Coinbase’s entry into the S&P 500 marks a historic milestone for crypto, signaling Wall Street’s growing embrace of digital assets.

Coinbase’s inclusion in the S&P 500 marks a significant milestone for the cryptocurrency industry, signaling increased acceptance within traditional financial markets. This development has sparked discussions about the evolving relationship between digital assets and Wall Street.

Coinbase’s S&P 500 Debut: A Milestone for Crypto

On May 19, 2025, Coinbase Global Inc. (NASDAQ: COIN) officially joined the S&P 500, replacing Discover Financial Services following its acquisition by Capital One.

This move positions Coinbase as the first cryptocurrency-focused company to be included in the benchmark index, highlighting the growing integration of digital assets into mainstream finance.

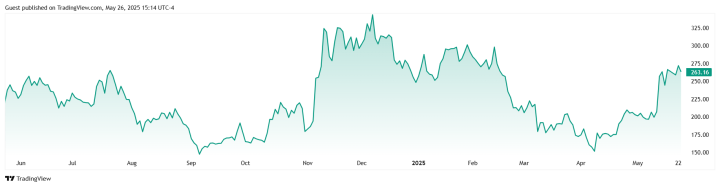

The inclusion coincided with a surge in Bitcoin prices, which reached a record high of over $112,000, fueling investor confidence in crypto-related stocks. Coinbase’s stock responded positively, reflecting the market’s optimism about the company’s future prospects.

Financial Performance and Market Position

Coinbase’s recent financial results reflect on its strong market position. In 2024, the company reported revenue of $6.56 billion, a 111% increase from the previous year, and net income of $2.58 billion, marking a significant turnaround from prior losses .

The company’s dominance in the cryptocurrency trading space is evident, with a 67% market share in January’s spot trading volume, significantly outpacing competitors like Robinhood.

This commanding position has been fueled by Coinbase’s offering of over 200 tradeable tokens, attracting a diverse investor base.

Broader Implications for the Crypto Industry

Coinbase’s S&P 500 inclusion is more than a corporate achievement; it represents a broader shift in the financial industry’s perception of cryptocurrencies. The move may pave the way for other crypto-focused companies to gain similar recognition, further integrating digital assets into traditional investment portfolios.

Additionally, Coinbase’s launch of the COIN50 Index, in partnership with MarketVector, aims to provide a comprehensive benchmark for the crypto market, akin to the S&P 500’s role in traditional finance.

This initiative reflects the company’s commitment to enhancing transparency and accessibility in the digital asset space.

Conclusion

Coinbase’s entry into the S&P 500 marks a pivotal moment for the cryptocurrency industry, signaling its growing legitimacy and integration into the broader financial system.

As digital assets continue to gain traction among investors and institutions, Coinbase’s trajectory may serve as a bellwether for the sector’s future within traditional markets.

Capture the Big Moves in Crypto Before They Happen

InvestingHaven’s premium alerts deliver timely, high-conviction signals based on 15 elite leading indicators. Built for forward-looking investors who want to forecast, not follow.

This is how we are guiding our premium members (log in required):