Ethereum has been doing rather well this week, following Bitcoin’s footsteps, as the world’s second-largest cryptocurrency holds strong momentum at the start of October. For the Ethereum weekend forecast, those who prefer short-term gains will keep an eye on whether ETH can sustain above key levels, while long-term investors are wondering if this is the start of a real push toward new all-time highs.

Speaking of long-term, we’ve made an evaluation on where Ethereum will be in five years, so you might want to give it a read after catching up on the latest ETH news below.

RELATED: What to consider before Investing In Ethereum (ETH)

Ethereum Weekend Forecast

Considering how the price is going, the primary support is situated at $4,350, with a more substantial foundation at $4,200. The key resistance level to watch is the ceiling at $4,550 (with the next target at $4,700).

Trading is usually thinner on weekends, which may increase price swings. On the positive side, a lot of ETH is being locked up for staking, showing long-term confidence, and a good market mood with steady fund inflows could help prevent big drops.

Analyzing the Ethereum weekend forecast shows that if ETH holds above $4,350 through the weekend, bulls could attempt another push toward $4,550. Though, a break below that level could shift focus back to $4,200 support.

Either way, those interested in a more distant future forecast should take a look at our full Ethereum price prediction.

Ethereum Recap of the Week

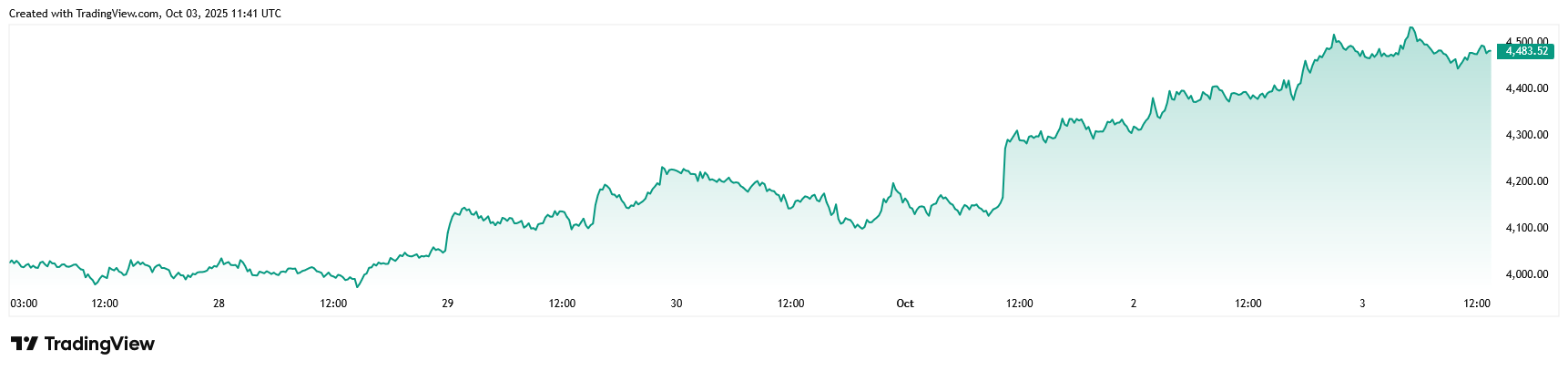

The week started with a notable upward momentum, as Ethereum eventually went over the $4,300 threshold during the week.

(Ethereum weekend forecast and recap, October 3, 2025)

Interestingly, Ethereum moved up along with Bitcoin and managed to post bigger gains than most other altcoins, showing relative strength.

What’s more, during the week, activity on the Ethereum network skyrocketed as it hit record highs between 1.6 and 1.7 million transactions daily. This is particularly noteworthy, since for years, daily transaction volume consistently ranged between 900,000 and 1.2 million.

Overall, Ethereum closed the working week strong, supported by institutional interest and a massive number of network transactions.

RECOMMENDED: Is Ethereum (ETH) A Good Investment? 7 Factors You Should Know

Conclusion

Ethereum is heading into the weekend holding above $4,400, with immediate resistance observed at $4,550 and a floor at $4,350. Looking at the Ethereum weekend forecast, it seems the traders are aware that lighter trading volume could lead to bigger price jumps, but the overall mood is optimistic thanks to good network activity and a generally positive crypto market.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)