Bitcoin hit record highs, propelled by pro-crypto policy, institutional demand, ETF flows, and rate-cut optimism.

Bitcoin climbed to a new all-time high near $124,500, propelling the total crypto market to over $4.2 trillion.

So, what is driving the current crypto rally and can it sustain itself? Investors cite clearer U.S. regulation, growing institutional crypto demand in 2025, and optimism over an imminent Federal Reserve rate cut as key factors supporting the rally and encouraging renewed market participation.

Let’s look at the reasons why cryptocurrency prices are rising in more detail.

RELATED: Why Are Bitcoin (BTC) Prices Up? What’s Happening?

Regulatory Clarity and U.S. Strategic Assets

The U.S. Senate passed the GENIUS Act, setting a clear framework for stablecoins and encouraging confidence in crypto regulations in the U.S.

The Trump administration also issued executive orders to create a Strategic Bitcoin Reserve and digital asset stockpile in March 2025, marking U.S. government support for crypto assets as national reserves.

That visibility and endorsement reassure institutional players and enhance crypto’s credibility in mainstream finance.

RELATED: How Institutional Inflows & Regulatory Clarity is Fuelling Bitcoin as a Macro Asset

Institutional Inflows, ETFs, and IPO Activity

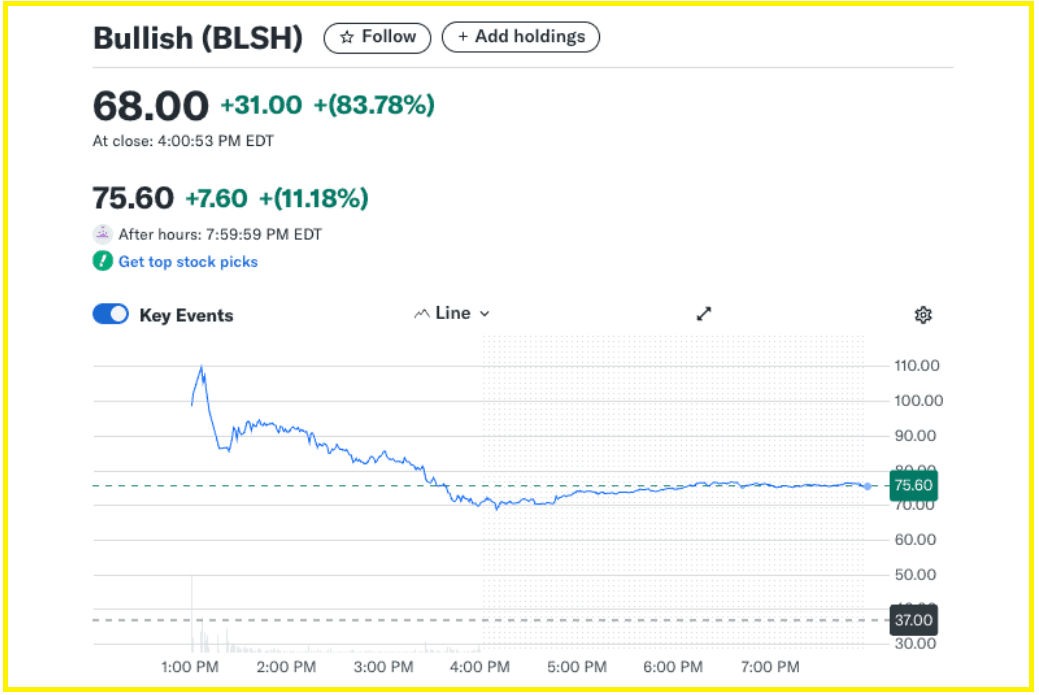

Institutional dollars are surging. Bullish, a crypto exchange, raised over $1.1 billion in its IPO and saw ARK Invest acquire more than 2.5 million shares. The Peter Thiel-backed exchange soared 83.78% above IPO price on the first day of trading.

Bitcoin spot ETFs attracted hundreds of millions in inflows. For instance, $260 million flowed into Bitcoin alone following Donald Trump’s executive order urging retirement plan inclusion of crypto.

These inflows added traction, with ETF daily records contributing to Bitcoin’s months-long climb. U.S. policy now allows crypto in 401(k) accounts, potentially unlocking trillions in new capital.

RELATED: Why Is XRP Going Up?

Macro Momentum and On-Chain Indicators

Markets expect the Federal Reserve to announce a 50-basis-point rate cut in September, weakening the U.S. dollar and prompting investors toward risk assets like crypto.

Bitcoin’s market cap briefly eclipsed Google’s, becoming the world’s fifth-largest asset by valuation.

On-chain data shows subdued profit-taking: funding rates remain moderate and short-term holders show limited selling, implying more room to run.

Still, a hotter-than-expected U.S. PPI (0.9% MoM) triggered a sharp pullback early on August 14, a reminder of persistent inflation risk.

RELATED: XRP, Bitcoin, Ethereum, and Solana Surge – Crypto Market Rally Gains Momentum

Conclusion

A potent mix of regulatory clarity, massive institutional inflows, ETF momentum, and monetary easing expectations is boosting crypto markets. That said, ongoing inflation pressures and policy shifts could trigger volatility.

While short-term corrections may arise, the current structural setup favors continued upside in Bitcoin and broader crypto for now.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)