Markets price a September Fed cut that could lift risk assets and help SOL head towards $300. Solana shows rising on-chain activity and key protocol upgrades.

A likely Federal Reserve rate cut in September has shifted liquidity toward risk assets, and Solana has already rallied from its early August low. SOL climbed from about $155 on August 3 to roughly $210 by late August, a recovery of about 36% in price.

Could a September rate cut pave the way for a new Solana all-time high?

Read on for greater insight

If you are a premium crypto subscribers can access our up to date crypto price alerts here

Why A September Rate Cut Matters For SOL

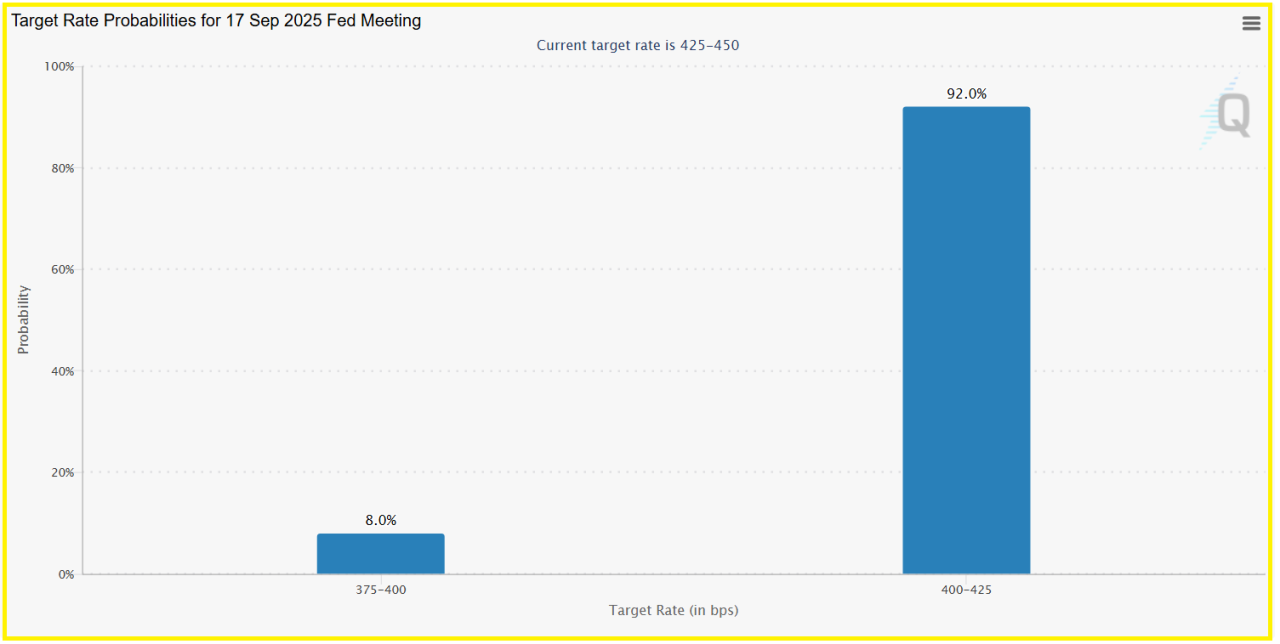

Traders now assign a high probability to a 25 basis point Fed cut at the September FOMC meeting, a shift reflected in futures markets and the CME FedWatch tool.

Lower policy rates reduce real yields and tend to weaken the dollar, increasing dollar liquidity for risk assets. Fed easing episodes have historically coincided with broad crypto rallies, as capital moves from cash into yield and growth positions.

If the Fed cuts as priced, capital that chased safer crypto plays could rotate into higher beta tokens like SOL, amplifying price moves rapidly.

RECOMMENDED: Which Crypto Is More Likely to Be a Millionaire Maker? XRP vs. Solana

Solana Price Forecast: Specific Drivers That Could Amplify A Rally

Several protocol and product developments can magnify a Fed-led rally in SOL. Asset managers have filed S-1 amendments for spot Solana products, including VanEck and Grayscale, which would create direct institutional demand if approved.

Solana’s community approved the Alpenglow overhaul that replaces legacy consensus components and cuts finality to roughly 150 milliseconds, improving user experience and validator economics.

August on-chain reporting showed about 2.9 billion transactions and roughly $148 million in app revenue, evidence of real activity. Faster confirmations and staking-friendly ETF structures together increase measurable bids for SOL across long and short buyers actively.

RECOMMENDED: Is It Worth Buying Solana In 2025?

Technical Picture And Risk Framework

Technically, SOL trades in a $200 to $220 range, with the prior Solana all time high around $294 as the main upside barrier. A clean break above $220 would target the 2025 top.

Major risks include Fed disappointment and sell-the-news profit taking, ETF delays or rejection, and a network outage or security event. Crowded derivatives positioning could amplify sharp reversals in volatile sessions.

RECOMMENDED: Ethereum vs Solana: Who’s Leading the Altseason Rally?

Conclusion

A price in September cut raises the probability of SOL gains, but size positions and monitor CME FedWatch, ETF filings, Alpenglow rollout, and on-chain metrics.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)