KEY TAKEAWAYS

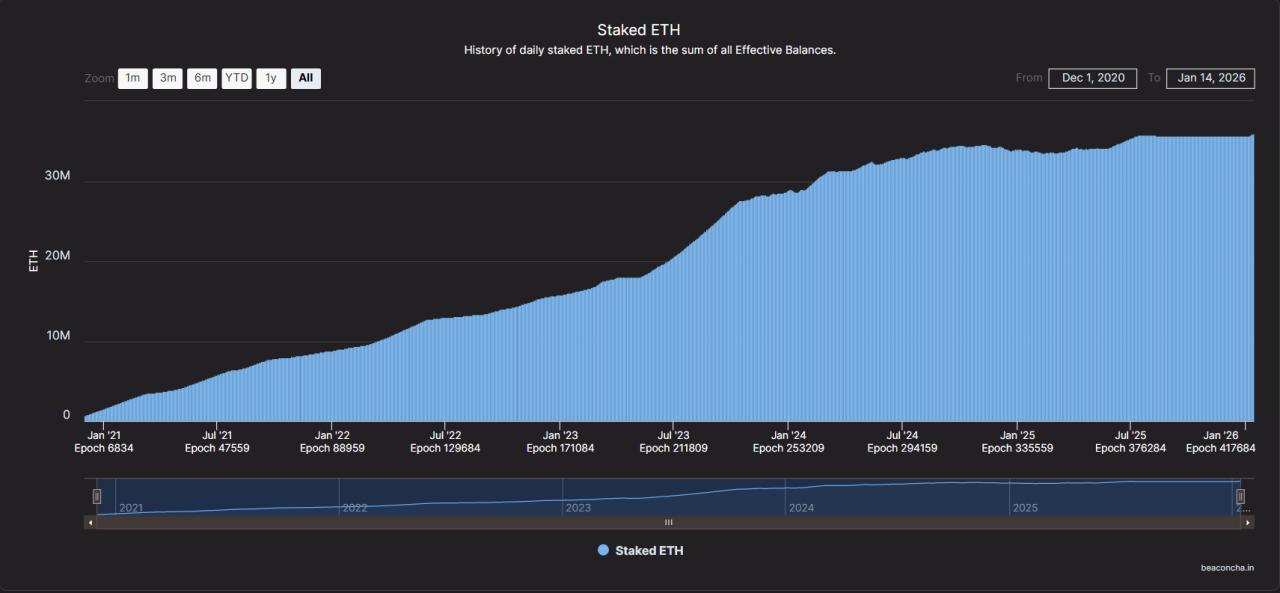

- About 29% of ETH supply sits staked, cutting immediate sellable tokens.

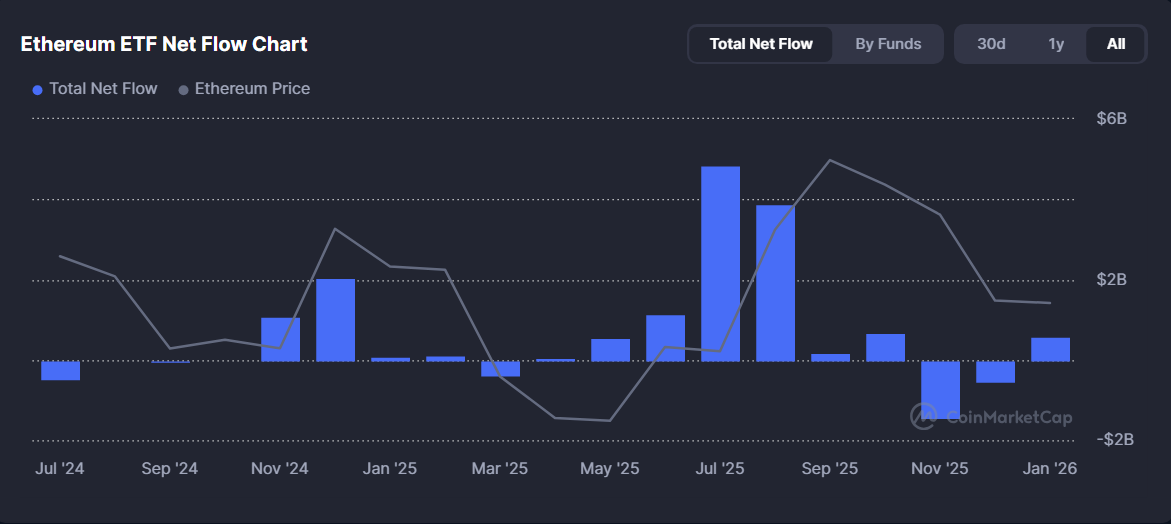

- ETFs and major custody platforms funnel billions into long-term positions.

- ETH needs steady inflows and calm macro conditions to clear $4,000.

Ethereum now locks $120B in staking, shrinking supply and amplifying price moves.

Institutional inflows make $4,000 possible but not guaranteed.

Ethereum is trading around 3301.24, validators currently secure the network with about 35.9M staked ETH, roughly 29% of all circulating supply.

At current prices, that equals around $120B locked away from daily trading.

This level of commitment signals confidence, tightens available liquidity, and makes every new dollar of demand move the market more.

Withdrawals also move through structured queues rather than instantly hitting exchanges.

RECOMMENDED: Morgan Stanley Files Ethereum ETF – Impacts for ETH in 2026

Why $120B In Staked ETH Matters

Locking 35.9M ETH removes a huge slice of coins from active markets.

With fewer tokens available, buyers must compete harder, and prices can jump faster.

Staking mechanics add friction as validators cannot exit instantly, so large amounts of ETH stay off exchanges even during hot markets.

That creates short periods where demand runs into thin supply, which tends to produce sharper rallies.

At the $120B level, even moderate new inflows can push prices higher than when supply flowed freely.

RECOMMENDED: Bitcoin, Ethereum, XRP: The 3 Cryptos Dominating January 2026

Why Big Money Keeps Buying ETH

Large custodians and staking providers now hold significant ETH, and institutions increasingly prefer earning yield while holding.

Spot ETH ETFs widened access for funds that cannot stake directly, yet still want exposure.

Many of these investors treat ETH as a multi-year allocation, not a trading chip.

Their steady buying shrinks the liquid float further and reinforces upward pressure when demand rises.

ALSO READ: Who Owns The Most Ethereum (ETH)? Revealed

Can ETH Really Reach $4,000?

Bulls point to tighter supply, consistent ETF inflows, and continued network use as reasons for upside.

Bears counter that higher interest rates, broad market sell-offs, or new staking rules could stall momentum.

Hitting $4,000 looks realistic only if inflows stay positive and the wider market remains stable.

RECOMMENDED: Will Ethereum Hit $5,000 Sooner Than Expected?

Conclusion

The $120B staking milestone makes big moves more likely by reducing supply and anchoring long-term demand.

Whether ETH reaches $4,000 will depend less on hype and more on sustained institutional buying and a steady macro backdrop.

Before you invest in ETH, our next premium crypto alert will be published in the coming days and we will reveal the crypto assets you may want to consider for 2026 with explosive potential.