Solana, Polygon, and Avalanche are driving Asia-Pacific’s DeFi boom with rising adoption, developer activity, and cross-chain innovation.

Asia‑Pacific has emerged as the fastest‑growing region in decentralized finance, capturing nearly 23 % of global DeFi TVL by mid‑2025 and fueling APAC decentralized finance growth. With over 350 million active wallets in the region, APAC is home to a quarter of the world’s crypto users.

At the top of the pack are Asia Pacific DeFi altcoins that offer scalability, liquidity and regional relevance. This article explores Solana, Polygon and Avalanche as the leading best altcoins for Asia DeFi in August 2025.

1. Solana (SOL)

Solana’s DeFi ecosystem holds roughly $8–9 billion in TVL, growing about 18 % quarter‑on‑quarter in early 2025, second only to Ethereum. Known for ultra‑fast block times and ~$0.00025 transaction fees, its network handles up to 65,000 transactions per second – ideal for high‑frequency DeFi activity across Southeast Asia.

The surge in DeFi volume is reflected in institutional demand: Solana ETP exposure now surpasses Bitcoin in some markets (prnewswire.com). Together, Solana, Polygon and Avalanche APAC DeFi ecosystems account for the lion’s share of emerging services and yield pools.

RELATED: Solana (SOL) Price Prediction 2025 2026 2027 – 2030

2. Polygon (MATIC / POL)

Polygon’s PoS chain processed an average of 8.4 million daily transactions in Q1 2025, up from 4.6 million in Q1 2024. This growth is aided in large part by DeFi and NFT apps, which account for 38 % of activity.

Daily active wallets topped 1.23 million, with India and Vietnam among the leading countries for adoption. Around 19 % of traffic involves cross‑chain bridging, supporting multi‑chain DeFi strategies.

In fact, Polygon DeFi adoption in Asia spans use cases such as tokenized assets, gaming yield and credit rails.

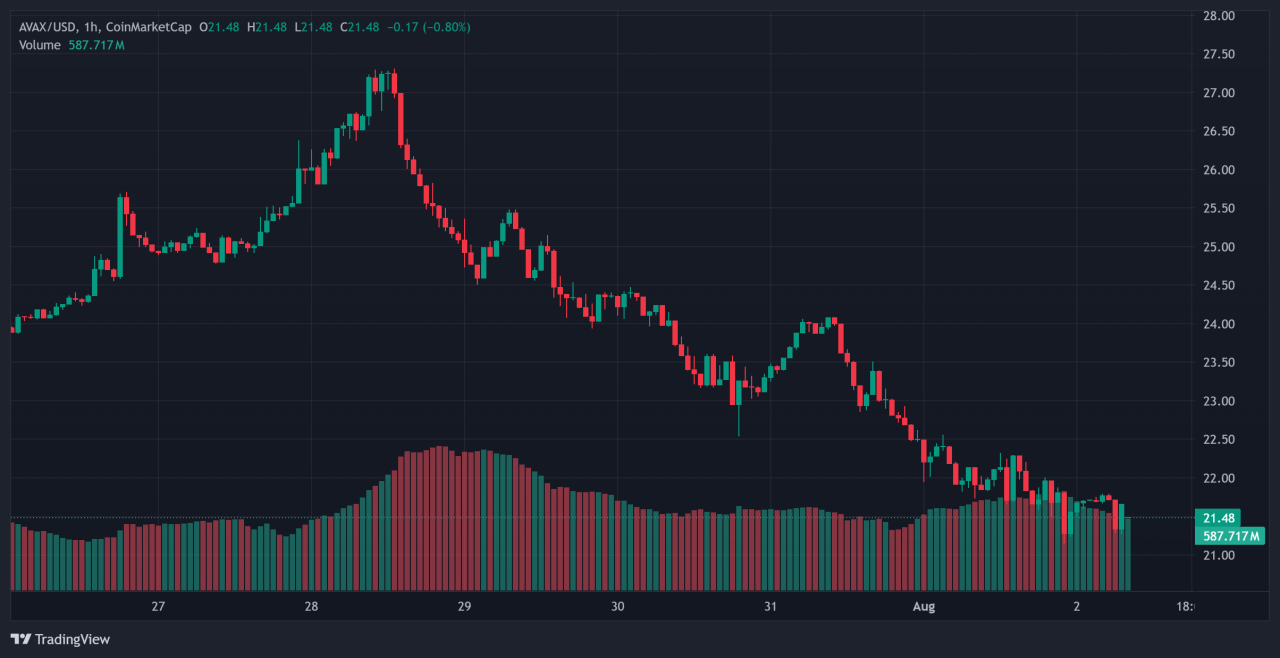

3. Avalanche (AVAX)

Avalanche maintains about $3.7 billion in DeFi TVL, with accelerated institutional and retail adoption in Asia‑Pacific.

Its new AvaCloud infrastructure enables regional enterprises to launch permissioned subnets for real‑world asset tokenization – in areas like real estate and supply‑chain finance across Hong Kong and Singapore.

The platform’s scalability and interoperability are attracting DeFi builders targeting the APAC mid‑market segment.

RELATED: Avalanche (AVAX) Price Prediction 2025 2026 2027 – 2030

Conclusion

Solana, Polygon and Avalanche are the standout altcoins leading Asia‑Pacific DeFi growth this month. Each brings unique strengths in cost, liquidity and developer momentum to emerging economies.

Tracking quarterly TVL, dev activity and asset‑tokenization pipelines across Asia will help pinpoint further investment opportunities through August 2025.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):