Rules aim to enhance transparency, stability, and consumer protection, influencing how consumers use and trust stablecoins in daily transactions.

Global regulators are racing to tame the $248 billion stablecoin market, with the U.S. Senate advancing the GENIUS Act, the EU enforcing MiCA, the U.K. drafting new crypto laws, and Hong Kong passing a licensing regime—all within the past two months.

These measures mandate full reserve backing, regular audits, and issuer authorization, while banning risky practices such as algorithmic and interest-bearing stablecoins .

As regulation clarifies, market forecasts project growth to $2 trillion–$3.7 trillion by 2030, and institutions like Mastercard and major banks prepare infrastructure upgrades to meet demand .

Global Regulatory Overhaul

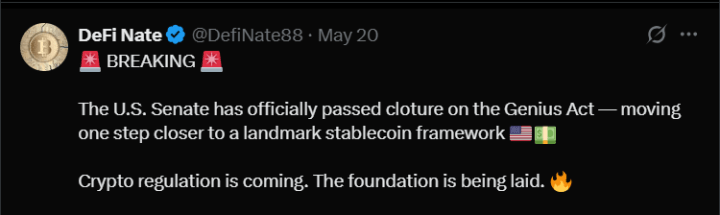

In the United States, the Senate recently passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act with a 66–32 vote. This groundbreaking legislation mandates that stablecoin issuers maintain a 1:1 reserve backing with liquid assets, conduct regular audits, and prohibits interest-bearing stablecoins.

The act aims to provide clear compliance guidelines, encourage broader issuance by traditional institutions, and enhance consumer protections. Citi predicts that, if enacted, the stablecoin market could expand to $3.7 trillion by 2030.

Across the Atlantic, the European Union’s Markets in Crypto-Assets (MiCA) regulation, effective since December 2024, enforces strict requirements: 100% reserve backing, authorization for issuers as electronic money institutions, and bans on algorithmic and interest-bearing stablecoins. Non-compliant stablecoins, such as Tether (USDT), have been delisted from EU exchanges.

In Asia, Hong Kong’s legislature passed a landmark stablecoin bill on May 21, 2025, establishing a licensing framework for fiat-referenced stablecoin issuers.

Issuers must obtain a license from the Hong Kong Monetary Authority (HKMA), adhere to reserve asset management protocols, and implement robust risk controls. This move positions Hong Kong as a competitive hub for digital assets.

Implications for Your Wallet

These regulatory changes aim to enhance the stability and reliability of stablecoins, potentially increasing their adoption in everyday transactions. For consumers, this means greater confidence in using stablecoins for payments, savings, and investments.

However, the delisting of non-compliant stablecoins in certain jurisdictions may limit access to some tokens, affecting liquidity and choice.

On the positive side, clear regulations could lower transaction fees and enable faster, real-time settlements, making stablecoins more attractive for everyday use. Traditional financial institutions, encouraged by regulatory clarity, may also enter the stablecoin space, offering new services and products.

Bottom Line

As global regulations take shape, it’s important to stay informed about compliant stablecoins to ensure security and accessibility in digital transactions.

Opting for fully backed, audited stablecoins issued by licensed entities can provide greater protection and peace of mind. By understanding and adapting to these changes, you can make the most of the evolving stablecoin ecosystem and pick the best cryptocurrencies to invest in.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):