KEY TAKEAWAYS

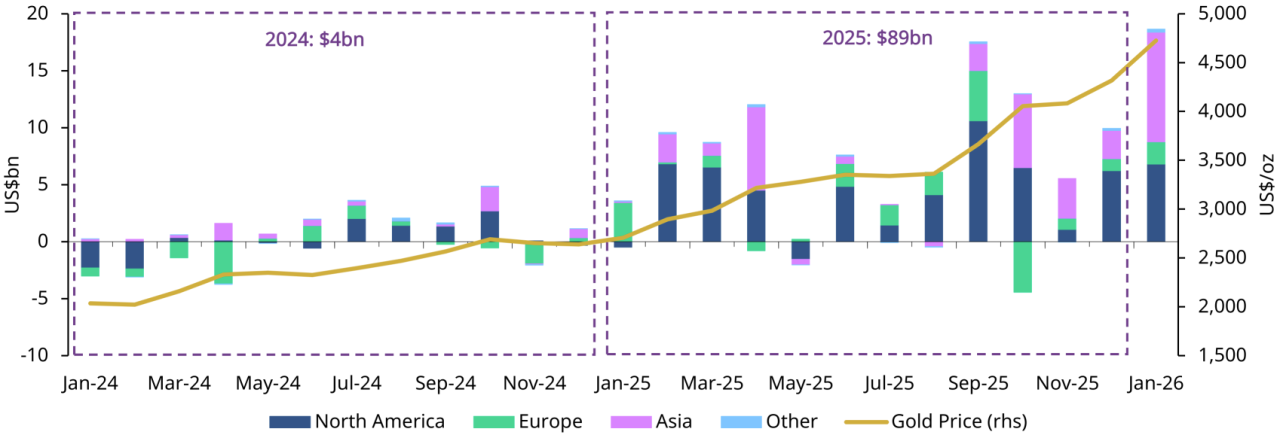

- Gold ETF inflows remain strong, supported by institutional buying and declining confidence in risk assets.

- Bitcoin price action remains fragile, with buyers defending key levels but lacking strong follow-through.

- ETF flows, yields, and currency moves will likely decide short-term direction across both assets.

Gold continues to attract large institutional flows while Bitcoin struggles to regain momentum, forcing investors to choose between stability and volatility.

Markets opened the week with a clear divide in investor behavior. Gold remains firmly bid as institutions and central banks add exposure, while Bitcoin trades below recent highs after weeks of choppy price action.

ETF flows show investors leaning defensive, and bond yields continue to influence capital allocation decisions. At the same time, crypto markets show signs of hesitation rather than panic, suggesting capital has not fully exited risk assets.

This creates a tense situation where even small macro developments can shift flows quickly.

The coming days will test whether safety remains the priority or whether speculative appetite begins to return.

RECOMMENDED: Gold & Silver: Could One Jobs Report Flip Metals Market This Week?

Why Gold Is Winning The Risk-Off Trade

Gold has started the week with a clear advantage. Institutional investors continue to allocate heavily to gold-backed ETFs, extending a trend that began earlier in the year. January saw billions of dollars move into gold funds, one of the strongest starts in recent years.

That demand reduces available supply and supports prices even during quiet trading sessions.

Central bank purchases also continue to support gold. Several large buyers have increased reserves as part of longer-term diversification strategies. This steady accumulation adds stability and reinforces gold’s role during uncertain periods.

Forecasts from major banks now project significantly higher prices over the year, which strengthens investor confidence and attracts additional inflows.

READ: JP Morgan Says Gold To Hit $6,300 By Year-End: Is Fiat Finished?

Gold also benefits from shifting expectations around interest rates. Real yields have eased from recent highs, which improves gold’s appeal compared with cash or short-term bonds. If yields continue to soften or currencies weaken, gold could maintain its momentum through the week.

For now, flows remain consistent, and that keeps gold firmly positioned as the preferred defensive asset.

Macro Signals To Watch Closely

Several macro signals will influence short-term direction across gold and Bitcoin. Bond yields will remain a primary reference point.

When real yields fall, gold tends to attract steady inflows as the opportunity cost of holding metal declines. Rising yields usually pressure gold and support cash and bonds instead.

Currency markets also deserve close attention. Movements in the US dollar often influence capital allocation. A weaker dollar generally supports gold prices, while a stronger dollar can limit upside across metals and crypto.

Equities might also provide an important signal this week. Bitcoin continues to trade alongside risk assets, especially large technology stocks.

Equity pullbacks often spill into crypto markets, while gold benefits from defensive rotation. Recent stock market softness has reinforced this relationship.

Investor positioning shows caution rather than outright fear. That leaves markets sensitive to economic data and central bank messaging. A shift in tone can quickly change flows across bonds, equities, gold, and digital assets.

RECOMMENDED: Gold Heading Towards $6,000/oz? Deutsche Bank Believes It Is

What Bitcoin Needs To Regain Momentum

Bitcoin faces a more complex path. The asset has held above recent lows but continues to struggle with follow-through buying.

ETF flows remain mixed, showing interest from long-term holders but hesitation from short-term traders. Without sustained inflows, price rallies tend to fade quickly.

A move above key resistance in the mid $70,000 range would improve sentiment and could trigger renewed buying.

That outcome likely requires a broader improvement in risk appetite, stronger equity performance, or a clear signal that liquidity conditions are easing.

On the other hand, renewed ETF outflows or equity weakness would favor gold and delay any Bitcoin recovery. For now, Bitcoin remains reactive rather than leading, and that keeps traders cautious.

ALSO READ: Is Bitcoin Finished? Washington Rejects Bailout As Price Plummets

Conclusion

Gold enters this week with strong institutional support, steady ETF inflows, and favorable macro conditions. Bitcoin remains range-bound, dependent on improving sentiment and fresh capital to regain strength.

ETF flow data, yield movements, and currency trends will provide the clearest signals for both assets. Short-term outcomes will likely hinge on which side sees consistent inflows rather than brief reactions.