New U.S. stablecoin legislation could boost institutional adoption and dollar liquidity while reshaping Treasury yields and financial stability risks.

The U.S. House passed the GENIUS Act this last week, stablecoin legislation is edging toward becoming law. This U.S. stablecoin legislation promises to redefine flows of dollar-denominated crypto assets, touching on institutional adoption, Treasury markets, and global dollar liquidity.

Regulatory Clarity & Institutional Uptake

As the GENIUS Act passed President Trump’s desk, following Senate approval in June and House passage on July 17, the bill brings much-needed crypto regulatory clarity. By setting 1:1 reserve backing and mandating banks or licensed entities as issuers, it signals institutional readiness.

Major banks like Bank of America, Morgan Stanley, JPMorgan, and Citi are already preparing stablecoin initiatives, citing these new rules as pivotal. Clear legal frameworks typically unlock billions in on-chain flows, as traditional finance bridges into digital dollars.

Macro Impact on Dollar Liquidity & Yields

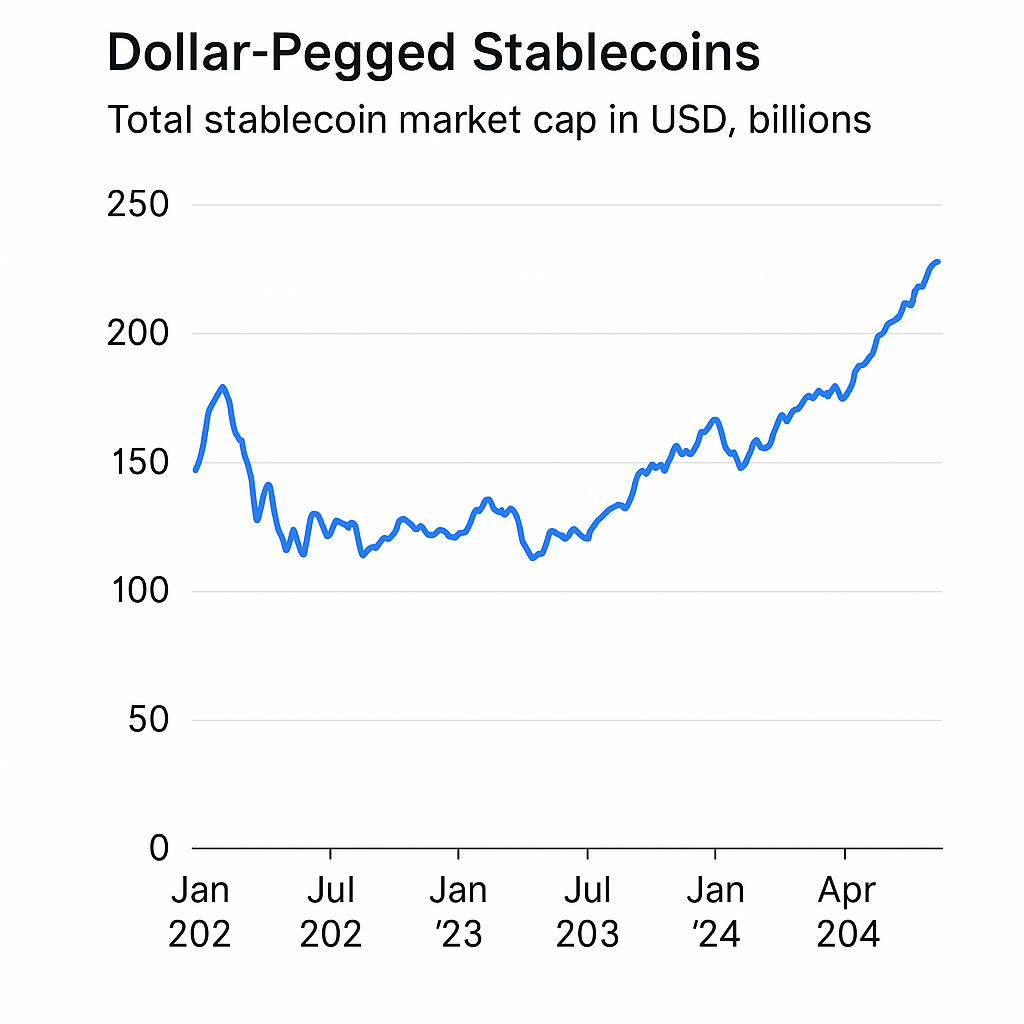

Dollar‑pegged stablecoins now total around $236–250 billion, with market share rising nearly 40% since late 2024. Their massive holdings in U.S. T‑bills (about $40 billion in 2024) have put measurable downward pressure on short-term yields, shaving off 2–4 bps over typical cycles.

With projections suggesting stablecoin assets could swell to $3–3.7 trillion by 2030, the dollar-backed stablecoins trend threatens to deepen dollar liquidity, reshape treasury demand, and impact yield curve dynamics.

Global Dollar Role & Financial Stability

By reinforcing the global dollar liquidity framework, stablecoins strengthen U.S. currency dominance in digital payments. However, this also raises systemic risks: shadow‑banking strains, opaque reserve disclosures, and central-bank sovereignty challenges.

The BIS and global regulators are warning that unchecked stablecoin expansion may compel accelerated development of CBDCs or tighter reserve regulatory regimes to safeguard monetary control.

Conclusion

U.S. stablecoin legislation stands at a critical juncture. It could unlock institutional adoption and inject fresh liquidity into dollar-denominated crypto, but also trigger yield shifts and regulatory responses.

As the dollar-backed stablecoins ecosystem grows, balancing innovation with systemic safeguards remains essential.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)