KEY TAKEAWAYS

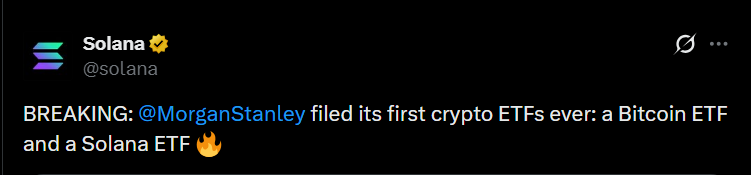

- Morgan Stanley filed for a spot Bitcoin ETF on Jan 6 and included a separate Solana trust.

- Bitcoin traded above $93,000 with a short move toward $94,000 and higher trading volume.

- Institutional access expanded, but short-term price swings remain likely.

Morgan Stanley’s Jan 6 ETF filing lifted trading activity and kept Bitcoin above $93,000 as institutional interest stayed in focus.

Bitcoin is trading around 91291.4 and pushed past $93,000 after Morgan Stanley submitted an S-1 filing on Jan 6 for a spot Bitcoin ETF.

Prices briefly reached the $94,000 level as trading activity picked up across major exchanges.

We will be covering Bitcoin in detail in our next Premium Crypto Alert along with a crypto that we believe has 10X potential in 2026

The bank also filed paperwork for a Solana trust, adding to the sense that large financial firms are expanding their crypto offerings at a measured but steady pace.

RECOMMENDED: Will Bitcoin Ever Hit $1 Million?

Market Reaction And Bitcoin Price Moves After The Morgan Stanley Filing

Bitcoin moved higher soon after the filing became public, holding above $93,000 through much of the session.

Trading volume increased on large U.S. exchanges, and spreads tightened as buyers stepped in quickly following the news.

Crypto-linked equities and ETF-related products also showed gains, reflecting renewed interest from institutional desks.

Derivatives markets echoed the move. Options activity increased and short-term volatility rose as traders adjusted positions. Technical indicators shifted into overbought territory, which often signals stronger momentum but also raises the risk of short pullbacks.

Overall, price action suggested confident buying rather than thin or speculative trading.

RECOMMENDED: 5 Reasons To Buy Bitcoin (BTC) Today

Why A Morgan Stanley Spot ETF Filing Matters For Institutional Adoption

A spot Bitcoin ETF from a major U.S. bank changes how many investors can access BTC. Wealth managers, private banks, and financial advisers can allocate through familiar ETF structures instead of handling wallets or custody directly.

That lowers operational barriers and makes Bitcoin easier to include in diversified portfolios.

Large banks also bring broad distribution networks. If approved, such products could compete on fees and access, encouraging wider participation from long-term investors. This type of access tends to support steadier demand compared with retail-driven spikes.

Risks To Watch And Near Term Outlook

Despite the positive signal, risks remain. Regulatory responses from the SEC will shape expectations, and shifts in rate outlooks can quickly affect crypto sentiment. Elevated volatility often follows major filings, especially when technical indicators flash overbought conditions.

Monitoring daily volume, ETF flow data, and options pricing can help gauge whether demand stays firm or cools.

RECOMMENDED: U.S. Fed Could Soon Become A Buyer Of Bitcoin: Find Out More

Conclusion

Morgan Stanley’s ETF filing helped Bitcoin hold above $93,000, signaling steady institutional interest.

Whether that support lasts will depend on ETF flow data, regulatory signals from the SEC, and broader risk sentiment across global markets in the days ahead.

We just covered Bitcoin and many others Cryptocurrency assets in today’s Premium members alert

Latest Crypto Premium Alert: The Bounce Is Here, As Expected. A Few Alts That Look Tremendously Powerful. (6th January 2026)

In our next premium crypto alert we will identify the crypto that we think has 10x potential