Bitcoin (BTC) is trading with minor gains today, September 24, 2025, rising approximately 0.3% to 90546.51 in the last 24 hours.

With key factors like macro data, potential new regulations, and mass liquidations in focus, traders are likely bracing for volatility.

The battle between what news is moving Bitcoin today and important price points will probably decide BTC’s next move.Key market updates, institutional flows, and macro drivers shaping Bitcoin’s price action today.

Key News Impacting Bitcoin Price Today

A major wave of liquidations, totaling over $1.8 billion across the crypto market, has recently taken place, with Bitcoin representing a notable share of this activity.

This forced selling makes declines more severe, particularly when the price falls below key support levels.

On a more positive note, the SEC has updated listing standards to fast-track crypto ETFs, reducing approval timelines by a large margin.

This is making markets hopeful that more large-scale investment will enter Bitcoin through these regulated channels.

While not technically standard news, there’s also the fact that the popularity of perpetual futures trading (often done with borrowed money) has made the market riskier.

Because these financial instruments magnify both upward and downward price movements, sudden price changes in either direction can be much more damaging.

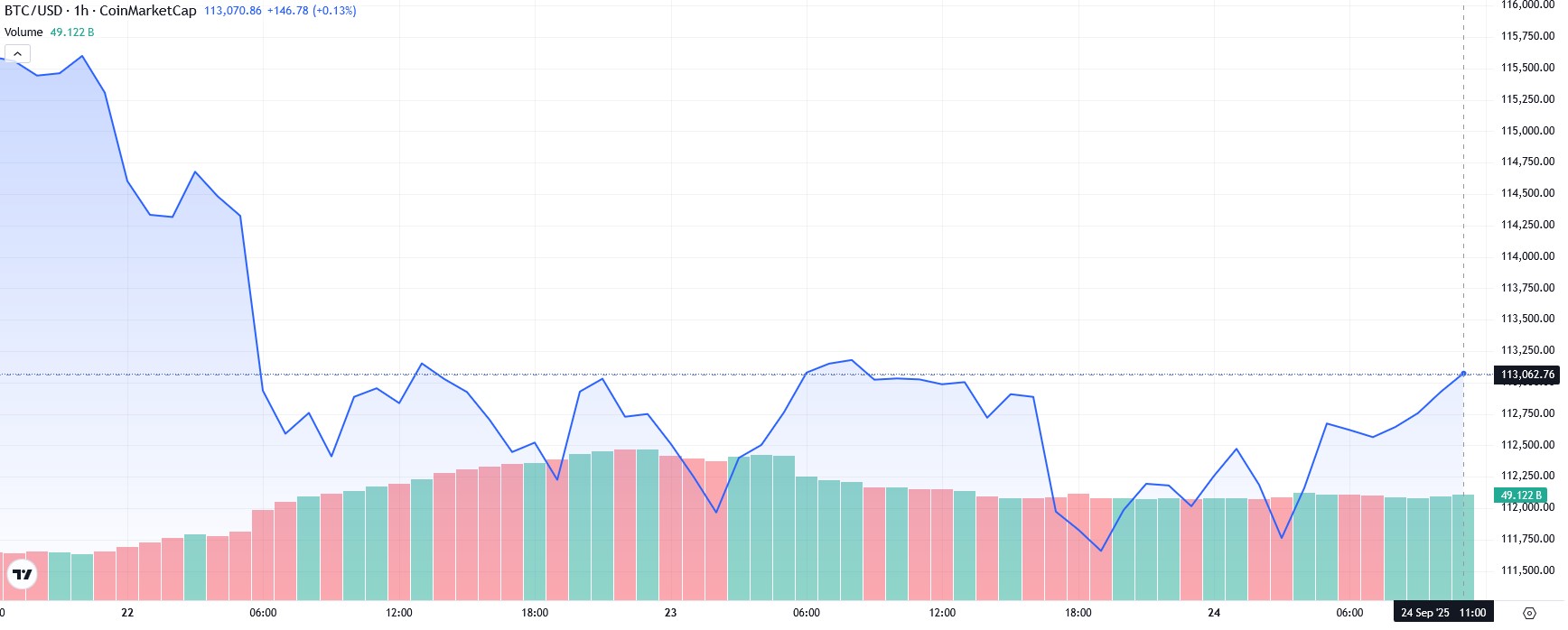

Due to the combination of positive and negative news, Bitcoin has been moving up and down recently, translating to a small price change in the last 24 hours.

(Bitcoin key news price chart September 24, 2025)

Bitcoin Price Levels To Watch

Taking a closer look at what news is moving Bitcoin today and in the last several days, we can see that the price has struggled to get past the $115,000 – $117,000 area. Breaking above it would be a strong sign for a return of bullish strength.

Above that, the $118,000 – $120,000 range represents a more formidable resistance level. A sustained breach here would very well lead to a more definitively positive shift in market sentiment.

In the current situation, $112,000 is a key near-term support level. A breakdown below this point could accelerate selling pressure and lead to a worse decline.

Lastly, the $110,000 – $111,000 price range is a lower safety net, where if the price falls past the first support, this is the next level where buyers might step in.

What’s Next for Bitcoin?

BTC’s price can go in either direction at the moment, but if Bitcoin defends $112,000 support and buyers return in strength, then we could see a retest of $115,000 – $117,000 range. If that breaks, the path toward $120,000 and above opens.

Then again, a bearish scenario might happen as well. If the price drops below $112,000, more so if accompanied by renewed liquidation pressure, it could drag Bitcoin down toward $110,000 and lower.

As for the long-term forecast, you should look at our Bitcoin 2026 prediction.

Conclusion

Analyzing what news is moving Bitcoin today, the cryptocurrency is showing almost negligible price difference when compared to what it was 24 hours ago. While streamlined SEC rules for ETFs and seasonal narratives add some upside potential, the backdrop of heavy liquidations took its toll and now Bitcoin’s near-term path depends heavily on whether $112,000 holds or cracks.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)