KEY TAKEAWAYS

- Litecoin remains a viable buy because it has a fixed 84,000,000 supply, fast 2.5-minute blocks, and strong exchange liquidity.

- Its predictable halving cycle, broad payments support, and clear utility keep LTC relevant for long-term investors.

- Steady buying, a small allocation, and simple risk rules help reduce timing pressure and manage volatility effectively.

Litecoin offers fast confirmations, strong liquidity, and a fixed supply cap. Steady buying and clear rules make it easier to manage risk.

Momentum comes and goes in every market, but strong assets often keep their relevance when they have clear utility and dependable economics.

Litecoin is trading around 51.39 USD and fits this pattern because it stays simple, functional, and widely accessible.

But is it too late to buy LTC? Let’s look at some facts.

RECOMMENDED: 5 Must-Know Reasons To Buy Litecoin (LTC) In 2025

Is It Too Late To Buy LTC?

It is not too late to buy Litecoin. LTC still has a fixed 84,000,000 supply, fast 2.5-minute block times, broad exchange liquidity, and ongoing merchant use.

These traits keep it practical and accessible, which supports long-term participation for investors who manage position size and risk with discipline.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Why Litecoin Still Makes Sense

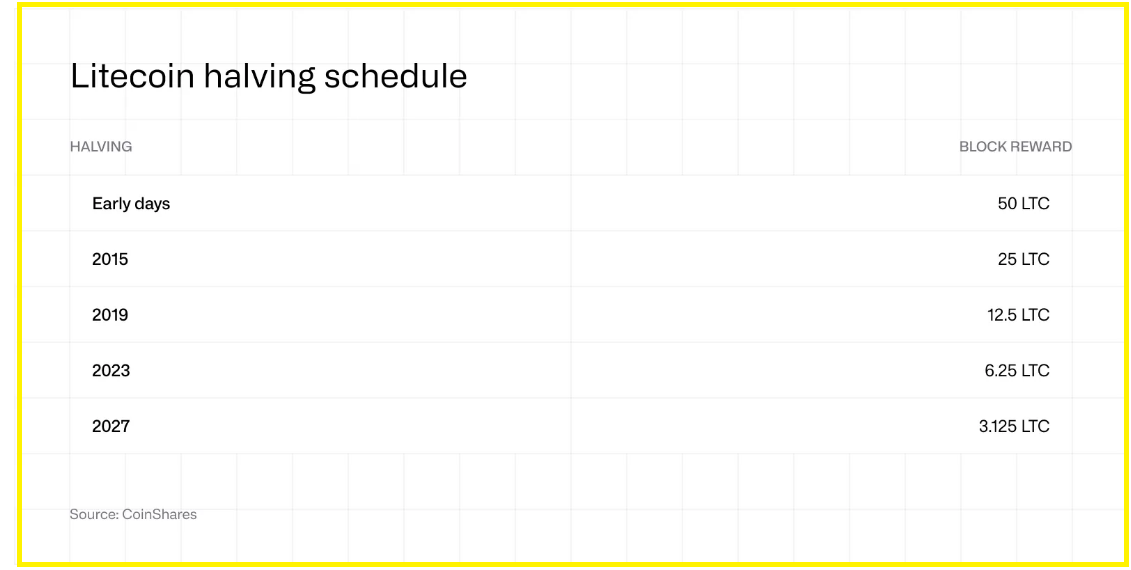

Litecoin follows a predictable supply schedule. About 76 million coins already circulate, and the total supply will never exceed 84 million.

Halvings occur about every four years and reduce miner rewards, with the next estimated for 2027.

Its 2.5-minute block time keeps transfers quick and fees low, which supports everyday payments.

LTC also trades on almost every major exchange, so buyers get strong liquidity and simple on and off ramps.

Merchant processors and wallet providers continue to support Litecoin payments, giving it real-world use beyond speculation.

Optional features like MimbleWimble extension blocks offer extra privacy without changing its core supply rules.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

RECOMMENDED: Litecoin Price Prediction 2025 – 2030

Risks, Timing And How To Buy LTC

Litecoin still carries real risks. Prices move sharply, it often follows Bitcoin’s direction, and competing payment-focused assets continue to grow.

Regulations may shift, so investors should stay mindful.

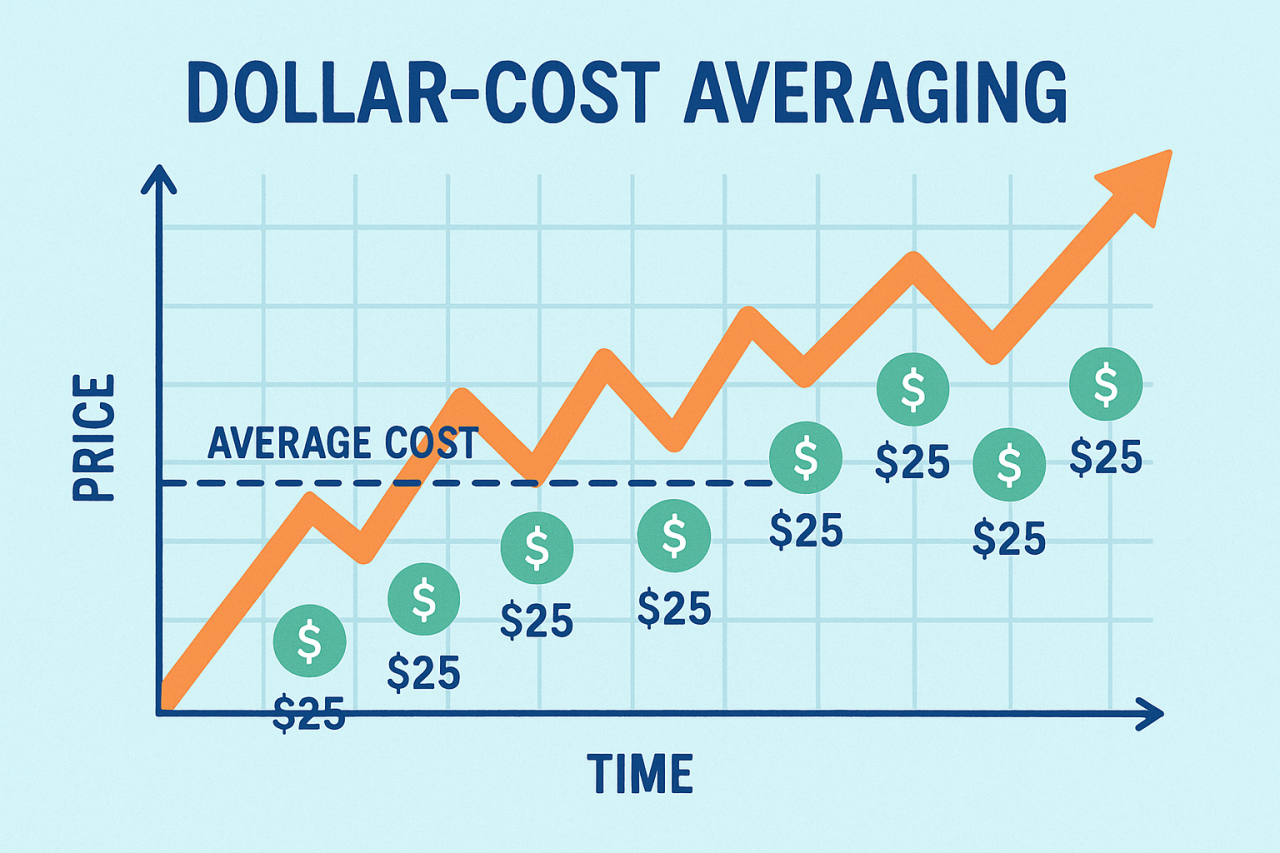

To reduce timing pressure, you can use dollar-cost averaging.

A portfolio allocation of 1% to 5% fits most risk levels, while still leaving room for gains. Use reputable exchanges for liquidity or trusted noncustodial wallets for long-term storage.

Always check trading and withdrawal fees.

Finally, before buying Litecoin, set a clear goal, preferred holding period, and rules for taking profit or cutting losses.

Conclusion

You can still buy LTC with confidence if you treat it as a long-term, volatile asset.

Focus on steady entries, manageable size, and simple rules to stay in control.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower