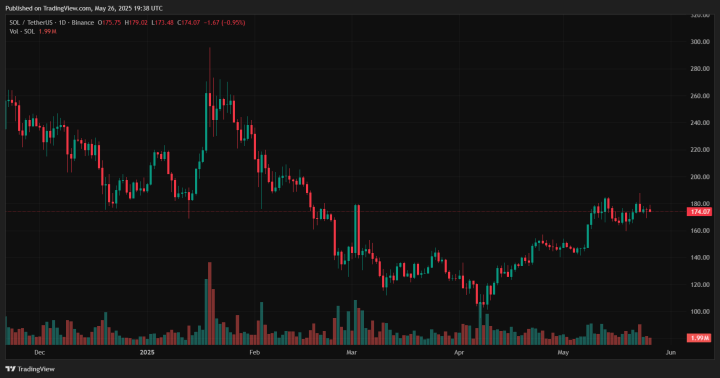

Solana’s steady rise and bullish technical patterns suggest a major breakout could be imminent if it clears the critical $183 resistance level.

Solana (SOL) has quietly rebounded, rising to around $177—a nearly 20% gain so far this month, reversing an 18% dip in April. This recovery has sparked renewed interest, especially as technical patterns point toward a potential breakout.

Could SOL be gearing up to surge past its previous highs?

Technical Indicators Hint at a Rounding Bottom Breakout

SOL’s recent price action has formed a rounding bottom pattern, with a key resistance near the $180 zone. This pattern, which resembles a U-shape, suggests a transition from a bearish to a bullish trend.

According to technical analysis, a daily close above $183—near the 50% Fibonacci retracement level based on the January to April price range—could trigger a significant breakout. The projected target for this move is around $257, aligning closely with the 78.6% Fibonacci level at $262.

Adding to the bullish sentiment, Solana’s 50-day and 100-day exponential moving averages (EMAs) have produced a bullish crossover, signaling a potential trend reversal.

However, momentum indicators like the Relative Strength Index (RSI) at 60 and the MACD hovering near a crossover suggest that there’s still untapped bullish potential.

Analyst Sees Long-Term Cup-and-Handle Forming

Veteran analyst Peter Brandt has identified a cup-and-handle pattern forming on Solana’s weekly chart. This longer-term pattern has a neckline near the all-time high at $295. If SOL can break above this level, the projected target could reach an ambitious $518.

However, a failure to close above the $183 resistance mark in the short term might result in a retest of the 200-day EMA around $163.

Ecosystem Growth and Institutional Interest Add Fuel

Solana’s ecosystem continues to grow, with its Total Value Locked (TVL) inching closer $10 billion as more developers and users flock to the network.

At the same time, institutional players, including major firms like VanEck and JPMorgan, project that SOL could reach $500 by the end of 2025, driven in part by anticipation of a Solana-based ETF.

Conclusion

Solana’s current trajectory is supported by technical patterns, including a potential breakout above $183 and a broader cup-and-handle formation.

With institutional backing and a thriving ecosystem, SOL appears poised for a breakout that could propel it to new highs—if it can overcome the crucial $183 resistance level.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):