KEY TAKEAWAYS

- Robinhood holds the largest labeled Dogecoin wallet, with about 27.16 billion DOGE, nearly 18% of total supply.

- Binance and Upbit follow, each holding over 10 billion DOGE in exchange custody.

- Most company-linked DOGE is held by exchanges for users, not by corporations as treasury assets.

- Only a few public companies report Dogecoin on their balance sheets, and amounts remain small.

Most Dogecoin is held by major exchanges like Robinhood, Binance, and Upbit, not corporate treasuries. Learn which companies control the largest DOGE wallets and why it matters.

If you are wondering who owns the most Dogecoin, this guide is for you. I looked at on-chain records and public trackers so you do not have to dig through raw addresses.

You will learn which companies hold the biggest piles of Dogecoin, and what those holdings actually mean for the market.

Most of the largest company-labeled Dogecoin wallets belong to exchanges, which hold crypto for customers rather than for the company balance sheet. I will walk you through the five biggest company holders, show the on-chain numbers, and give my quick take on why each holding matters.

Data comes from labeled wallet lists and treasury trackers, so the figures reflect what those services currently show on-chain.

RECOMMENDED: 5 Powerful Reasons to Buy Dogecoin in 2025

Companies That Own The Most Dogecoin

| Company | Type of Holding | Estimated DOGE Balance (2025) | % of Circulating Suppl |

| Robinhood | Custodial (Exchange Wallet) | ~27.16 billion DOGE | ~17.9% |

| Binance | Custodial (Exchange Wallets, multiple) | ~15.7 billion DOGE | ~7.2% |

| Upbit | Custodial (Cold Wallet) | ~10.56 billion DOGE | ~6.9% |

| Cryptsy | Legacy Exchange Wallet | ~5.03 billion DOGE | ~3.3% |

| Gate.io / Kraken / Bybit | Custodial (Exchange Wallets) | ~1.0–1.1 billion DOGE each | ~0.7% combined |

1. Robinhood

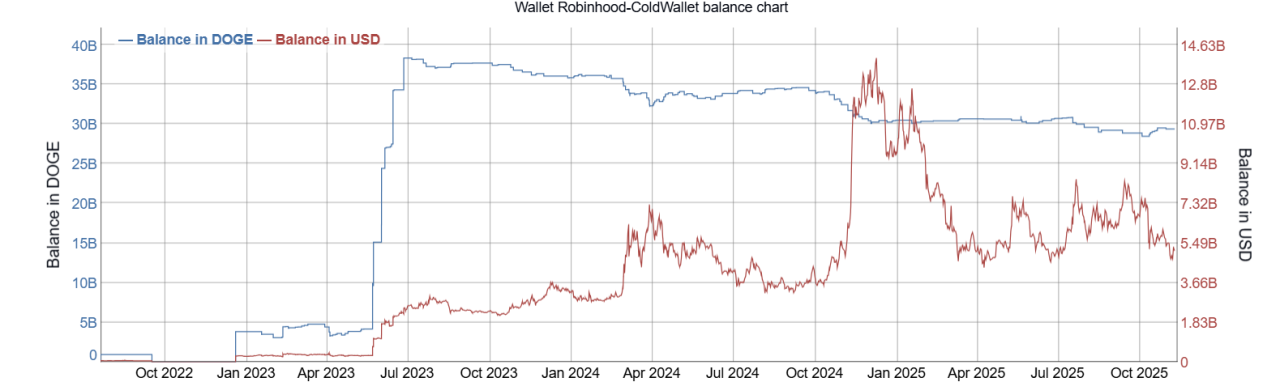

Robinhood’s cold wallet appears as the largest single labeled company address, holding about 27.16 billion DOGE, which is roughly 17.9% of Dogecoin’s supply according to rich-list data.

This is a custodial pool, meaning it represents customer balances and trading float kept by Robinhood for its users. This makes Robinhood one of the most important custodial players for DOGE liquidity.

If many users move coins off the platform or into markets, the effect shows up here first.

2. Binance

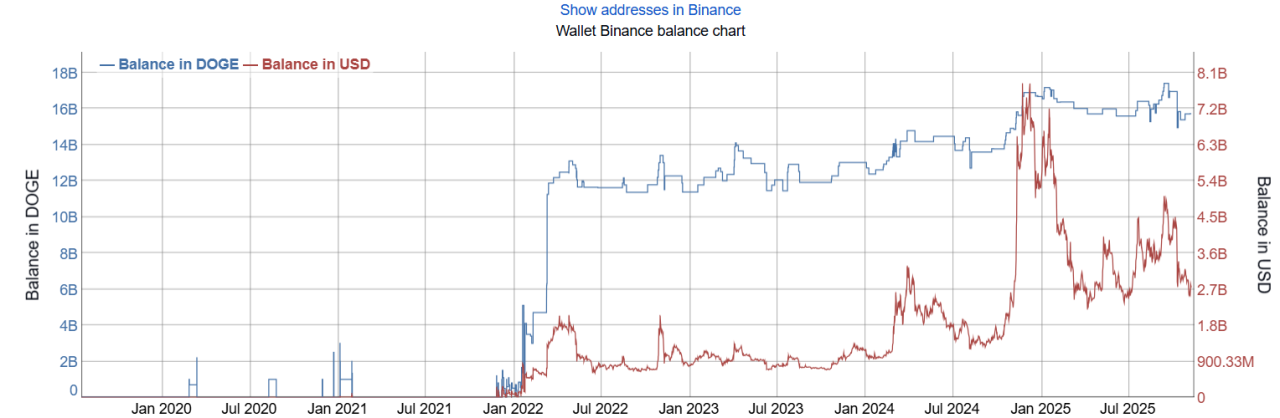

Binance’s labeled Dogecoin wallets combine to hold billions of DOGE as well. One Binance wallet page shows roughly 15.7 billion DOGE in exchange custody, though the rich-list aggregates and splits addresses, so you will also see combined figures around 10 to 11 billion depending on which addresses you count.

These are exchange pools used for trading, withdrawals, and hot wallet operations. Binance balances act as a proxy for global retail and institutional activity because Binance serves so many markets.

Watch for big transfers between Binance cold and hot wallets, they often precede price moves.

RECOMMENDED: Where Will Dogecoin Be in Five Years?

3. Upbit

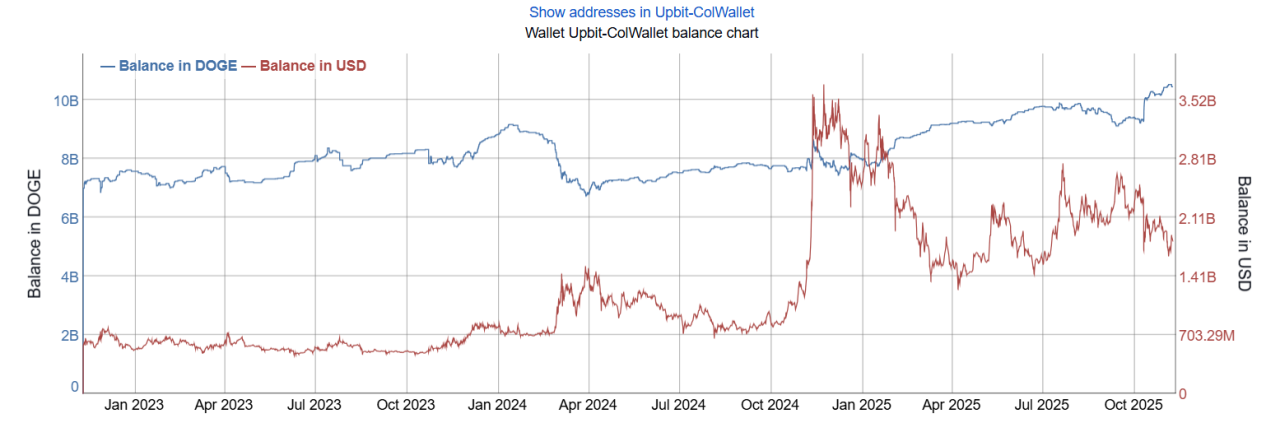

Upbit’s cold wallet holds roughly 10.54 billion DOGE, putting it among the top custodial company holders.

This is a Korean exchange, and that concentration shows regional demand can produce large custody pools on a single platform.

Local events or regulatory changes in markets where large custodians operate can shift sizable volumes of DOGE quickly. For traders, that means keep an eye on on-chain flows tied to big regional exchanges like Upbit.

RECOMMENDED: Is It Worth Buying Dogecoin in 2025?

4. Cryptsy

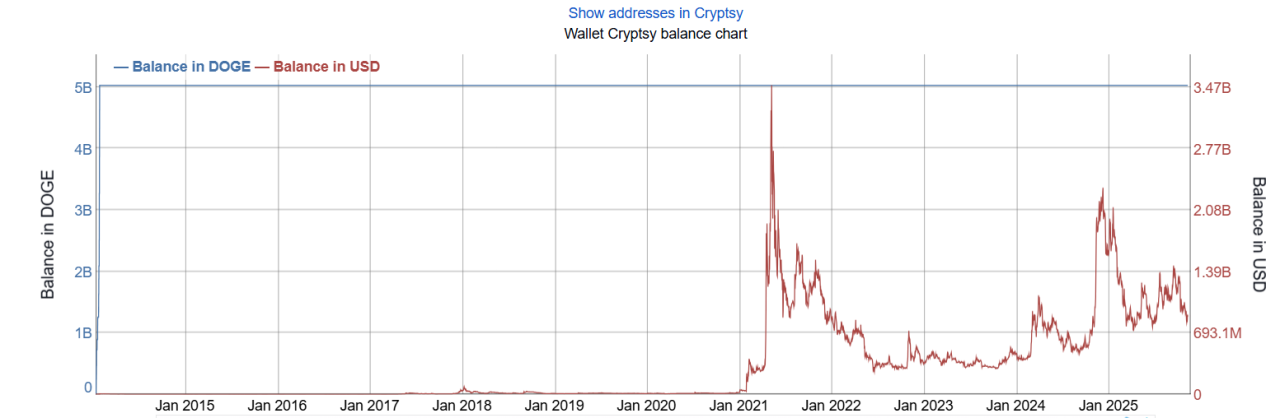

Cryptsy’s address shows about 5.03 billion DOGE on the rich lists. That figure appears in legacy and dormant address records, so it likely traces to older exchange infrastructure or long-held custodial stores.

This is a caution to watch. Large, dated balances can sit untouched for years, and when they start moving the market may react because they suddenly add liquidity or supply pressure. Treat such legacy wallets as potential wild cards.

5. Gate.io, Kraken, Bybit And Other Exchange Pools

Smaller but still material company-labeled wallets include Gate.io hot wallets at roughly 509 million DOGE, Kraken addresses around 1.0 billion DOGE, and Bybit around 1.1 billion DOGE.

These pools serve the same function, custody for customers and operational liquidity. Together the exchange pockets outside the top two still represent billions of coins that can move into or out of markets quickly.

The sum of these pockets matters more than any one small address, because coordinated flows across exchanges create real market pressure.

RECOMMENDED: Is Dogecoin A Good Investment And How to Buy DOGE?

Corporate Treasuries Vs Exchange Custody

Many people confuse exchange wallets with company treasuries, but they are not the same thing. Exchange wallets like those owned by Robinhood or Binance hold Dogecoin for millions of users. The company acts as a custodian, not an investor.

A treasury, on the other hand, means the company itself bought and holds DOGE as part of its financial reserves.

According to CoinGecko’s corporate treasury tracker, very few public companies have disclosed Dogecoin holdings on their balance sheets, and those amounts are tiny compared to exchange pools.

This shows that Dogecoin’s “company ownership” is mostly in custodial form, not strategic corporate investment. For traders, that means supply is liquid and can move fast when users buy or sell through these platforms.

Methodology And Data Caveats

The numbers in this article come from labeled on-chain data from sources like BitInfoCharts and CoinCodex, along with public treasury records from CoinGecko. Labeled addresses identify known exchange and custodial wallets, though they are not perfect.

Some labels trace back to legacy or inactive exchanges, while others combine multiple wallet clusters under one name.

Data updates often, so balances may shift with withdrawals and deposits.

What This Means For Dogecoin Holders

Large portions of Dogecoin are stored on exchange wallets, which means most DOGE is liquid and ready to move. When users deposit coins into exchanges, the market often sees higher sell activity. When withdrawals increase, it signals accumulation.

I see this as both a strength and a weakness. It’s good for liquidity, but it also means no major company is hoarding DOGE for long-term use. The price remains heavily influenced by retail demand and short-term speculation.

Traders should pay attention to major on-chain flows from these exchange wallets, as they often precede strong price reactions.

Conclusion

Dogecoin’s biggest holders in 2025 are not secret whales but major exchanges and custodians. Robinhood, Binance, and Upbit together hold tens of billions of DOGE, mostly on behalf of users.

This means that Dogecoin’s supply rests with platforms that manage trading access, not companies investing for the long haul.

If you hold DOGE, keep watching those labeled wallets. Track changes through public Dogecoin rich lists, and follow corporate treasury updates on CoinGecko. It’s the easiest way to see where the real Dogecoin power lies at any moment.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here