Listings bring public capital and stricter rules, speed institutional access, and force firms to balance growth with governance and oversight.

A recent wave of large fundraises and planned crypto IPOs in 2025 has pushed crypto firms into mainstream capital markets. Experts say these events increase liquidity, create public valuation benchmarks, and force firms to meet higher disclosure and governance standards.

Market Impact: Valuations, Liquidity, And Price Signals

Farzam Ehsani of VALR says public listings and big private rounds mark a maturation point for crypto and produce visible benchmarks investors use to price companies.

Recent reports show Tether in talks to raise $15–20 billion, a move that could value it near $500 billion, and Kraken closed a $500 million round at roughly $15 billion, preparing for an eventual IPO.

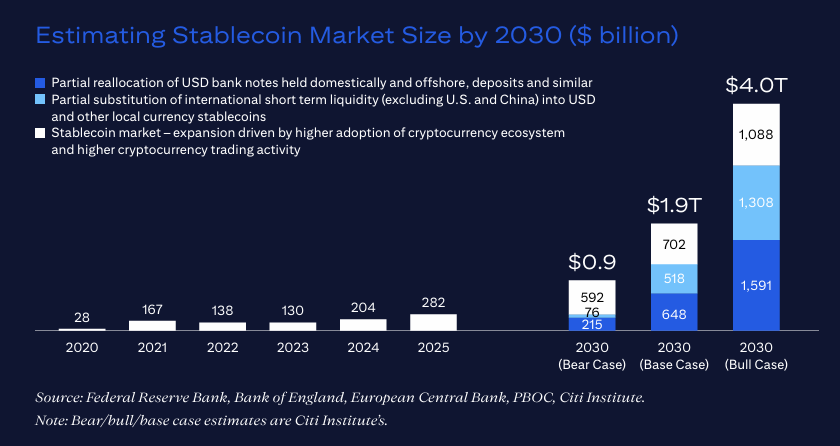

Citi’s revised forecast now models stablecoin issuance at a $1.9 trillion base case and a $4.0 trillion bull case by 2030, which signals much larger on-chain liquidity ahead.

Together, these deals lift sector valuations and broaden liquidity, but they also expose firms to intense market scrutiny, and that can amplify volatility when public investors test earnings and disclosures.

Institutional Implications: Who Is Buying And Why It Matters

Shawn Young, chief analyst at MEXC, notes that strategic and institutional crypto investment gives exchanges and issuers credibility and helps expand payment and custody infrastructure in emerging markets.

Major investors reportedly in talks for these rounds include technology and asset managers, which lets pensions and asset managers access regulated crypto exposures via equities rather than direct token holdings.

Public shareholders will press for consistent returns and tighter controls, which can limit rapid product changes and concentrate decision making, shifting governance dynamics inside these firms.

Regulation And Governance: What Regulators Will Watch

Lionel Iruk, a legal partner at NAV Markets, says legal and compliance frameworks are now central to attracting top-tier institutional capital.

New U.S. proposals and the GENIUS Act text require monthly reserve reports, auditor examinations, and stricter reserve rules for payment stablecoins, raising compliance costs and enforcement focus for listed issuers.

Regulators will focus on reserve quality, timely disclosures, operational resilience, and cross-border compliance as firms move into public markets.

Conclusion

The current crypto IPO wave gives crypto firms going public access to scale and capital, and experts say this legitimizes the sector while forcing harder choices about governance, disclosure, and long-term strategy.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)