KEY TAKEAWAYS

- Ethereum is trading around $4,000 and testing a key resistance zone between $4,200 and $4,400.

- A daily close above $4,400 could confirm a breakout toward $4,800, while a drop below $3,550 would invalidate the pattern.

- On-chain data shows large wallet accumulation and higher futures activity, but rising leverage increases the risk of a fakeout.

Ethereum is testing a key level after weeks of sideways trading. The next few days could confirm whether the move is real or just another short-term fakeout.

Ethereum is trading around $4,000 after bouncing from its recent pullback. Traders are watching closely as the price tests the top of a bull-flag pattern – a common setup that can lead to strong rallies if confirmed.

Trading volume has picked up in recent sessions, showing renewed market activity after a quiet start to October. Let’s look at why Ethereum is the best crypto to buy today.

ALSO READ: Is Ethereum (ETH) A Good Investment? 7 Factors You Should Know

Price Structure And Key Levels

Ethereum’s current setup is clear. The coin has been holding between $3,800 and $4,400, forming a tightening pattern that looks like a flag on the daily chart.

A daily close above $4,400 would confirm the breakout and signal a possible move toward $4,800 or higher. On the other hand, a drop below $3,800 would show weakness, and a break under $3,550 would completely invalidate the pattern.

Over the past week, Ethereum has faced repeated rejections around $4,200. This level has become short-term resistance, so a strong candle above it – supported by high volume – would be an early sign that bulls are back in control.

RECOMMENDED: Will Ethereum Hit $5,000 Sooner Than Expected?

On-Chain And Derivatives Signals

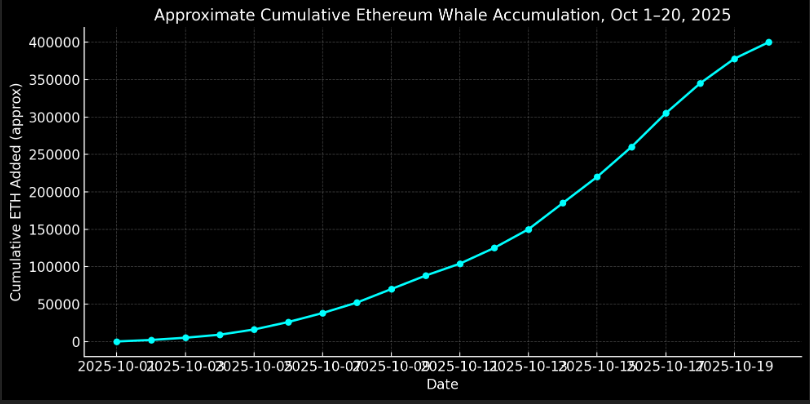

Blockchain data shows growing activity among large holders. Wallets with over 10,000 ETH have been accumulating since mid-October, which often hints at rising confidence.

At the same time, open interest in futures markets has increased, meaning more traders are betting on short-term moves. While these signals can support a bullish case, they also bring risk.

Crowded long positions and rising leverage can trigger sudden liquidations if the price pulls back. ETF inflows remain steady, but traders should still watch for changes in funding rates, as these shifts often reveal when the market is overheating.

RECOMMENDED: What to consider before Investing In Ethereum (ETH)

News Catalysts And Short-Term Risks

Recent market swings have been linked to global news and risk sentiment. Rapid changes in macro headlines or sudden Bitcoin volatility could easily pull Ethereum in either direction.

If buying pressure fades while open interest rises, it could signal a fakeout instead of a confirmed rally.

Conclusion

A close above $4,400 with strong volume and continued Ethereum whale accumulation would confirm a breakout. But if Ethereum slips below $3,550 while leverage builds up, it would point to a false break.

The next few sessions will decide which story plays out, and the data so far shows both potential and caution.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- The Ongoing Test Of Bitcoin’s 200 dma Will Be Decisive For The Outcome In Crypto Markets (Oct 20th)

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)