Aave holds much larger locked capital, while Uniswap generates higher fee flow relative to its TVL. Watch V4 upgrades and volume shifts for the next signal.

Aave and Uniswap serve different roles in DeFi, lending and swaps. Aave posts far higher total value locked and active borrow demand, while Uniswap posts stronger recent swap fee flow versus its liquidity. These differences shape which token can run first.

Here is a quick comparison between Uniswap vs Aave to help you understand which has more impact on the DeFi market.

On-Chain Fundamentals: Lending Scale Versus Fee Momentum

Aave’s deployed liquidity sits around $71.4B, with roughly $28.4B borrowed, giving the protocol a large lending scale and cash flow exposure.

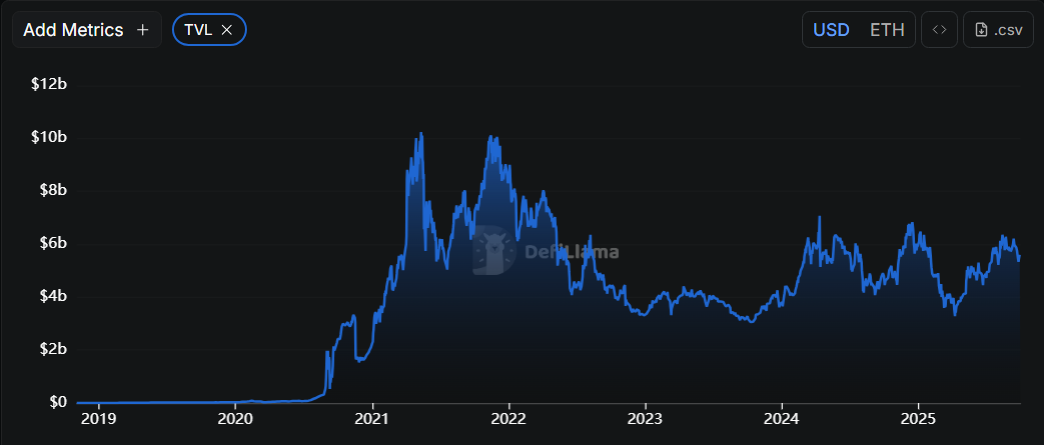

Uniswap’s combined TVL sits about $5.57B, and the protocol collected about $129M in fees over 30 days.

Put another way, Uniswap’s 30-day fees equal roughly 2.32% of its TVL (annualized ~27.8%), while Aave’s 30-day fees equal roughly 0.14% of its TVL (annualized ~1.67%).

These ratios show Uniswap produces more immediate fee flow per unit of locked capital, while Aave controls much larger absolute capital and borrowing activity.

RECOMMENDED: Prediction: $1,000 Investing in Uniswap Could Be Worth What in a Year?

Price Action And Technical Signals To Watch

UNI trades around $7.6, AAVE trades around $270, so watch percent moves rather than nominal price.

Scan 4-week and 50-day moving averages, RSI divergence, and MACD cross for early breakout signs.

For AAVE, rising borrow demand or shrinking TVL can lift price momentum. For UNI, rising DEX volume and a sustained increase in 30-day fees often precede strong runs.

Uniswap vs Aave: Catalysts And Risk Factors

Uniswap V4 introduces hooks that let builders customize pools and fee behavior, which can lift volumes if widely adopted.

Aave’s V4 hub and spoke upgrade aims to add modular lending markets, a potential multi-quarter catalyst when released.

Risks include protocol-specific governance changes, liquidity shifts, and broad market volatility.

Conclusion

Aave leads on raw scale and lending activity, making it the more defensive pick; Uniswap can outperform quickly if V4 features and higher swap volume push fee income up. Watch TVL, borrow growth, 30-day fees, and volume for the next signal.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)