ETH is trading slightly above $4,470 in a $4,300 to $4,500 range. ETF flows and upcoming U.S. macro prints will decide the next directional leg.

As of September 3, 2025, Ether trades around $4,470, after a recent pullback from late August highs.

The market now sits between $4,300 support and roughly $4,500 resistance, making short-term Ethereum price outlook and direction sensitive to flows and macro prints this week ahead.

RELATED: Ethereum Price Prediction: Will ETH Smash Its $4,800 All-Time High This Year?

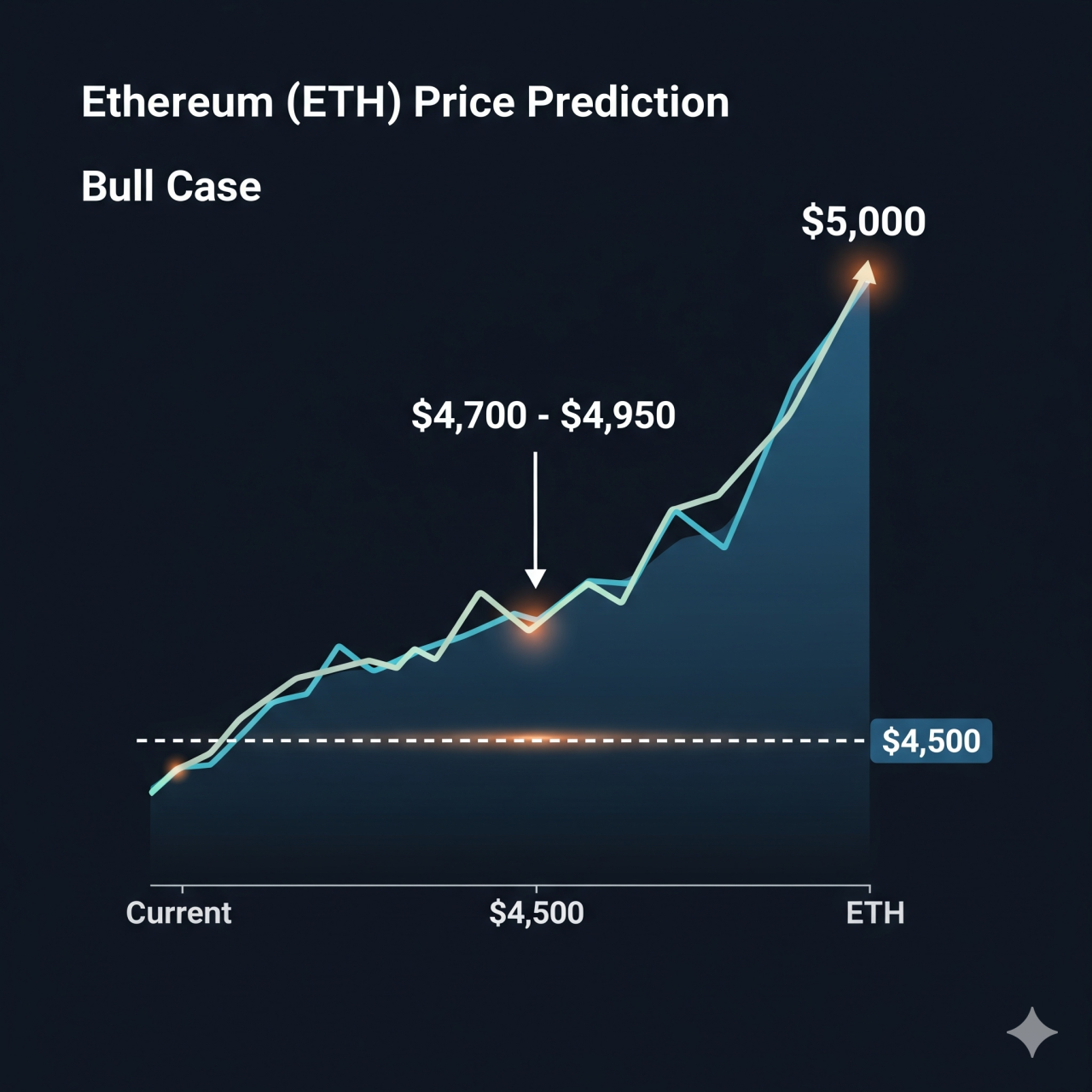

Bull Case: Daily Close Above $4,500

A clean daily close above $4,500 on rising spot volume would open a constructive path toward $4,700 to $4,950, with $5,000 as a psychological target. August ETF flows provide proof of demand, with one tracker reporting $1.08B in spot ETH ETF inflows between August 25 and 29, the fourth-largest weekly total.

Deribit analytics show ETH 25-delta skew less tilted toward puts than BTC, implying options traders carry a bearish bias. Positive but modest perpetual funding across major venues suggests leverage on longs remains sustainable for continued upside.

If price cannot close above $4,500 with rising volume, the bullish case fails.

RECOMMENDED: Ethereum’s Secret Weapon in 2025? Tokenization, Says Billionaire Investor

Bear Case: Slip Under $4,300

A decisive break below $4,300 on heavy volume would tilt the tape toward $4,260 to $4,200 as the next visible demand area. ETF flows reversing to net outflows would amplify selling pressure, especially if weekly creation data turns negative after August inflows.

Options markets would confirm stress if 25-delta risk reversal flips toward puts and short-tenor implied volatility jumps, signaling hedging and higher tail risk.

Perpetual funding turning negative and open interest dropping would accelerate de-risking, opening measured moves to $3,800 and then $3,600.

RECOMMENDED: Where will Ethereum (ETH) Be in 5 years?

What To Watch (Next Two Weeks)

Key macro catalysts include U.S. nonfarm payrolls on Sep 5, CPI on Sep 11, and the FOMC meeting on Sep 16 and 17, any print that surprises can swing risk appetite.

At the market level, watch daily spot ETF creations and redemptions, Deribit 25-delta skew shifts, and funding rates for confirmation of flow-driven moves. Also track open interest changes daily.

You can also check out InvestingHaven’s Ethereum price prediction in 2025 and beyond for a more long-term outlook.

ALSO READ: Ethereum Price Prediction: Tom Lee Makes The Case For $30,000 ETH

Conclusion

ETH sits coiled between $4,300 and $4,500. A confirmed break will align with spot ETF flows and U.S. macro prints. Trade confirmation only, control size and use tight stops today.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)