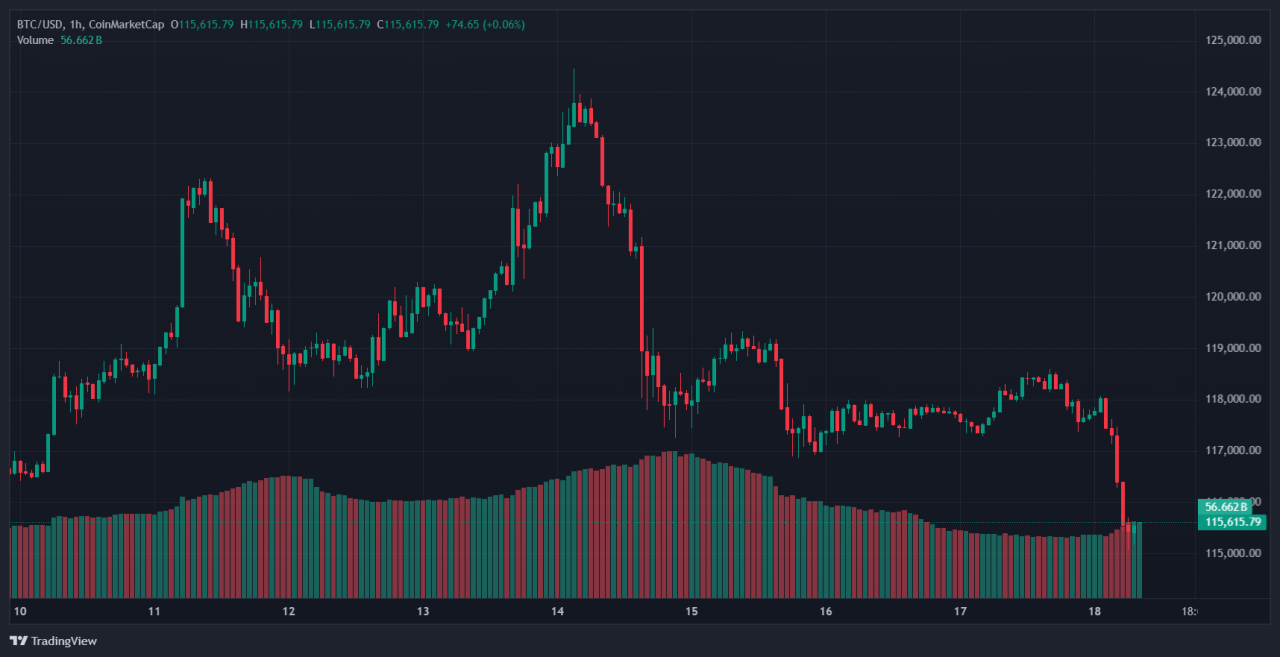

Bitcoin hit a fresh record near $124,500 on August 14 with 33 % YTD gain. Now the key question: will support around $115 K hold or will volatility take over?

Bitcoin reached a new all-time high around $124,500, climbing over 33% so far this year and nearly doubling in value over the past 12 months.

The rally reflects strong institutional interest and rising Fed rate cut expectations. However, price pulled back to the $116,000–$120,000 zone, raising concern that momentum may weaken.

RECOMMENDED: Why Are Bitcoin (BTC) Prices Up? What’s Happening?

What’s Driving the Surge?

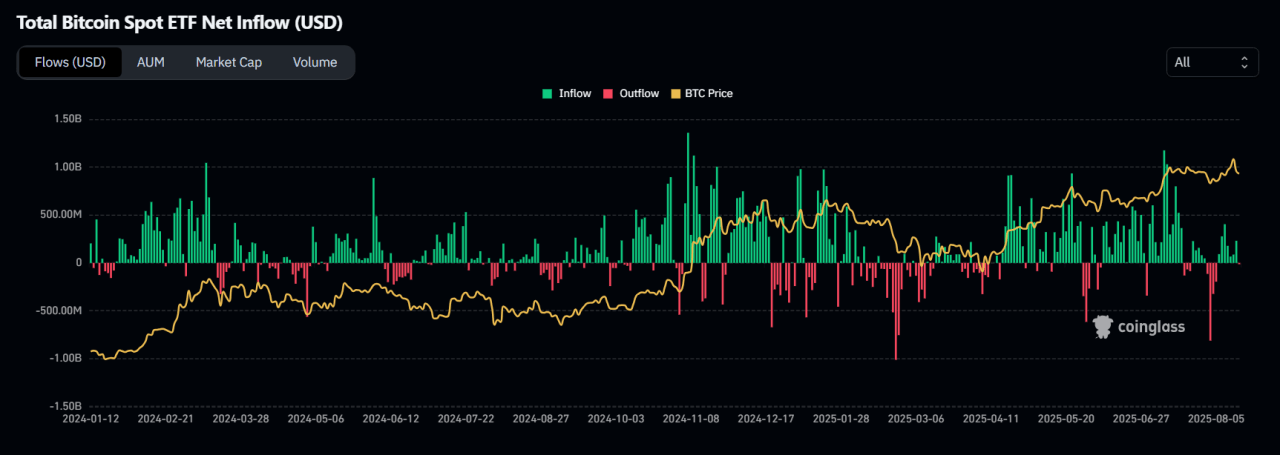

Institutional demand gained traction after U.S. policy shifted. An executive order cleared crypto access for 401(k) plans and eased regulatory barriers. ETF inflows also surged. In August, analysts cited $572 million in net crypto inflows, around $260 million directed to Bitcoin.

Bullish sentiment gained further support from expectations of Federal Reserve rate cuts. Bitcoin’s market value briefly passed $2.46 trillion, making it the fifth-largest global asset by valuation.

RECOMMENDED: How U.S. Retirement-Account Inclusion Is Fueling Bitcoin’s August Rally

Signs of Strain—Pullbacks and On-Chain Indicators

Traders marked a quick retreat of 4% from the all-time high to around $118,000 and then to the current price just above $115k. This sharp pullback reflects profit taking after intense gains.

Technical signals raise caution. Bitcoin formed a lower high and failed to sustain its level above $124,000, suggesting fading bullish pressure.

Momentum indicators show mixed readings. MACD remains above signal line but slowly softens, RSI around 50 shows indecision. On the other hand, on-chain data shows long-term holders engaged in profit realization, with over 300,000 BTC moved in recent weeks.

ALSO READ: Want to Make $1M with Bitcoin? Here’s How in 10 Years

Conclusion

Bitcoin reached highs near $124,500 based on strong institutional inflows and Fed expectations. However, mounting technical caution and long-term holder activity mean the rally may not last. On-chain data now signals selling pressure, with distribution trending upward.

You should monitor the $115 K–$118 K support closely in the coming week. A sustained break below this range could trigger deeper correction, while a hold may reignite upside momentum.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)