Yes, ETH has been a good investment for 2025, it has increase in value over 90% in the last 12 months. Investing Haven’s price prediction suggests it could exceed $10,000 by 2023.

In this article we will explore whether Ethereum is a good investment in 2025, by examining seven key factors, from staking supply and ETF flows to scalability upgrades and long-term risks.

Is Ethereum a good investment in 2025, and what does an Ethereum price prediction in 2025 look like? Ethereum trades around2933.31after a large rebound this year. The U.S. approved spot-ETH ETFs in July 2024, which opened a major institutional on-ramp.

Over 35.7M ETH are staked, removing a substantial share of liquid supply. Now, to understand whether Ethereum is the right addition to your crypto portfolio, we’ll look at seven factors you should know before investing.

🔑 Key Takeaways: Ethereum Investment 2025

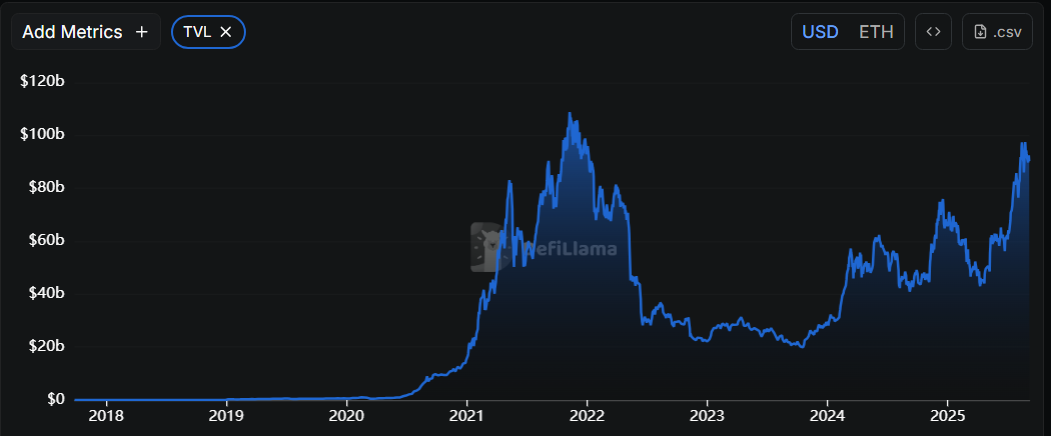

- Strong adoption: Ethereum secures ~$90–96B in DeFi TVL and ~500k daily active addresses, showing real economic activity.

- Staking impact: 35.7M ETH (~31% of supply) staked, reducing liquid supply and tightening circulation.

- Upgrades: EIP-4844 (Proto-Danksharding) and Layer-2 growth cut costs, boost throughput, and support mainstream usability.

- ETF flows: Spot-ETH ETFs launched in July 2024, holding ~5% of supply by mid-2025, driving institutional inflows and new demand.

- Competition: Other L1s compete on speed/fees, but Ethereum keeps a developer advantage and composability via rollups.

- Risks: Regulation, DeFi/bridge exploits (~$2.2B lost in 2024), and macro shocks remain key Ethereum investment risks.

- Price outlook: ETH trades near $4,400 (Sep 2025); forecasts suggest $5k–$7k in 2025 under favorable conditions, with long-term potential up to $10k by 2030.

Bottom line: Ethereum can be a strong long-term investment if you accept volatility and regulatory risk. ETFs give regulated access, while direct ETH allows staking and on-chain participation.

1. Network Fundamentals And Real-World Use Cases For ETH

Ethereum adoption shows in measurable activity, not slogans. The chain holds roughly $90–96B in DeFi TVL, and daily active addresses in the mid-500k range, indicating wide protocol use across finance and token markets.

These funds and flows reflect real user activity, including lending, decentralized exchanges, and stablecoin settlement.

Developer momentum matters for long-term value. Ethereum remains the largest smart-contract ecosystem by developer contributions and open-source activity, which sustains ongoing innovation on rollups and wallets.

Healthy developer activity raises the odds that useful applications continue to appear.

RECOMMENDED: Thinking About Investing in Ethereum? Here’s Why It’s Not Too Late!

2. Supply Dynamics, Staking And Monetary Policy Affecting ETH

Supply dynamics will have a big impact on whether Ethereum is a good invesment, The Merge cut ETH issuance materially versus proof of work, reducing new supply and making ETH yield-bearing for stakers. Post-Merge issuance is far lower than pre-Merge levels, which changed the basic supply math for holders.

EIP-1559 introduced a base-fee burn that removes ETH as the network sees activity. Combined with staking, the net circulating supply can tighten during periods of strong use.

Today about 35.7M ETH are staked, roughly 31% of supply, which limits liquid availability and links staking economics to price dynamics.

Staking yields trade off with liquidity for long-term holders, so you must weigh yield versus access.

3. Upgrades And Scalability

To consider whether ETH is a good investment, we need to look at the future potential, Ethereum’s roadmap includes Proto-Danksharding (EIP-4844), a change that adds a low-cost data type for rollups.

This update lowers the cost to publish rollup data on L1 and improves practical throughput for Layer-2 networks.

“Proto-Danksharding is a way for rollups to add cheaper data to blocks,” notes Ethereum.org.

The Dencun/Cancun upgrade deployed EIP-4844 to expand L1 block space for rollup data and reduce user fees.

Layer-2 networks now handle a large share of transaction volume and show rising throughput and TVL, which improves usability for mainstream apps. Developers and projects are already shifting to rollups to capture these savings.

RECOMMENDED: 5 Reasons to Buy Ethereum (ETH) Today

4. Institutional Adoption And The ETF Effect

One of the biggest factors to look at when considering is Ethereum is a good investment is institutional adoption. U.S. regulators approved spot-ETH ETFs in July 2024, creating a direct and regulated on-ramp for institutions.

ETF vehicles now hold millions of ETH, about 5% of supply in mid-Aug 2025, tightening liquid availability on exchanges.

Fund trackers and on-chain analytics reported large weekly inflows at times, with some weeks seeing roughly 286,000 ETH added to ETF wallets. These flows can move short-term prices when they concentrate.

For investors, ETFs offer easy access and regulated custody, while direct ownership permits staking yield and on-chain participation.

Note that many ETFs initially did not stake their holdings, so ETF exposure differs from owning ETH and staking it yourself. ETFs also connect ETH price action more tightly to global fund flows and macro sentiment.

ALSO READ: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

5. Competition, Layer-2s And Composability

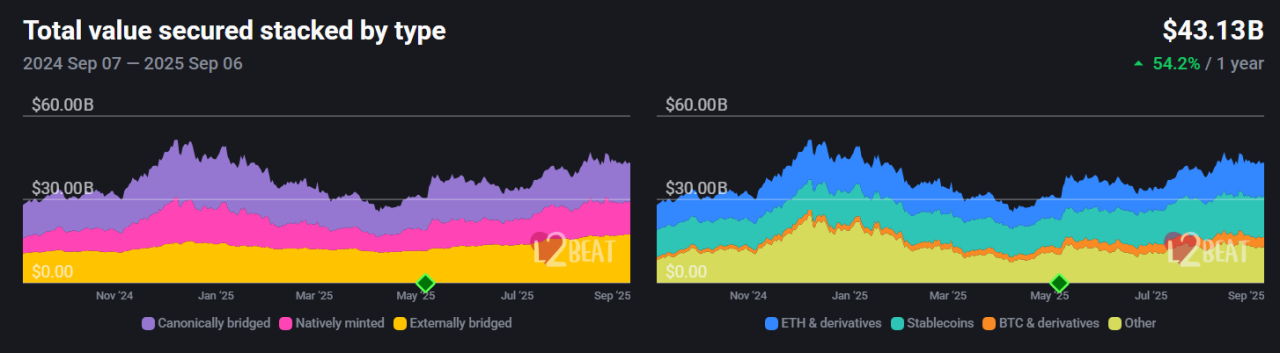

Layer-2 networks reduce fees and raise throughput, while keeping Ethereum’s base-layer security. The total value secured (TVS) in Layer-2s sits around $43.1B as of Sep 6, 2025, showing meaningful economic activity moving to rollups.

That shift preserves Ethereum’s composability advantage, because rollups inherit L1 settlement and let many apps interoperate. At the same time, other L1 chains pursue raw throughput and lower fees.

Ethereum retains the largest developer ecosystem, which supports long-term innovation and makes ecosystem migration costly for projects and users. Recent ETF-driven flows have also pushed ETH to outperform BTC at times in 2025, lifting the ETH/BTC ratio. This ecosystem has a strong positive impact when considering is Ethereum is a good investment.

6. Risks: Regulation, Security, Macro And Execution

Regulatory risk remains a primary concern for investors. The EU’s Markets in Crypto-Assets (MiCA) framework is in effect and global rule-making continues, creating both clarity and fragmentation across jurisdictions.

Regulators routinely warn about misleading marketing and uneven national implementation. These rules affect custody, exchanges, and product availability.

Security risk also matters. DeFi and bridge exploits continue to cause losses, with stolen funds totaling roughly $2.2B in 2024, showing attack surfaces persist. Macro shocks, liquidity tightening, or delayed protocol upgrades can compound losses for holders.

Investors should treat these as core Ethereum investment risks and weigh position size, custody choices, and ETF versus direct ownership when deciding if Ethereum is a safe investment long term.

RECOMMENDED: Is It Still Worth Buying Ethereum In 2025?

7. Price History, Forecasts And Long-term Outlook

Historical Perspective

History plays a key part in considering whether ETH is a good investment, Ethereum has risen roughly 90% over the past year, moving from about $2,448 to around $4,298 as of September 5, 2025.

In April, ETH dipped to near $1,600, its low point for the year, before climbing steadily into the mid-$4,000s.

The price reached an intraday high near $4,956 in late August. These swings show Ethereum’s volatility and why any Ethereum forecast must account for wide movement ranges.

Scenario-Based Forecasting

Multiple Ethereum price prediction in 2025 figures exist, but they serve only as scenario sketches. InvestingHaven sees a reasonable upside to $5,000 in 2025 if institutional flows, staking, and scaling upgrades persist.

Some forecasts point to $7,000 by Q4 2025, while others range from $5,500 to $10,000, depending on adoption levels and ETF momentum. Tom Lee even predicts $30,000 long-term if institutional adoption continues.

RECOMMENDED: Ethereum Price Outlook: Is ETH Gearing Up to Cross $4,500

Long-Term Outlook

Can Ethereum reach $10,000 by 2030? It is possible under aggressive institutional adoption, tokenization of new assets, and continued L2 scaling. Yet such a target requires sustained demand and supply constraints.

Instead of chasing predictions, build risk-adjusted scenarios and align position sizing with your own tolerance and goals.

RECOMMENDED: Where will Ethereum (ETH) Be in 5 years?

Conclusion

Is Ethereum a good investment? It can be for investors who accept high volatility and long time horizons. As of Sep 5, 2025, ETH trades near $4,400. About 35.7M ETH are staked, roughly 30% of circulating supply, and U.S. spot-ETH ETFs began trading in July 2024.

These facts change how capital flows into the market and how liquid supply behaves.

The seven factors in this article – adoption, supply dynamics, upgrades, institutional flows, competition, risks, and valuation – shape any Ethereum price prediction in 2025 and the token’s long-term potential.

Choose exposure that matches your goals: ETFs for regulated access, or direct ETH for staking and on-chain participation.

Is ETH a Good Investment – FAQ

Will Ethereum Go Up In 2025?

Ethereum may go up in 2025 if ETF inflows continue and Layer-2 adoption expands; tightening macro conditions could reverse gains.

Can Ethereum Reach $10,000 By 2030?

Ethereum might reach $10,000 by 2030 under aggressive tokenization and sustained institutional demand, but it requires several positive factors to persist.

Is Ethereum Better Than Bitcoin For Investment?

They play different roles. Ethereum offers programmability and staking, while Bitcoin functions mainly as a digital store of value.

Why Is Ethereum So Cheap Compared To Bitcoin?

Unit price differs by supply and market-cap. Compare market caps and use cases instead of per-coin price.

Is Ethereum A Safe Investment Long Term?

No asset is fully safe. Ethereum has strong fundamentals but faces regulatory and security risks investors must manage.

Should I Buy Ethereum Right Now?

You can buy Ethereum right now if you are building a long-term crypto portfolio but align any purchase with your goals and risk tolerance. Consider ETFs for convenience or direct ETH for staking.

What Should Be Your Very Next Crypto Investment?

The best opportunities are often in plain sight, buried amongst thousands of Crypto Assets that you do not have time to analyse.

Fortunately, you don’t have to. Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)