Persistent inflation above 3% would raise odds of a Fed pause and higher real yields. That could increase crypto volatility.

U.S. Consumer Price Index (CPI) stood at 2.9% in August, and the Fed cut its policy rate by 25 bps on Sept 17, 2025. That mix creates conflicting signals for crypto as markets reprice Fed rate cut odds and traders watch yields and the dollar.

RELATED: Bitcoin (BTC) Fed-Cut Odds Collide with Spot-ETF Flows

Short-Term Market Mechanics: Liquidity, Dollar And Price Action

Fed easing tends to lower short-term rates and weaken the dollar, which can lift risk assets, and yet rate surprises trigger fast re-pricing that spike crypto volatility.

Bitcoin swung roughly between $112,000 and $117,000 in the weeks around the Fed meeting, showing how quickly traders adjust cut odds.

Also watch funding rates and open interest for leverage cues, and follow the 2-year Treasury yield and the dollar index for immediate signs of changing liquidity and risk appetite.

Transmission If Inflation Holds Above 3%

If CPI persistently exceeds 3% the Fed faces a harder choice. Markets would raise the probability of a pause or tighter policy, which would push real yields up and the dollar stronger, materially so.

Academic studies find Bitcoin reacts strongly to unexpected monetary policy moves on FOMC days, with tightening prompting negative price reactions. That channel can spread to broader crypto through higher funding costs, margin calls and forced deleveraging, increasing short-term downside risk.

RECOMMENDED: Top 3 Cryptos to Buy Now as Fed Uncertainty Looms

Practical Scenarios And What To Watch

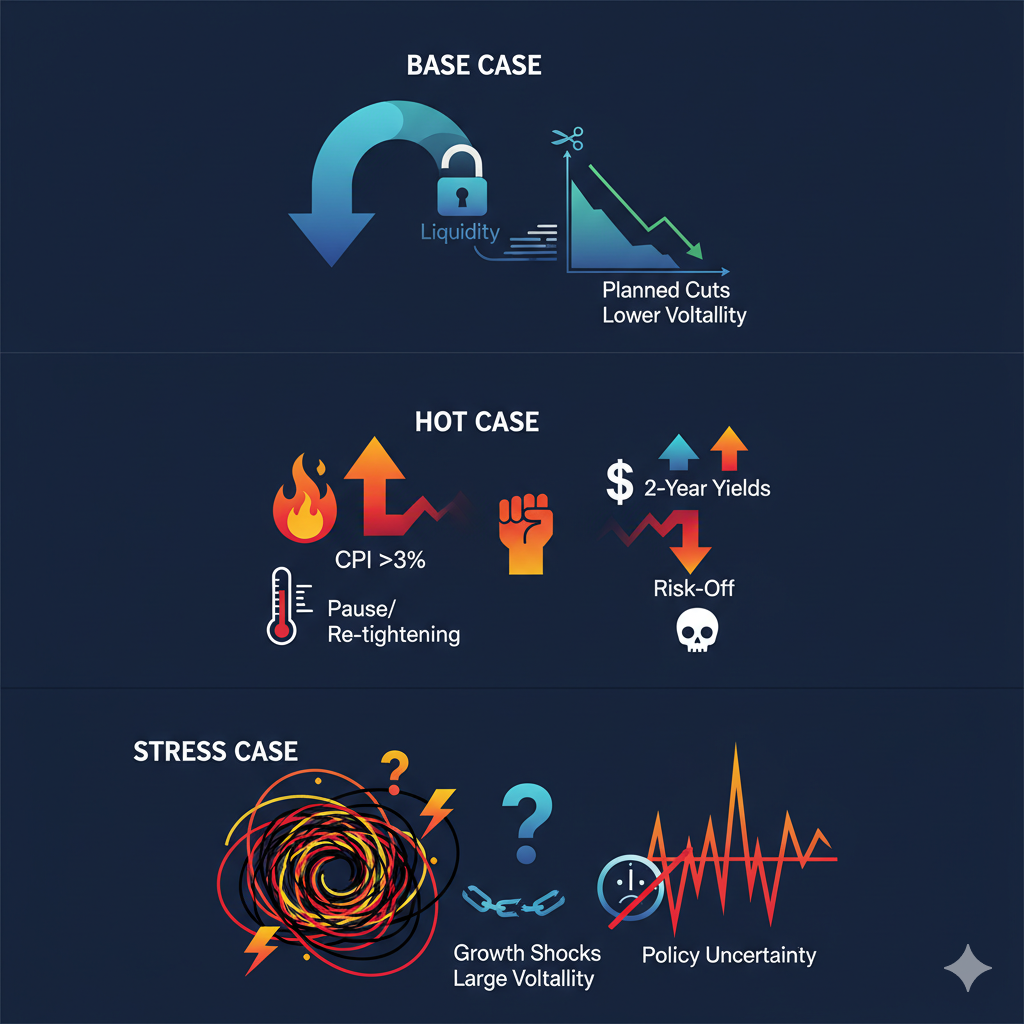

Three scenarios matter:

- Base case: Inflation cools below 3% and the Fed delivers planned cuts, supporting liquidity and lower realized volatility.

- Hot case: CPI >3% leads to a pause or re-tightening, lifting 2-year yields and the dollar and triggering risk-off.

- Stress case: Sticky inflation plus growth shocks creates policy uncertainty and large volatility spikes.

Track CPI/PCE prints, the 2-year yield, DXY, BTC 30-day realized volatility, option skew and funding spreads to update position sizing.

RECOMMENDED: Jerome Powell FED Chairman GreenLight On Crypto

Conclusion

Persistent inflation above 3% raises the odds of a Fed pause or re-tighten and higher real yields, increasing short-term crypto volatility. Monitor CPI, the 2-year yield and the dollar closely.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)