KEY TAKEAWAYS

- The sell-off accelerated because too many long positions sat in the same price zone.

- Options traders positioned defensively before price cracked.

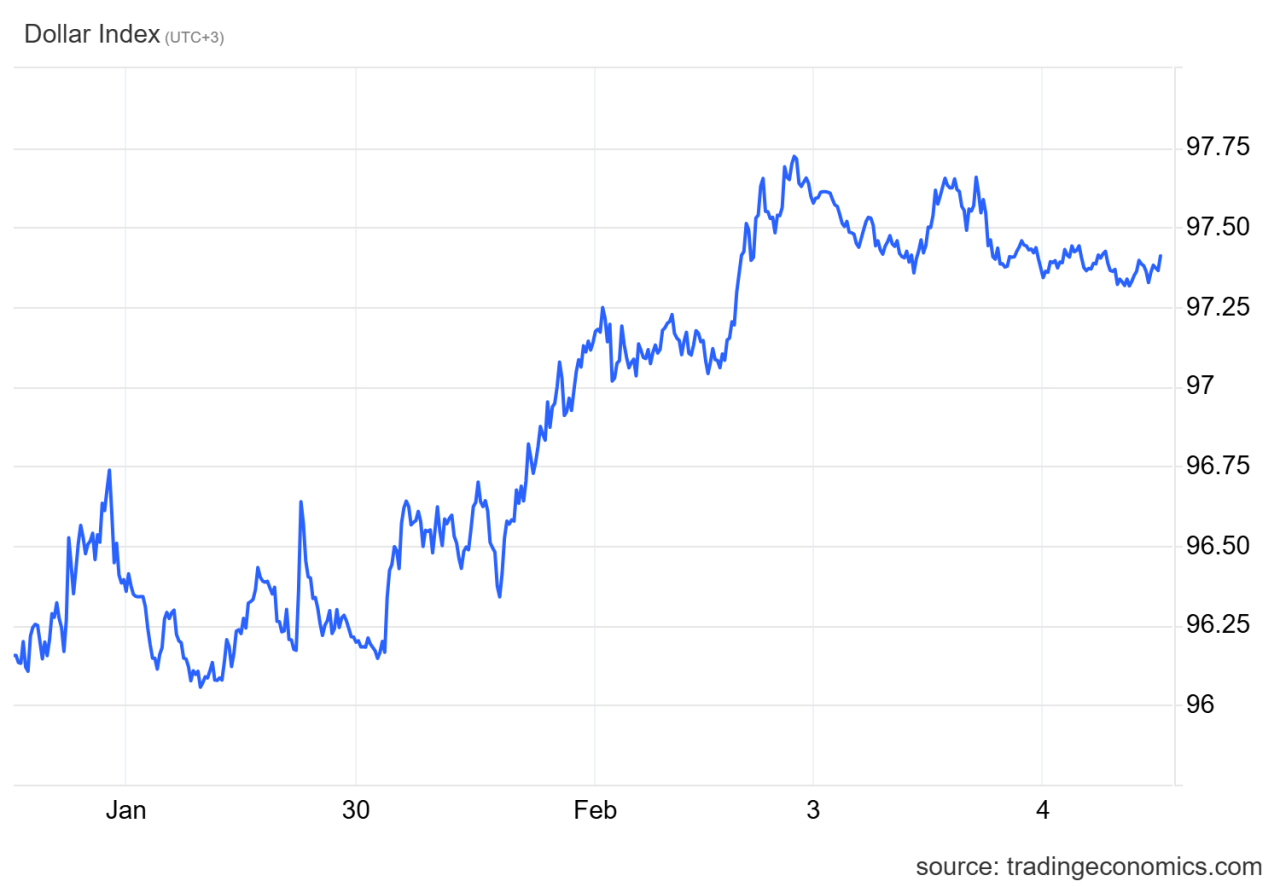

- Dollar strength reduced the flow of fresh capital into Bitcoin at a critical moment.

- Should you invest $1,000 in Bitcoin now?

Bitcoin’s slide exposed a fragile market structure built on crowded long trades and shallow liquidity.

Options data and macro pressure signaled stress before the price broke.

Bitcoin’s sudden drop into the mid-$70,000s caught many traders off guard.

Price briefly slipped below $73,000, more than $1.6 billion in leveraged positions were wiped out, and what looked like a normal pullback turned into a sharp, uncomfortable fall.

To many people, it felt sudden and confusing.

But this move didn’t come out of nowhere.

Several quiet pressures built up at the same time. Thin liquidity, too much leverage in the same place, cautious behavior in the options market, and a stronger U.S. dollar helped drag the price down.

RECOMMENDED: Metals Meltdown Sends Bitcoin To A 10-Month Low – What’s Next?

What Actually Happened Over Two Days?

Bitcoin had been rising for weeks, and some traders started locking in profits. Early selling was slow and orderly.

Buyers stepped in, and nothing about the price action looked alarming.

However, that changed as Bitcoin moved toward the $75,000 area.

Many traders were heavily positioned here. As a result, a large number of leveraged long positions were stacked around that zone, with stops sitting just below it.

When price dipped under those levels, automatic liquidations kicked in.

Over roughly 24 hours, around $1.6 billion worth of positions were forced closed, most of them long trades.

The problem was that the market wasn’t deep enough to absorb that selling.

Order books on major exchanges were thin, especially during lower-volume trading periods.

With fewer buyers waiting below, each wave of selling pushed price down faster than expected.

Spreads widened, slippage increased, and traders trying to exit manually often got worse prices than they planned.

By the time Bitcoin dipped below $73,000, things had turned violent.

This wasn’t because traders panicked, but because the structure of the market couldn’t handle the pressure.

A bounce followed, but the damage had already been done.

ALSO READ: $7B Leaves Crypto Markets: Can Bitcoin Still See A Real Bounce?

The Signal Most Traders Overlooked

While many traders were focused on price levels and headlines, the clearest warning showed up elsewhere: in the options market.

Before Bitcoin broke down, options traders quietly turned defensive.

Demand for downside protection increased, and implied volatility started to rise.

This kind of behavior doesn’t usually come from emotional traders. It tends to come from professional desks managing risk.

When options traders buy protection instead of chasing upside, it implies that confidence is fading, and fewer buyers are willing to step in aggressively if price drops.

At the same time, short-term holders were in a vulnerable position.

Many recent buyers had entered above $75,000, leaving little room for price to move against them.

Once Bitcoin slipped below those entry points, selling pressure increased naturally.

The U.S. dollar also strengthened as markets reacted to interest rate expectations and central bank commentary.

A stronger dollar usually tightens financial conditions and reduces appetite for risk. Crypto felt that pressure quickly.

RECOMMENDED: Dubai Now Lets You Pay Car Insurance With Bitcoin

What You Should Focus On Now

The mid-$70,000 range is now the key area to watch. Holding above it would suggest the market absorbed the liquidation wave and stabilized.

A break below $70,000 would signal that structural pressure remains and another leg lower is possible.

That said, options data remains one of the most useful signals.

Continued demand for puts and elevated volatility suggest traders are still cautious. A shift back toward call buying would indicate confidence is slowly returning.

Exchange flows are also important. Rising Bitcoin deposits to exchanges often precede selling pressure, while steady withdrawals tend to signal accumulation by longer-term holders.

Finally, keep an eye on macro conditions. As long as the dollar stays strong, liquidity remains tight for risk assets like Bitcoin.

Relief usually comes when that pressure eases, not before.

If you are trading, this environment requires patience. So, focus on smaller position sizes, staggered entries, and respect for liquidity.

YOU MIGHT LIKE: This Company Spent $2.13B On Bitcoin Despite The Downturn

Conclusions

Bitcoin fell because too much leverage built up in a thin market, professional traders quietly reduced risk, and macro pressure removed support at the wrong time.

The signals were there before a price breakdown. You should now watch liquidity, positioning, and options behavior.

While these won’t predict every move, they often explain them before the chart makes it obvious.

Should You Invest $1,000 In Bitcoin Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: Major Support Being Tested in Crypto – This Is The Point For a Bounce to Develop

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.