Arbitrum is seeing faster liquidity growth and stronger DeFi activity, while Polygon is improving speed and nearing a major token transition. Both have important signals that could shape their next big move.

Layer-2 networks are built to make Ethereum faster and cheaper. Today, two leaders – Arbitrum and Polygon – are competing for users, liquidity, and developer attention.

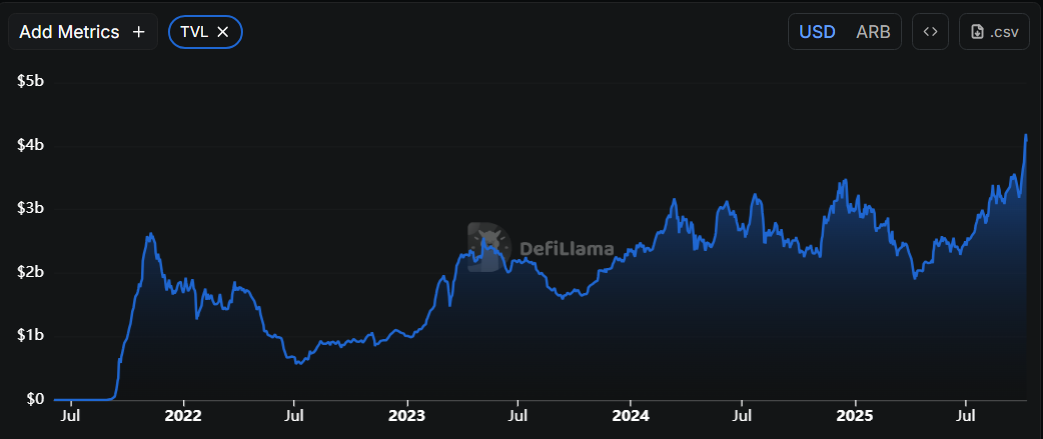

Arbitrum’s Total Value Locked (TVL) recently reached about $4.1B, showing solid capital inflows and growing DEX activity.

Polygon, meanwhile, has nearly completed its MATIC-to-POL token migration and introduced upgrades that reduce transaction finality to around 5 seconds, improving performance and reliability.

Let’s look at a Polygon vs Arbitrum comparison to understand which of the two tokens has better potential.

On-Chain Fundamentals: TVL, Transactions And Network Use

Arbitrum currently leads in on-chain liquidity. Its TVL and weekly DEX trading volumes continue to rise, signaling strong investor confidence and a healthy DeFi ecosystem.

Polygon remains one of the busiest networks in terms of daily active addresses and transaction counts. Its upgrades have improved network stability and speed, keeping it attractive for payments and small transfers.

The key numbers to watch are TVL growth, daily users, and DEX volume. They show whether real money and users are flowing through these networks.

Technical Setups And Breakout Levels

From a chart perspective, Arbitrum is showing a bullish reversal pattern, suggesting potential for a short-term breakout if trading volume increases. The resistance level acts as the key trigger for this move.

Polygon’s price action remains in a consolidation phase, waiting for stronger momentum. The full rollout of POL could serve as the catalyst that revives buying interest.

For both assets, confirmation will come when volume increases alongside a daily close above resistance.

Sentiment Drivers: Tokenomics And Partnerships

Polygon’s POL upgrade will reshape its staking and supply system, potentially strengthening its long-term appeal. The network’s many corporate and developer partnerships continue to support consistent adoption.

Arbitrum benefits from new DeFi projects and a steady rise in stablecoin liquidity, which could spark faster short-term price reactions as capital moves across its ecosystem.

Conclusion

Arbitrum appears slightly better positioned for a near-term breakout because of its stronger liquidity and DeFi traction. Polygon remains a solid longer-term play, with its upgrades and new token model likely to support growth once activity picks up.

Traders should focus on three things: volume confirmation during rallies, consistent TVL growth, and updates related to tokenomics or network upgrades.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)