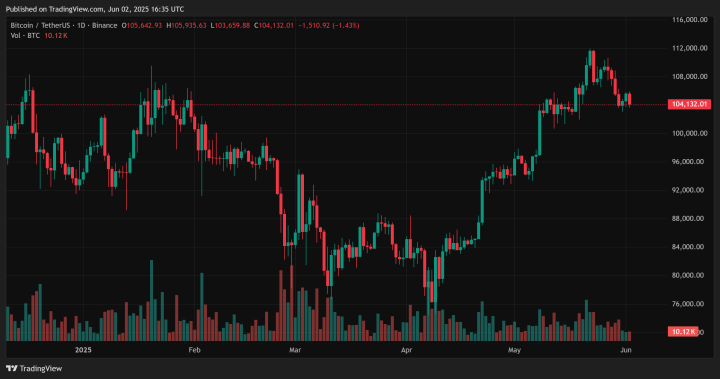

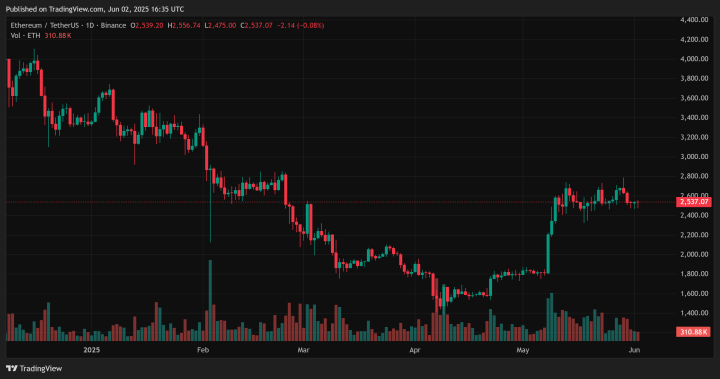

Bitcoin (BTC) and Ethereum (ETH) have entered June 2025 with renewed momentum, each poised at critical price levels. BTC is currently trading around $105,518, while ETH hovers near $2,642.

As markets look ahead,we are watching both technical signals and fundamental drivers to gauge the next moves for these leading cryptocurrencies.

Bitcoin: Technical Resistance and Bullish Fundamentals

BTC price action reveals immediate resistance at $105,800 and support at $103,969. A breakout above $105,800 could open the door to a retest of $110,000, while a dip below support may signal a short-term pullback.

On the fundamental front, institutional interest continues to build. Bitcoin ETFs are seeing increased inflows, and the recent U.S. government move to establish a Strategic Bitcoin Reserve underscores rising confidence in digital assets as a strategic component of financial reserves.

According to Standard Chartered, BTC could hit $200,000 by year-end, with a potential long-term target of $250,000, based on current supply constraints and increasing demand.

Ethereum: Navigating Support Levels Amid Upgrades

ETH faces key resistance at $2,660 and support around $2,482. If ETH holds above $2,645, it could aim for the $2,600–$2,800 range, while a break below support might trigger a correction.

Ethereum’s network fundamentals are also gaining attention. The highly anticipated “Pectra” upgrade is expected to boost scalability and staking options, providing a technical foundation for further growth.

Additionally, the approval of spot Ether ETFs, which could attract significant institutional capital, adds to the bullish outlook.

Standard Chartered’s forecast suggests ETH might climb to $14,000 by the end of 2025, contingent on successful network enhancements and favorable regulatory developments.

Conclusion

Both BTC and ETH are at pivotal junctures, with technical charts and underlying fundamentals pointing to potential gains in the week ahead. Key resistance and support levels, institutional developments like ETFs, and Ethereum’s network upgrades will be crucial factors to monitor.

Investors should stay alert as these drivers could determine whether this week marks a breakout or a consolidation phase for the crypto market.

Unlock the Power of Smart Crypto Investing — Get Instant Access to Exclusive Crypto Alerts

Step into the future of investing with InvestingHaven’s premium crypto alert service — the world’s first of its kind, backed by over 15 years of market expertise.

Our proprietary 15-indicator methodology cuts through the noise to deliver actionable insights and timely crypto forecasts — helping serious investors stay one step ahead of market-moving trends.

🚀 Don’t follow the hype — lead with insight.

📈 Join a growing community of crypto investors who act before the big moves.

Start your journey now — smart crypto investing begins here.

This is how we are guiding our premium members (log in required):

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)

- Charts – XRP, Theta, Uniswap, and two RWA Token Tips (April 29th)