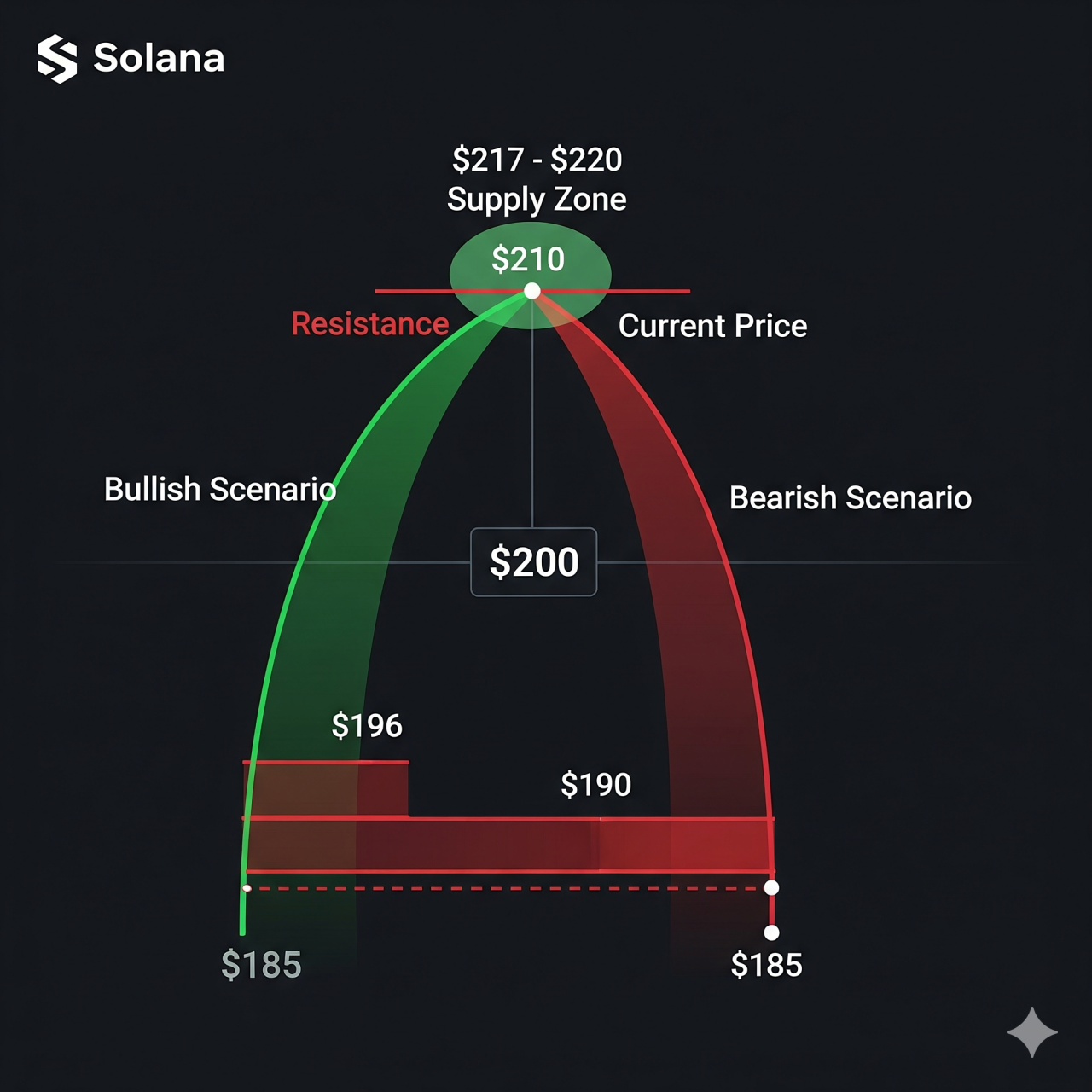

SOL sits just around $209 after last week’s swing. A close above $210 points up, a close below $196 points down.

As of September 3, 2025, SOL is trading at $209 after a volatile week that ran from roughly $186 to a high near $218 on August 29. Traders now treat $210 as the critical upside gate and $190 as the key downside buffer.

So, what’s the direction of Solana price this week? Let’s look at some possible scenarios.

Solana Price Snapshot & Key Levels

SOL current price is around $209 with a seven day band at $186 to $218, reflecting the late August swing. Immediate resistance sits at $210, and a clear daily close above that level opens the $217 to $220 supply zone.

Traders should watch daily 24h volume relative to the 30 day average, order book depth at $210, and options open interest clustered near $210 strikes for confirmation. Option expiries and gamma exposure can amplify swings.

RECOMMEDED: Ethereum vs Solana: Who’s Leading the Altseason Rally?

Flows & On-Chain Signals

On chain and derivatives flows point to elevated activity, with Solana DEX volume close to $3.65B and perps volume about $1.13B over 24 hours. The network shows roughly 2.6M active addresses and about 58M transactions in the last day, signaling high on chain churn.

Futures open interest rose to record levels around $12B to $13B while funding rates averaged around +0.01% on major venues. That mix supports momentum, but concentrated leveraged longs raise the risk of a rapid unwind.

Monitor net exchange flows, shifts in open interest, and whether spot inflows keep pace with derivatives demand. Watch book skew at $210.

RECOMMEDED: Is Solana A Good Investment Right Now?

Catalysts: What to Watch This Week

Various asset managers updated spot SOL ETF filings and are actively engaging with the SEC, leaving timing uncertain. Governance approved the Alpenglow proposal by overwhelming margins, cutting finality and improving throughput expectations.

The Firedancer validator client remains in testing with a planned mainnet rollout later in 2025, which could improve resilience and performance. If regulators push back or DEX volumes collapse.

For a more long term outlook, you can check out InvestingHaven’s Solana price prediction in 2025 and beyond.

RECOMMEDED: Will Solana (SOL) Hit All-Time Highs in 2025?

Conclusion

Base case is a range trade toward $210 to $217 if DEX flows remain multi billion. A daily close above $210 opens $217 to $220, while a close below $196 likely pulls price to $190. That said, if you are looking to buy Solana this week, watch flows for direction.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)