Solana (SOL) continues to capture investor interest in 2025 as network upgrades, developer growth, and expanding DeFi adoption strengthen its position in the blockchain ecosystem – but the real reasons behind Solana’s growing appeal may surprise even seasoned crypto followers.

Solana delivers ultra-fast, low-cost transactions backed by real ecosystem growth, major upgrades, staking yields, and token scarcity.

Solana has returned to heavy on chain use and offers fast, low cost transactions that support real applications. SOL trades around $212 and Solana’s DeFi total value locked sits at about $11.4 billion, showing practical demand for the network and its token.

Recent software upgrades and validator work aim to improve reliability and throughput, which reduces a key historical concern for the chain. For investors who value usage, staking yield, and fee burns, Solana now presents a clearer case than it did in prior cycles.

This article lists five practical reasons to buy Solana today.

RELATED: Is It Worth Buying Solana In 2025?

1. Major Protocol Upgrades Are Arriving For Solana

Alpenglow changes how Solana orders and confirms blocks to lower finality time and reduce skipped slots. The upgrade moves key consensus pieces into a simpler flow that cuts latency and makes validators more resilient.

At the same time, Firedancer, a new validator client created by Jump Crypto, offers faster validation and better memory handling, which helps keep nodes online during heavy load.

Together these upgrades should reduce the frequency and duration of past outages and let the network serve more sustained traffic. Both projects have public testnets and staged rollouts scheduled for late 2025, with community testing already underway.

That timeline gives developers and exchanges clearer signals about long term reliability. Improved validator diversity reduces central points of failure and helps decentralize network operations quickly.

RECOMMENDED: Forward Industries’ Kylie Samani Says ‘I’m a Long-Term Believer In Solana’: Here’s Why

2. Web Scale Speed And Extremely Low Fees Make Solana Practical For Apps

Solana uses Proof of History and a parallel runtime called Sealevel to process many transactions at once, which underpins its high throughput claims. Independent sources and Solana documentation cite architectural ceilings above 60,000 transactions per second, though real workloads vary.

Users typically see confirmations in under one second for normal transactions. Transaction costs also stay tiny, with base fees measured in thousands of lamports, which translates to a fraction of a cent for most transfers.

Those two facts, speed and low fees, let developers build fast exchanges, games, and micro payment flows without large user fees.

Lower friction improves user experience and helps applications scale without frequent cost spikes during traffic surges. That model suits trading, NFTs, and live multiplayer game systems at consumer scale.

ALSO READ: Is Solana a Good Investment? 7 Factors Every Investor Should Know

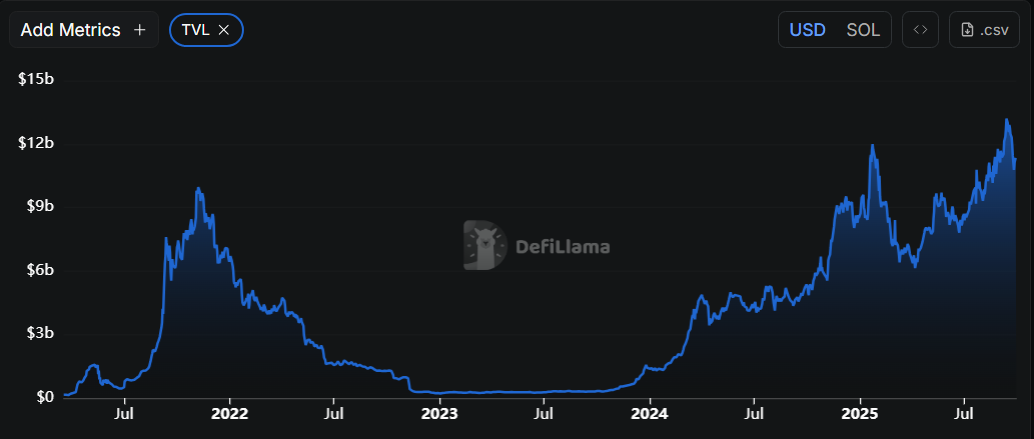

3. Solana DeFi Activity And TVL Are Surging

Solana’s DeFi activity has risen sharply, with total value locked on Solana reaching about $11.4 billion in late September 2025.

DEX trading volumes and perpetual markets show stronger activity than earlier in the year, suggesting users move assets on chain for real trades rather than only speculative ambitions.

Projects that aggregate liquidity and margin trading report higher daily volumes, which creates fee revenue and on chain demand for SOL.

A higher TVL signals greater asset security within Solana’s smart contracts and increased fee-generating activity – reinforcing the chain’s role as live infrastructure for real-world financial applications.

4. Solana Real Ecosystem Adoption: Wallets, Marketplaces, And Dexs

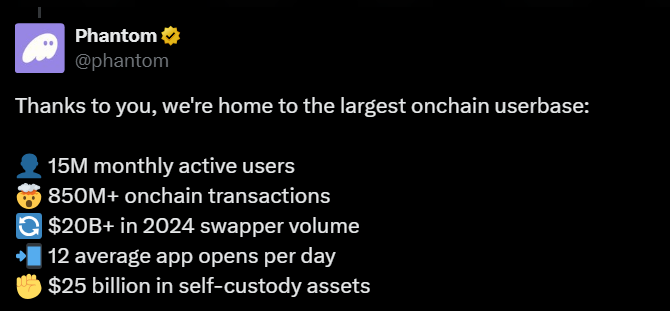

Solana now supports a broad consumer stack, including Phantom wallet, Magic Eden marketplace, and liquidity tools like Jupiter.

Phantom reports more than 15 million monthly active users and holds over $25 billion in self custody assets, which lowers friction for new users and streamlines on chain funding.

Magic Eden remains the largest Solana NFT marketplace and handles the majority of Solana NFT volume, especially for gaming and collectible drops. Aggregators and new decentralized exchanges improve trade routing and reduce slippage for traders.

This ecosystem of wallets, marketplaces, and DEX tools creates clear paths for new users to invest in Solana, which increases on chain demand for SOL.

RECOMMENDED: Is Solana A Good Investment Right Now?

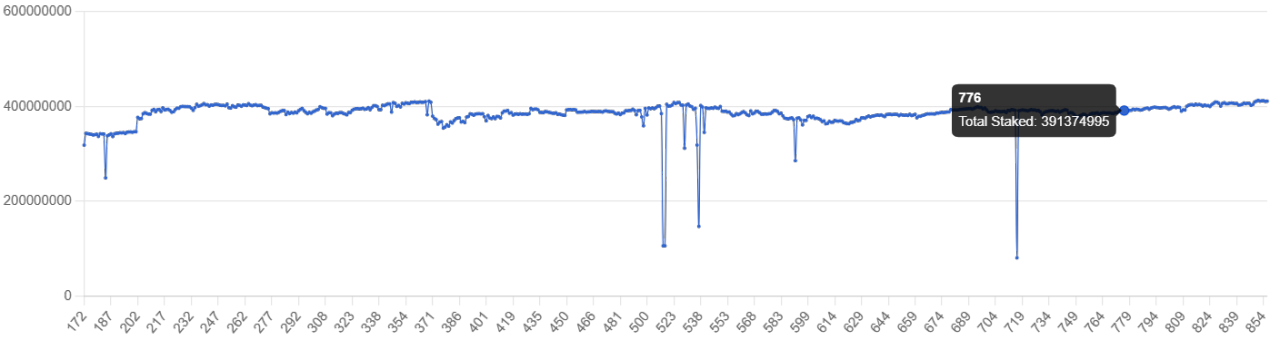

5. Staking Yields And Fee Burns Create SOL Holder Incentives

Token mechanics give holders two practical ways to earn and to benefit from usage. You can stake SOL to validators and earn rewards, with gross yields often in the mid single digits, roughly 6% in recent reports.

At the same time the protocol burns a portion of fees and priority payments, which reduces circulating supply as activity grows. Staking creates income for long term holders, while fee burns create a small steady supply drain when transactions increase. They favor holders.

ALSO READ: Solana Price Forecast: September Could Send SOL To New Highs

Conclusion

Solana now combines meaningful on chain activity, low transaction costs, and technical upgrades that address past reliability issues. Upgrades like Alpenglow and Firedancer aim to shorten finality and improve validator performance, while Sealevel keeps throughput high.

Rising DeFi TVL and active wallets show users moving real work to Solana. Staking yields and fee burns add holder incentives.

That mix is attractive for traders and builders, but SOL remains volatile. This is not financial advice. Do your own research, size positions carefully, and follow live dashboards for TVL and fee metrics.

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)