KEY TAKEAWAYS

- Democrats say the SEC reversed course on major crypto cases that once moved forward in court.

- Lawmakers link several dismissals to figures and ventures connected to President Trump.

- Congress warned it may escalate oversight through subpoenas and hearings.

Lawmakers cite at least 12 dropped crypto cases and point to overlaps with Trump-linked ventures.

The timing has triggered claims of political favoritism and weak oversight.

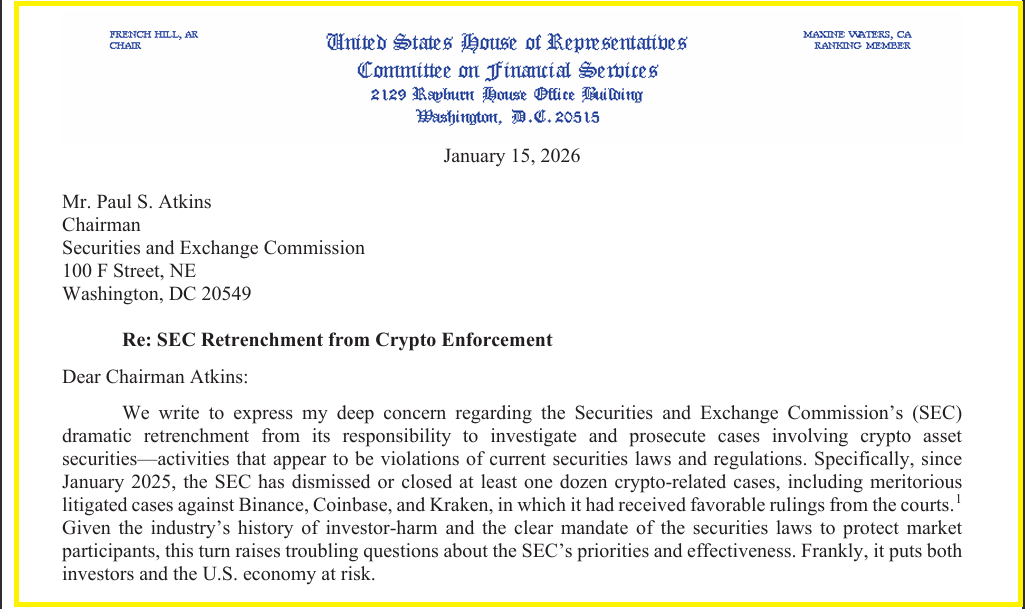

House Democrats told SEC Chair Paul Atkins that the agency closed or paused at least 12 crypto enforcement actions since early 2025.

The list includes cases involving Binance, Coinbase, Kraken, and Justin Sun, several of which intersect with Trump-linked political or business interests.

RECOMMENDED: US Senate Stall Crypto Bill After Coinbase CEO Rubbishes It

Which Crypto Cases Were Dropped?

The lawmakers’ letter details a series of enforcement pullbacks that followed earlier court approvals.

The SEC dismissed its civil case against Binance on May 29, 2025.

It then filed joint stipulations to drop cases against Coinbase on Feb. 27, 2025, and Kraken on Mar. 27, 2025.

Democrats stressed that judges had already allowed key claims in these cases to proceed.

That context makes the sudden closures stand out.

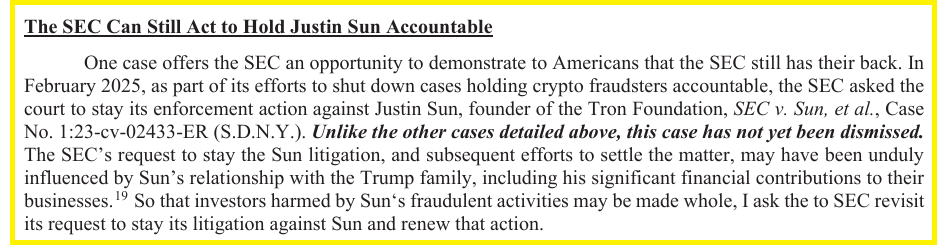

The SEC also paused its case against Justin Sun and Tron on Feb. 26, 2025, even though the complaint described alleged unregistered securities sales and market manipulation.

In total, lawmakers counted at least a dozen crypto-related actions closed or halted within about twelve months.

RECOMMENDED: Trump Tariffs Spark Overnight Crypto Bloodbath – $100B Wiped

Why Trump Ties Changed The Political Tone

The criticism sharpened because some of the dropped cases involve figures or firms linked to President Trump’s expanding crypto footprint.

Lawmakers pointed to reported investments by Justin Sun in Trump-affiliated crypto ventures and industry donations tied to Trump-aligned political efforts.

Democrats argue that this overlap creates a serious appearance problem.

They asked whether political access influenced enforcement choices and demanded records of meetings, emails, and communications with outside parties.

The letter frames the issue as trust in fair regulation, not just policy differences.

What This Means For Markets And Oversight

If federal enforcement weakens, crypto disputes may shift to state regulators, criminal probes, or private lawsuits. That could increase legal uncertainty for firms and investors.

Lawmakers signalled they will push harder if answers fall short, with document demands and hearings likely to follow.

ALSO READ: This Hidden Senate Clause Could Change Everything For XRP

Conclusion

The fight centres on transparency and credibility.

As scrutiny grows around Trump-linked crypto ties, the SEC faces rising pressure to explain why its enforcement posture changed so abruptly.

Wondering which crypto to Invest $1000 in Now?

Before you invest, in the new few days we will publish our next Premium Members Crypto Alert, where we will reveal some key crypto assets to consider in 2026 with explosive potential.