KEY TAKEAWAYS

- PEPE still offers entry opportunities because its large supply and sharp intraday swings create frequent dips.

- Strong liquidity, high daily volume, and active on-chain movement support ongoing trading activity but also increase volatility.

- Buyers should treat PEPE as speculative, use small position sizes, and follow simple, prepared exit plans.

PEPE’s strong liquidity and wild swings create repeated chances to buy.

Treat it as a high-risk trade and consider keeping position sizes small.

PEPE trades with heavy daily volume and a large holder base, which keeps it active even during slower market periods.

Its massive supply, sharp price swings, and frequent on-chain movements shape how traders look for entries.

But is it too late to buy PEPE now?

RECOMMENDED: 5 Must-Know Reasons To Buy Pepe (PEPE) In 2025

Is It Too Late To Buy PEPE

No. PEPE’s huge supply and fast-moving price action create regular dips that offer new opportunities to buy.

High trading volumes and recurring exchange outflows show that buyers and sellers keep rotating, which creates fresh setups.

Still, treat it as speculative. Use small positions, clear limits, and simple exit plans.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

PEPE Fundamentals: Why You Should Buy

PEPE sits around a $2B market cap with daily volume often between $300M and $500M, which keeps it liquid.

Its circulating supply stands at about 420.68 trillion tokens, held by roughly 496,000 wallets.

That wide distribution reduces concentration but increases dilution risk.

On-chain data often shows large outflows from exchanges followed by fast rebounds, a pattern tied to accumulation by bigger holders.

These moves happen in short bursts, which explains the heavy swings.

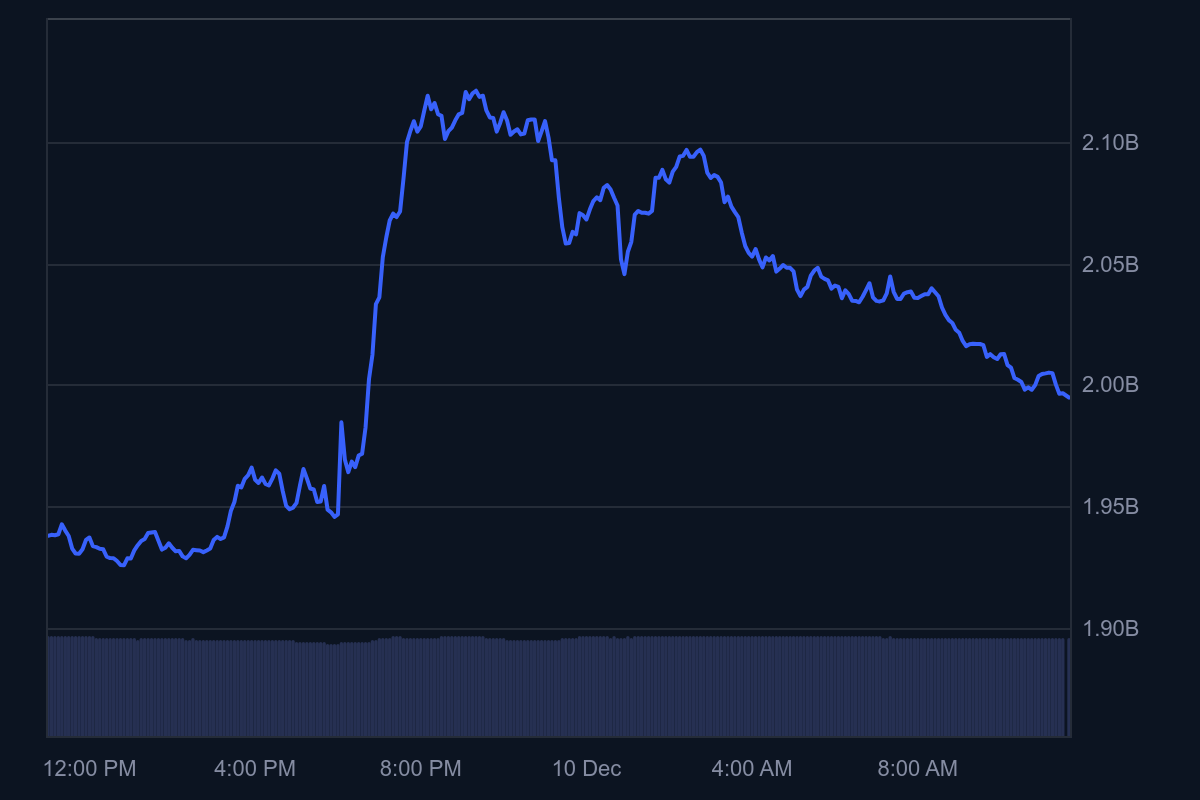

PEPE has a history of single-day drops over 50%, making it one of the more volatile large-cap meme tokens.

Below is an example from early February 2025.

Regulators generally view meme assets as retail-focused tokens rather than securities, which removes one major worry but doesn’t remove price risk.

If you plan to hold PEPE for long-term, expect wide drawdowns and sudden rallies.

RECOMMENDED: 3 Reasons to Buy PEPE and One Reason Not To

How To Buy PEPE – Practical Tips

- Always start by checking the correct contract address.

- Use large centralized exchanges or reputable DEXs and test with a small order first.

- Limit orders help reduce slippage, especially during high activity.

- Spread your buys across several entries instead of going in all at once.

- Keep PEPE at 1–5% of your portfolio and decide your maximum loss before you buy.

- Use stop-losses and take partial profits when the price runs.

- Watch exchange flows, holder changes, and community activity to understand momentum.

- Avoid leverage and keep your strategy simple and consistent.

Conclusion

It isn’t too late to buy PEPE, but it’s still risky.

If you choose to enter, stay disciplined, size positions carefully, and follow a clear plan from start to finish.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering If there are better options than PEPE right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- A Crucial Week & One Critical Level (Dec 7th)

- How We Think About The Current Bounce And What Matters in December (Nov 30th)

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts? (Nov 16th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower