KEY TAKEAWAYS

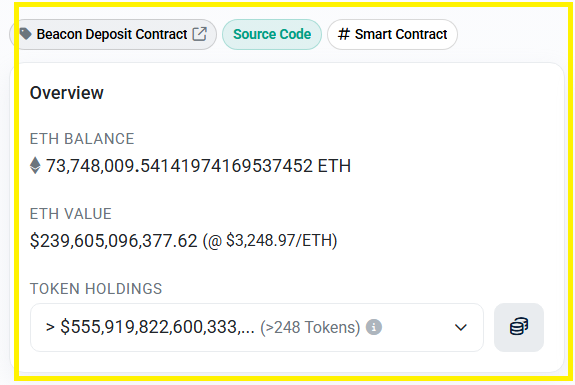

- The Beacon Deposit Contract is the largest single holder, with about 73.7M ETH; roughly 62.6% of the total supply.

- Coinbase and Binance hold millions of ETH in pooled exchange wallets, which directly affects liquidity and market movement.

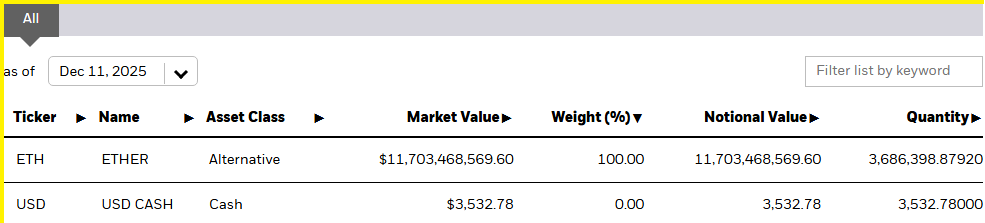

- Institutional products such as BlackRock’s iShares Ethereum Trust add another large concentration, with around 3.7M ETH locked in long-term custody.

- Individual and early wallets, including Vitalik Buterin’s roughly 260k ETH, make up a much smaller share of total holdings.

- Most ETH sits within a few major categories such as staking pools, exchanges, institutional funds and inactive wallets.

Most ETH sits in the Beacon Deposit Contract, while exchanges and big funds hold millions more. That balance shapes staking, liquidity and long-term market behavior.

The Beacon Deposit Contract holds about 73.7M ETH out of roughly 117.77M ETH in circulation.

That equals about 62.6% of the total supply.

Coinbase holds around 5.1M ETH, and Binance holds roughly 4.2M ETH.

BlackRock’s iShares Ethereum Trust owns close to 3.7 M ETH.

Vitalik Buterin’s tracked wallet holds about 260k ETH.

These numbers show that a few major holders, including staking pools, exchanges, institutions and early wallets, control a large part of all existing ETH.

Their actions influence how liquid ETH is, how staking behaves and how the market reacts to changes.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

RECOMMENDED: Is Ethereum (ETH) A Good Investment? 7 Factors You Should Know

Largest Ethereum Holders

| Holder | Estimated ETH Holdings | Share of Total Supply | Notes |

| Beacon Deposit Contract | 73.7M ETH | ~62.6% | Largest single on-chain holder; staking entry point |

| Coinbase | 5.1M ETH | ~4.33% | Pooled exchange custody for users |

| Binance | 4.2M ETH | ~3.57% | Major exchange wallet cluster |

| BlackRock iShares Ethereum Trust | 3.7M ETH | ~2.55% | Long-term institutional custody |

| Vitalik Buterin (publicly tracked wallet) | 260k ETH | ~0.22% | Individual holdings; much smaller share |

Beacon Deposit Contract

The Beacon Deposit Contract holds the largest amount of ETH by far, with about 73.7M out of the 117.77M ETH in circulation.

That’s roughly 62.6% of the entire supply sitting in one place.

Users send ETH here when they stake to support network security, and they withdraw it when they leave the validator set.

Because such a large share of ETH is locked inside this contract, it has a direct impact on how much ETH remains available for trading.

When staking grows, more ETH gets locked away; when withdrawals increase, more ETH returns to the market.

Its size makes it a good indicator of long-term confidence in Ethereum, since it shows how willing people are to commit their tokens for extended periods.

RECOMMENDED: What to consider before Investing In Ethereum (ETH)

Coinbase

Coinbase holds around 5.1M ETH, or about 4.33% of the total supply.

These tokens belong to millions of users, but on-chain they appear as a single large set of wallets.

Changes in Coinbase’s balances often reflect shifts in market mood.

When a lot of ETH moves into the exchange, it may signal that users want to trade or take profits.

When ETH flows out, it often means people are moving to long-term storage or staking.

Coinbase also offers staking services, so part of its holdings move regularly between exchange wallets and staking pools.

Because it is one of the most trusted platforms for both retail and institutions, its holdings help show how much ETH is actively available in the U.S. market.

Binance

Binance holds roughly 4.2M ETH, which is about 3.57% of the supply.

As one of the busiest global exchanges, Binance sees constant movement across its wallets.

Its ETH balance often shifts quickly as users trade, withdraw to private wallets or move tokens into different staking products.

Large inflows can increase immediate selling pressure on the market, while big outflows often tighten the supply available for trading.

Binance’s global reach means its on-chain activity reflects broader international trends, giving a useful window into how traders around the world react to market conditions.

RECOMMENDED: Is It Too Late To Buy Ethereum (ETH) in 2025?

BlackRock iShares Ethereum Trust

BlackRock’s iShares Ethereum Trust holds about 3.7M ETH, or 2.6% of circulating supply.

Unlike exchange holdings, this ETH sits in long-term custody and rarely moves.

Investors buy shares in the trust rather than holding ETH directly, so the underlying tokens remain locked until fund flows change.

This structure removes a large amount of ETH from daily trading and concentrates it under a single institutional custodian.

The trust’s size also shows how quickly traditional finance is adopting Ethereum.

As more investors choose regulated products, institutional holdings like this play a bigger role in shaping the available supply of ETH.

Vitalik Buterin

Vitalik Buterin is the co-founder of Ethereum. His publicly tracked wallet holds about 260k ETH. While this is small compared to exchanges or staking pools, his wallet draws attention because of his position.

Any movement from this address often sparks speculation, even when the transfers support research, donations or project funding. Vitalik’s balance also highlights how ETH ownership has spread over time.

In the early days, individual wallets held far larger shares, but today the supply is mostly concentrated in staking systems, exchanges and institutional funds.

Vitalik Buterin’s ETH holdings shows how much the ecosystem has grown and how widely ETH is now distributed across millions of users.

ALSO READ: Ethereum Outlook For December: Can ETH Find Support And Push Toward $4,000?

How ETH Ownership Affects Market Liquidity

Large holders shape how easily ETH moves through the market. When staking contracts or institutional funds lock up millions of ETH, the amount available for trading drops, which can tighten liquidity.

Exchange wallets work the opposite way: big inflows often increase sellable supply, while large outflows reduce it.

These shifts help explain why ownership patterns influence short-term price movement.

Conclusion

Most ETH sits in staking through the Beacon Deposit Contract, while exchanges and institutional funds hold millions more.

A small set of major holders shapes how ETH moves, trades and secures the network.

Therefore, understanding where ETH sits helps explain market behavior and long-term trends in the ecosystem.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower