KEY TAKEAWAYS

- Solana processes thousands of transactions per second with very low fees, making it ideal for trading, NFTs, and gaming.

- Avalanche offers consistent performance and fast finality, which supports reliable DeFi activity and enterprise use.

- Solana’s single, high-speed chain drives strong developer and user growth across multiple app categories.

- Avalanche’s subnet model gives projects flexibility to build custom blockchains with specific features and controls.

Solana offers unmatched transaction speed and low fees, while Avalanche focuses on flexible scaling and custom subnets. Both are gaining traction as altseason builds momentum.

Altseason often highlights which blockchains can handle real user demand. Two names stand out: Solana and Avalanche. Both promise fast transactions and growing ecosystems, but they take different paths to achieve it.

This article looks at their performance, adoption, and current market activity to see which chain holds the upper hand right now.

RELATED: Solana vs Avalanche: Who’s Winning the Speed & Breakout Battle?

Solana vs Avalanche: Performance and User Experience

Solana is known for its impressive speed. In real-world conditions, it can handle thousands of transactions per second with low costs, often just fractions of a cent. This makes it popular for trading, NFTs, and on-chain games where fast confirmations matter.

Avalanche, while not as fast in peak numbers, offers stable performance and quick finality. Its network maintains steady speeds even during busy periods, which is valuable for DeFi applications that need reliability.

Both chains keep fees much lower than Ethereum, giving users cheaper and faster ways to transact.

RECOMMENDED: 5 Reasons Solana (SOL) Could Explode in 2025

Ecosystem Growth: Apps, TVL, and Network Design

Avalanche continues to grow its ecosystem through subnets; custom blockchains that serve specific apps or companies. This setup attracts institutional users and developers who want more control over network rules and performance.

Solana, on the other hand, focuses on one powerful main chain that supports everything from DEXs and wallets to gaming projects. Developer activity on Solana remains strong, with steady growth in both total value locked (TVL) and new app launches.

Volume, Volatility, and Momentum

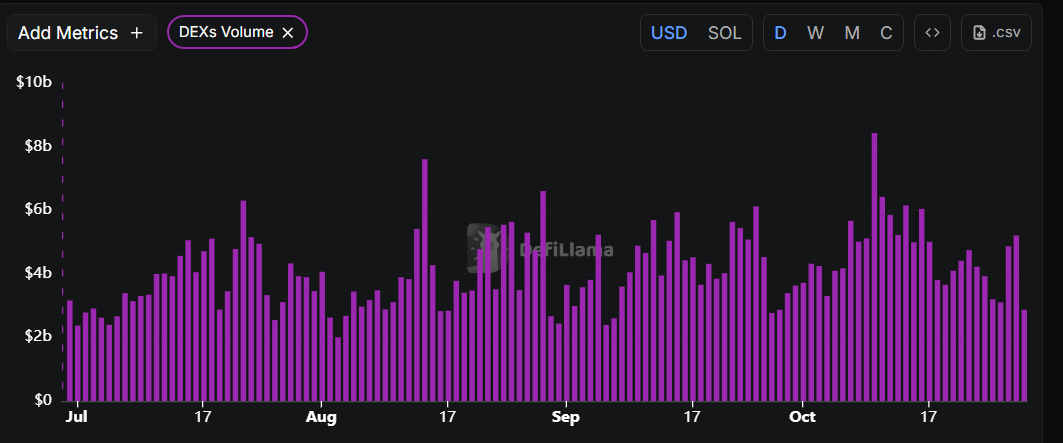

Trading data shows Solana has higher daily volume and slightly higher volatility, appealing to short-term traders.

Avalanche’s markets are more stable, making it a favorite for larger DeFi strategies and yield farming. Upcoming protocol upgrades and new dApp launches on both networks could influence their momentum in the next few weeks.

RECOMMENDED: 5 Compelling Reasons to Buy Avalanche (AVAX) in 2025

Conclusion

Solana currently leads in speed, activity, and trading excitement. Avalanche shines in flexibility and reliability. For traders chasing quick moves, Solana looks stronger. For builders and long-term investors, Avalanche’s modular design could offer more lasting opportunities.

Monitor TVL growth and average fees to understand which chain truly dominates this altseason.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- The Ongoing Test Of Bitcoin’s 200 dma Will Be Decisive For The Outcome In Crypto Markets (Oct 20th)

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)