KEY TAKEAWAYS

- The tariff news sparked a rapid sell-off that wiped roughly $100B from crypto markets in hours.

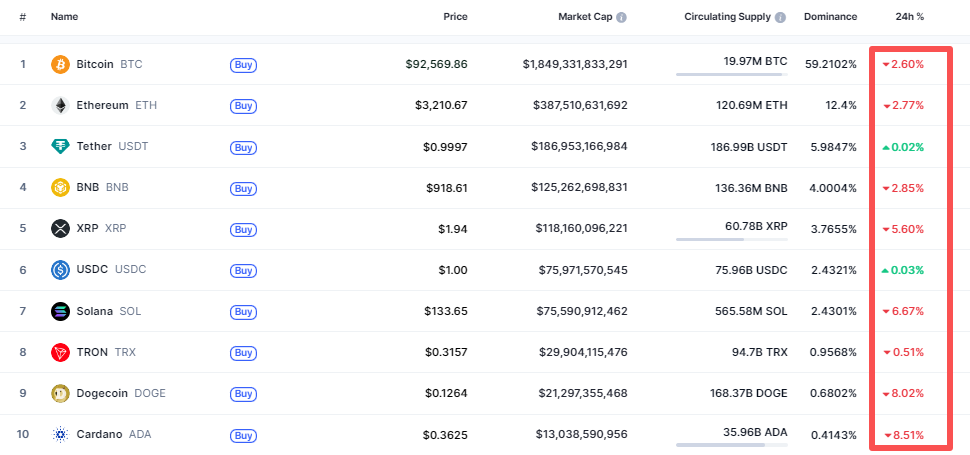

- Bitcoin dropped to about $92k, and heavy leverage turned normal selling into liquidation cascades.

- Whether crypto stabilizes now hinges on policy reactions, liquidity, and the $90k support level.

A sudden trade shock rattled global markets and shook digital assets hard. Bitcoin slid to about $92,000 while the broader crypto market shed roughly $100B–$115B in value before dawn.

President Trump’s surprise tariff threats against several European countries hit markets like a cold splash of water.

Within hours, Bitcoin fell to around $92,000 and Ether hovered close to $3,200, as nervous traders rushed to reduce risk.

Major market trackers showed the total crypto market cap shrinking by roughly $100B–$115B, while exchanges logged hundreds of millions in forced liquidations of leveraged positions.

ALSO READ: US Senate Stall Crypto Bill After Coinbase CEO Rubbishes It

How Hard Did Crypto Get Hit?

The move was fast and messy. Bitcoin slipped to about $92,000, and Ether traded around $3,200 as panic spread across screens.

Smaller tokens suffered the most, with many meme coins and thinly traded alts posting steeper percentage losses than the majors.

Derivatives platforms reported hundreds of millions in long liquidations, meaning traders betting on higher prices were automatically closed out.

Those forced sales added fuel to the slide and deepened the drawdown in a short window.

RECOMMENDED: US Senate Stall Crypto Bill After Coinbase CEO Rubbishes It

Why Tariffs Spilled Into Crypto

Tariffs are not a crypto story on their own, but they quickly became one.

The surprise announcement pushed investors into “risk-off” mode, pulling money out of volatile assets and into safer bets like cash and gold.

Because crypto trades 24/7 and relies heavily on leverage, that shift translated into faster, sharper moves than in traditional markets.

Thinner order books also meant big sell orders pushed prices down more than usual.

What Comes Next for Markets

Traders are now watching three signals closely: how the EU responds, what central banks say about interest rates, and whether exchange liquidations cool down.

Many analysts see $90,000 as a critical line in the sand for Bitcoin.

If buyers step in with enough liquidity, the market could steady; if not, another wave of selling becomes more likely.

RECOMMENDED: Tether Freezes $182 Million In Suspected Illicit Funds

Conclusion

The tariff shock showed how tightly crypto is tied to global events.

With leverage still high and headlines moving fast, the next few days will shape whether this proves to be a brief shakeout or the start of a deeper pullback.

Before you invest, in the coming days we will be publishing our next premium members crypto alert, we will reveal some key crypto assets to consider in 2026 with explosive potential.