Ethena remains in focus after finding a spot on Coinbase’s asset roadmap on June 4th. But is ENA worth buying at current levels?

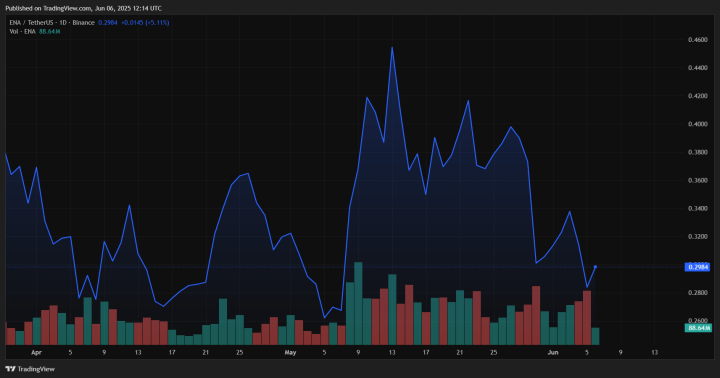

Ethena (ENA) recently caught investors’ attention after its addition to Coinbase’s asset roadmap on June 4, yet the price slipped—from around $0.34 to below $0.30. With stalled momentum and looming token unlocks, the question stands: is the current dip a buying opportunity or a red flag?

Technical Outlook & Key Price Levels

ENA faces resistance in the $0.35–$0.36 range, where 878 addresses hold roughly 2.77 billion tokens at a loss. Short‑term indicators such as MACD and AO paint a bearish picture, struggling below the 20‑day EMA.

That said, a breakout above USD 0.32 resistance could signal a reversal. FxStreet notes bullish technicals and derivative data suggesting a possible move to $0.34, while CoinCentral highlights the potential for a Golden Cross, paving the way toward $0.60.

Fundamentals & On‑Chain Signals

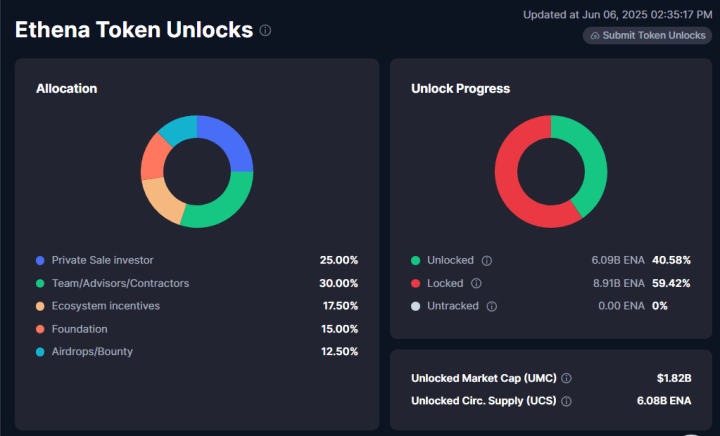

Token unlocks—such as ~$12.7 M on June 2 and another $50 M (≈171 M ENA) on June 5—have weighed on price but haven’t triggered major dumps.

Meanwhile, recent whale accumulation and rising futures open interest hint at underlying demand. Ethena’s on‑chain activity remains active and resilient, suggesting holders may be absorbing supply.

Utility, Yield & Forecasts

Ethena’s USDe stablecoin offers 37% APY, drawing in yield‑hungry capital. USDe has emerged as a top‑5 stablecoin ($1.9 B market cap), bolstering network credibility.

Longer‑term projections are mixed: CoinCodex forecasts ENA around $0.22–$0.24 by December 2025 (~18% upside), while BlockDAG’s bullish case projects $0.80–$1.20 for 2025. Gate.io averages a moderate $0.30–0.39 range.

Conclusion

ENA’s current dip to ~$0.30 may present a tactical entry for medium‑term upside. The protocol shows resilience with token unlock absorption, technical breakout potential, and compelling yield via USDe.

However, stubborn resistance at ~$0.35–$0.36 and scheduled unlocks necessitate caution. A confirmed breakout above $0.32–$0.34 with supporting EMA/MACD shifts could validate bullish conviction.

For now, we advise cautious accumulation with tight stops—especially around near‑term supply pressure and pending technical signals.

Unlock the Power of Smart Crypto Investing — Get Instant Access to Exclusive Crypto Alerts

Step into the future of investing with InvestingHaven’s premium crypto alert service — the world’s first of its kind, backed by over 15 years of market expertise.

Our proprietary 15-indicator methodology cuts through the noise to deliver actionable insights and timely crypto forecasts — helping serious investors stay one step ahead of market-moving trends.

🚀 Don’t follow the hype — lead with insight.

📈 Join a growing community of crypto investors who act before the big moves.

This is how we are guiding our premium members (log in required):

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)