ETF inflows have pushed large sums into ETH, while staking and DeFi activity have tightened supply and raised demand. These forces make ETH a clear candidate, but volatility remains.

Ethereum is seeing heavy institutional interest through spot ETFs. Recent ETF inflows and rising on-chain makes it the best crypto to buy today, but traders should plan for volatility and defined exit points.

RECOMMENDED: Ethereum Alert: The Make-or-Break Levels Traders Can’t Ignore

ETH ETF Flows And Institutional Demand

Spot ETH funds have recorded large net inflows in recent sessions, with reports noting a $547M inflow in early October and billions in ETF purchases through late September.

These flows create steady buying pressure from institutions that previously had limited access to ETH. Watch which funds lead inflows, because leadership often sets short-term price direction.

RECOMMENDED: Is Ethereum (ETH) A Good Investment? 7 Factors You Should Know

On-Chain Use And Supply Tightness

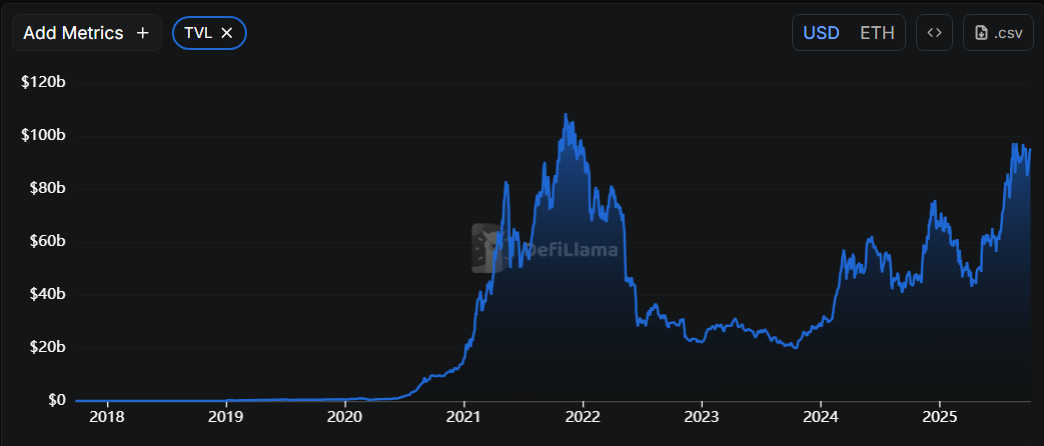

Real network use agrees with the ETF demand. Layer-2 TVL has climbed into double-digit billions, showing more capital working on Ethereum DeFi.

At the same time, staking levels exceed 35M ETH, which removes a meaningful share of circulating supply. This combination reduces available liquid ETH while increasing real utility on the network.

RECOMMENDED: What to consider before Investing In Ethereum (ETH)

Risks, Technicals And A Simple Trade Plan

Technically, ETH has tested resistance around $4,500 to $4,700, so a failed breakout can trigger sharp pullbacks. Expect high intraday swings and set position sizes you can tolerate.

A simple plan:

- Scale into positions in 2 steps; first at a minor pullback and second on a confirmed breakout

- Limit any single trade to a small percentage of your portfolio

- Use a stop loss under the nearest clear support to protect capital

RECOMMENDED: Where will Ethereum (ETH) Be in 5 years?

Conclusion

ETF momentum plus growing DeFi activity and staking make ETH a compelling buy for those who accept volatility. If you favor structured risk control, consider a measured entry with clear stops and size limits to capture upside while limiting downside.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)