Evaluate circulating supply, max supply, unlock schedules, and any planned token burns or staking programs. Tokens with large future unlocks can see price pressure when those coins enter the market.

Projects with deflationary mechanics or long lock periods may support tighter supply dynamics.

Catalysts And Roadmap Events

Identify tangible catalysts such as exchange listings, protocol upgrades with set dates, or integration announcements with major partners.

These events can create focused demand and price moves when they occur.

Fundamental Utility And Adoption

Assess real-world utility. Tokens with clear use cases, measurable adoption, and market demand are more likely to show growth than those based on hype alone. Utility and adoption reduce reliance on sentiment swings.

FAQs

What crypto has the most potential to explode in 2026?

While Bitcoin and Ethereum offer steady, large‐scale price action, smaller to mid‑cap tokens with real adoption, rising on‑chain activity, and upcoming catalysts often deliver larger percentage gains.

What crypto under $1 will explode?

Cryptos under $1 that might explode tend to have solid liquidity, genuine use cases, growing ecosystems, and strong trading volume. These include Stellar (XLM), VeChain (VET), and other under‑$1 networks gaining adoption, though price alone doesn’t guarantee value.

What if I put $1,000 in Bitcoin 5 years ago?

If you invested $1,000 in Bitcoin five years ago and held it, historical trends show substantial growth due to increased adoption and institutional interest. This means your investment would likely be worth many times more today, though past performance isn’t a guarantee.

How much should I Invest in Cryptocurrencies?

Your crypto allocation should match your risk tolerance and goals: deep‑liquid assets like Bitcoin or Ethereum for stability, and smaller stakes in higher‑volatility tokens for upside. Experts often recommend keeping crypto a modest portion of your overall portfolio.

Conclusion

Use quantifiable metrics like liquidity, trading volume, active users, and on‑chain data to identify cryptos with explosive potential. Next balance allocations between large, stable assets and higher‑upside mid caps. Finally, stay disciplined with position sizing and documented plans, and regularly review catalysts and risks to adjust exposure and protect capital.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

You can read more on our Blockchain and Cryptocurrency premium service by clicking here