KEY TAKEAWAYS

- Ethereum trades around $4,100, just below its all-time high of about $4,946, keeping $5,000 within sight.

- The EIP-1559 update has burned over 4.3 million ETH, steadily reducing total supply.

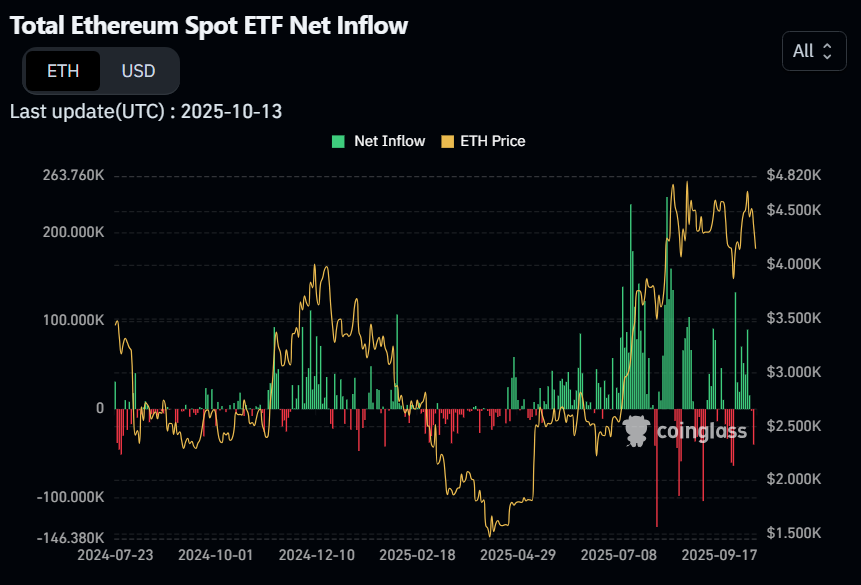

- Spot Ethereum ETFs have attracted billions in institutional inflows, adding strong upward pressure on price.

- DeFi and Layer-2 activity continue to grow, increasing network use and transaction fees.

Strong ETF inflows, growing network activity, and reduced supply have brought Ethereum closer to $5,000. Its next move depends on whether investor demand keeps up with these improving fundamentals.

Ethereum is trading around $4,100 with a market value of roughly $496 billion. The coin is gaining strength after a brief dip earlier in October. Many traders now believe that if current trends continue, Ethereum could test the $5,000 mark sooner than most expect.

RECOMMENDED: Ethereum (ETH) Price Prediction 2025 – 2030

Where Ethereum Stands Now: Price, Supply, And Demand Signals

Ethereum’s all-time high sits at about $4,946, leaving it just a few hundred dollars away from breaking records. The coin has seen strong daily swings as investor confidence shifts with global market sentiment.

Since the EIP-1559 update, more than 4.3 million ETH have been permanently removed from circulation. This steady burn reduces new supply entering the market, which can help prices rise when demand stays high.

Combined with regular staking and network use, Ethereum’s available supply is slowly tightening.

RECOMMENDED: What to consider before Investing In Ethereum (ETH)

Ethereum Price Prediction: Catalysts That Could Push ETH To $5,000 Faster

The recent approval of spot Ethereum ETFs has brought new attention from institutional investors. Global crypto funds have added billions in fresh inflows, showing that large players are willing to commit capital.

On-chain data also supports this optimism. Ethereum’s decentralized finance (DeFi) ecosystem now holds tens of billions in total value, and activity on Layer-2 networks like Arbitrum and Optimism keeps growing.

More users mean higher transaction fees and stronger burn rates, both of which can increase scarcity and support a higher price.

RECOMMENDED: Is Ethereum (ETH) A Good Investment? 7 Factors You Should Know

Will Ethereum Reach $5,000: Key Risks And Technical Barriers

The $4,900 to $5,000 range remains a major psychological barrier. A sudden drop in ETF inflows, tougher regulation, or a shift in global risk sentiment could slow Ethereum’s rise.

Lower transaction activity or smaller burn rates would also make it harder to sustain upward momentum.

RECOMMENDED: Where will Ethereum (ETH) Be in 5 years?

Conclusion

Ethereum has the right setup for another rally, supported by institutional demand and limited supply. If these trends continue, reaching $5,000 may happen much sooner than most people expect.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)