KEY TAKEAWAYS

- A dormant wallet transferred about 85,283 ETH, including a 50,000 ETH deposit to Gemini.

- The ETH originated from 2017, when prices were close to $90, implying a gain of over 30x.

- Large exchange deposits often raise concerns about selling pressure and short-term volatility.

A wallet silent since 2017 suddenly moved about 85,283 ETH to Gemini in late January 2026.

The transfer pushed hundreds of millions of dollars’ worth of ETH directly onto an exchange.

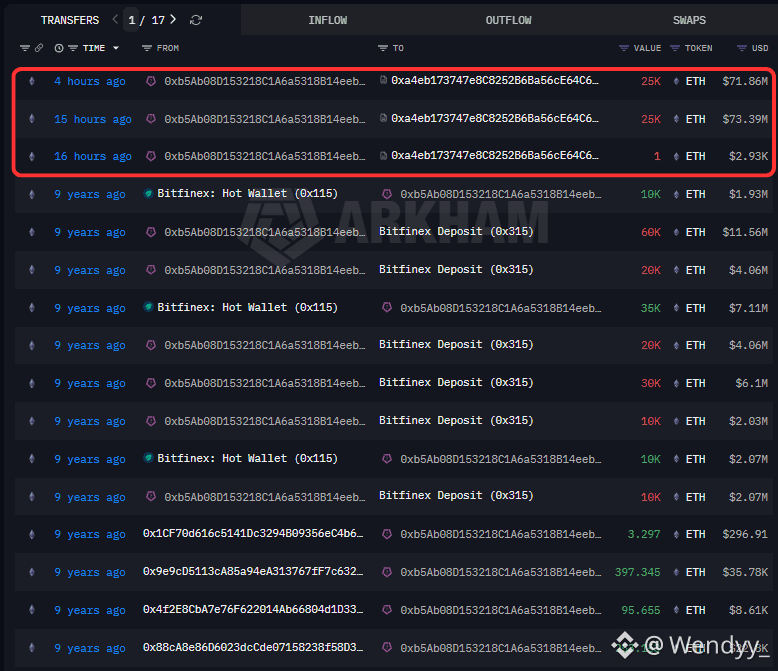

Late on Jan 26 and into Jan 27, 2026, one of Ethereum’s oldest large wallets came back to life.

The address, inactive for nearly nine years, began moving ETH that had not been touched since the early days of the network.

Within hours, tens of thousands of ETH flowed into Gemini-linked addresses.

At market prices during the transfers, the value crossed $240M, turning a quiet wallet into one of the most talked-about on-chain events of the week.

RECOMMENDED: Why BlackRock Is Bullish On Ethereum Despite The Price Stall

What Happened On-Chain

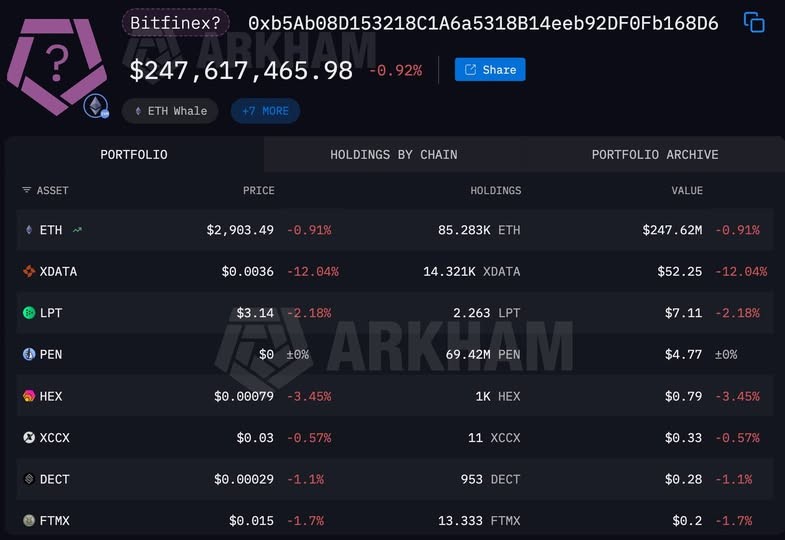

The wallet originally accumulated roughly 135,000 ETH in mid-2017, withdrawing funds from Bitfinex during Ethereum’s early growth phase.

After years of inactivity, the address reactivated on Jan 26, 2026.

The first major move sent 50,000 ETH to a Gemini-linked deposit wallet.

Additional transfers followed, bringing the total ETH moved to about 85,283 ETH.

On-chain data clearly links the destination to Gemini, signaling that the holder chose direct exchange access rather than private storage.

ALSO READ: Ethereum Shatters $120B Staking Record – Can ETH Hit $4,000?

Why This Move Matters

Large transfers to exchanges are worth watching because they make ETH immediately available for sale.

An inflow of this size can affect order books, OTC desks, and derivatives positioning.

Traders often react quickly, adjusting futures and options exposure in anticipation of volatility.

While not every deposit leads to selling, history shows that similar whale moves frequently trigger short-term price swings and thinner liquidity during active trading hours.

RECOMMENDED: Morgan Stanley Files Ethereum ETF – Impacts for ETH in 2026

What The Whale May Be Planning

Possible reasons include profit-taking after a multi-year hold, restructuring custody, or preparing a block sale.

Clear warning signs would include repeated deposits, large limit orders, or fast execution across Gemini markets.

Conclusion

This reactivation ranks among the largest 2017-era ETH movements seen in years.

With 85,000+ ETH now exchange-accessible, the market will closely track Gemini flows and trade data to see whether this whale plans to sell – or simply reposition a historic fortune.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

In the next few days we will release our latest Premium Crypto Alert and reveal the key assets we’re watching for explosive moves in 2026.