KEY TAKEAWAYS

- Tether scaled down a proposed $15–$20 billion fundraising plan after pushback on valuation.

- USDT supply remains steady at roughly $186–$187 billion, limiting short-term market impact.

- Ongoing questions about reserves and governance continue to influence investor confidence.

- Diversifying into physical gold adds resilience but also makes the reserve structure more complex.

- Should you invest in Tether now?

Tether cut back a planned mega fundraising round after investor resistance, raising questions about valuation, trust, and how USDT stays dominant.

Tether has scaled back plans for a massive fundraising round after investor resistance cooled early enthusiasm.

What started as talk of a $15–$20 billion private sale reportedly shrank to closer to $5 billion, raising fresh questions about valuation, transparency, and long-term trust in the company behind USDT, crypto’s most widely used stablecoin.

Despite the shift, around $186–$187 billion worth of USDT tokens are still in circulation, keeping Tether at the center of global crypto liquidity.

The pullback hasn’t shaken supply or the peg, but it has changed how investors and analysts view the company’s future.

When a firm rumored to be targeting a $500 billion valuation suddenly revises expectations, markets start looking more closely at reserves, governance, and how sustainable its dominance really is.

ALSO READ: Stablecoins Take Center Stage: What New Global Rules Could Mean for Your Wallet

What Happened To Tether’s $20B Raise?

Initial reports suggested Tether was exploring one of the largest private financings ever attempted, drawing attention from both crypto insiders and traditional finance.

Some discussions even floated a potential $500 billion valuation, a figure that raised eyebrows across the industry.

The excitement faded quickly as investors questioned whether the proposed pricing matched comparable deals or public market benchmarks.

Tether later clarified that the larger figure was not a firm target, and the fundraising effort was scaled down significantly.

Importantly, the business itself didn’t shrink. USDT circulation stayed stable, and trading volumes remained strong.

The change reflected investor caution rather than operational trouble. In other words, buyers weren’t convinced the valuation matched the perceived risks, so they pushed for smaller commitments.

RECOMMENDED: Tether Freezes $182 Million In Suspected Illicit Funds

Why Investors Said No

The main reason investors hesitated was valuation tied to transparency. Even with projected profits reportedly exceeding $10 billion by 2026, many investors wanted clearer insight into reserves and governance.

Stablecoins rely on trust in their backing assets. Analysts and ratings agencies have repeatedly emphasized that reserve clarity matters just as much as size.

When investors struggle to verify how liquid or secure those assets are, they build risk into pricing decisions.

That risk often shows up as lower valuations or smaller funding rounds.

The fundraising reset also shows that institutional investors now treat major stablecoin issuers more like traditional financial institutions.

This means disclosure, risk management, and governance carry more weight than hype or growth alone.

Inside Tether’s Changing Reserve Strategy

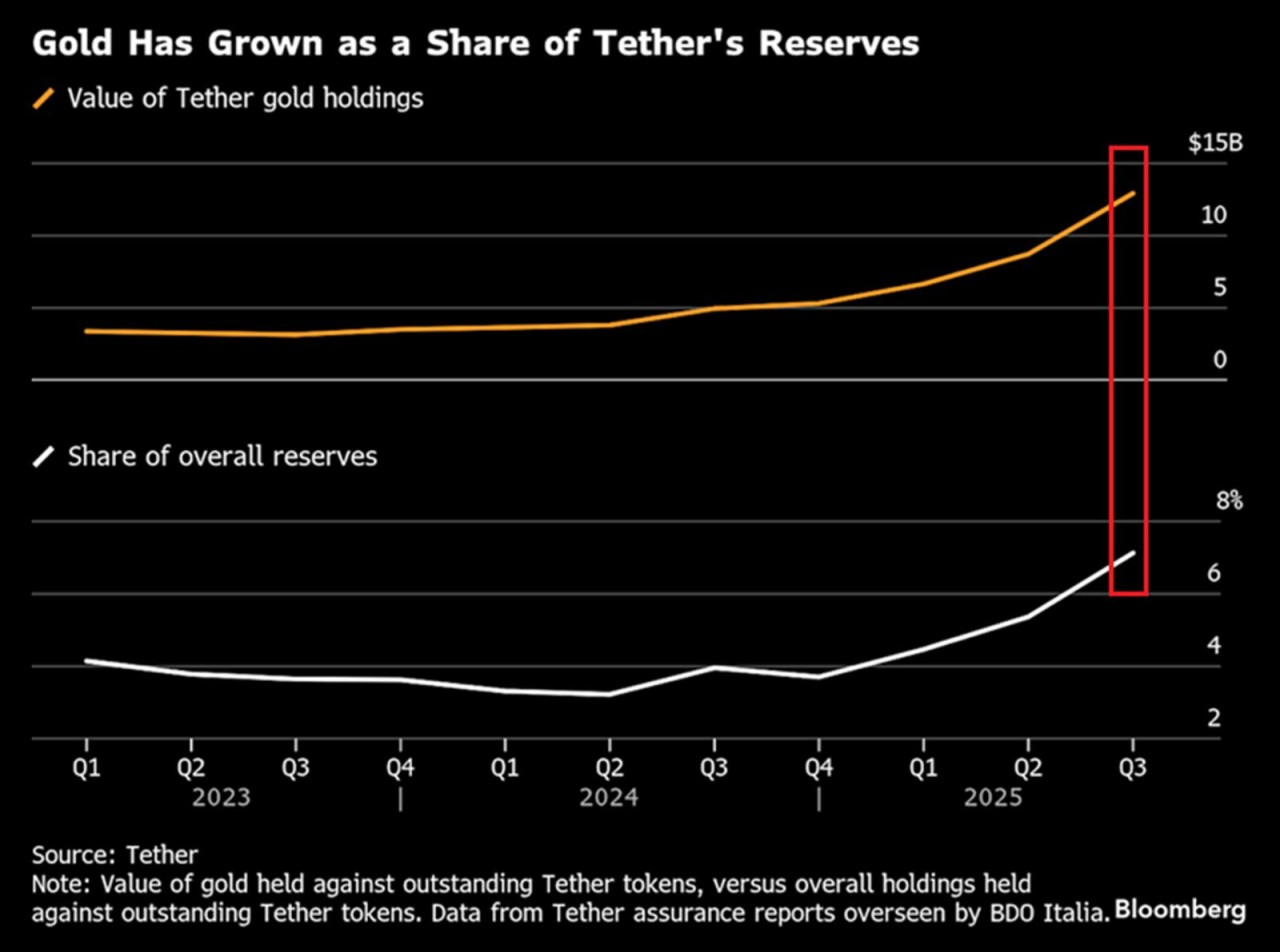

In response to ongoing scrutiny, Tether has been adjusting how it manages reserves.

One of its biggest moves has been accumulating physical gold. The company reportedly holds around 27 tonnes and has discussed allocating up to 10–15% of reserves to the metal over time.

Gold can act as a hedge against currency volatility and reduce dependence on short-term debt markets. But it also introduces new challenges.

Physical assets aren’t as instantly liquid as cash or Treasury bills, and managing them raises operational questions about storage, redemption speed, and market stress scenarios.

Tether has also explored tokenized assets and other structural changes aimed at future growth.

While diversification can strengthen resilience, it makes the reserve picture more complex. This and complexity can make investors uneasy when they’re trying to evaluate risk.

RECOMMENDED: Iran Allegedly Used $507M in USDT to Bypass Sanctions

What This Means for USDT and the Crypto Market

In the short term, traders are unlikely to feel any major impact. USDT liquidity remains deep, exchange activity is stable, and the peg has held firm.

The scaled-down fundraising round doesn’t directly affect how the token functions day to day.

Longer term, however, investors will increasingly want simpler reserve structures, clearer reporting, and governance standards they can understand and price confidently.

Stablecoins have moved from niche tools to critical financial infrastructure, and expectations have risen accordingly.

If Tether adapts and improves transparency, it could reinforce its leadership position. If not, regulated competitors may gradually chip away at its dominance as institutions look for alternatives with clearer oversight.

Conclusion

Tether’s ambitious $20 billion fundraising vision was thwarted by investor caution. However, the company remains the backbone of crypto trading with nearly $187 billion in USDT circulating.

As stablecoins grow more central to global finance, investors are demanding higher standards.

How Tether responds to that pressure could shape not only its own future, but the next chapter of trust in crypto’s most essential infrastructure.

Should You Invest In Tether Now?

Before you invest in Tether, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: Major Support Being Tested in Crypto – This Is The Point For a Bounce to Develop

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.