Ethereum nears $4,000 as ETF inflows surge and altcoins gain momentum amid renewed institutional interest and risk-on sentiment.

Ethereum recently climbed above $3,300 following spot ETF inflows exceeding $700 million in a single day, a record high for these products. At the same time, on-chain transfer volume jumped 288% in three weeks to over $10 billion, its most active level since 2021.

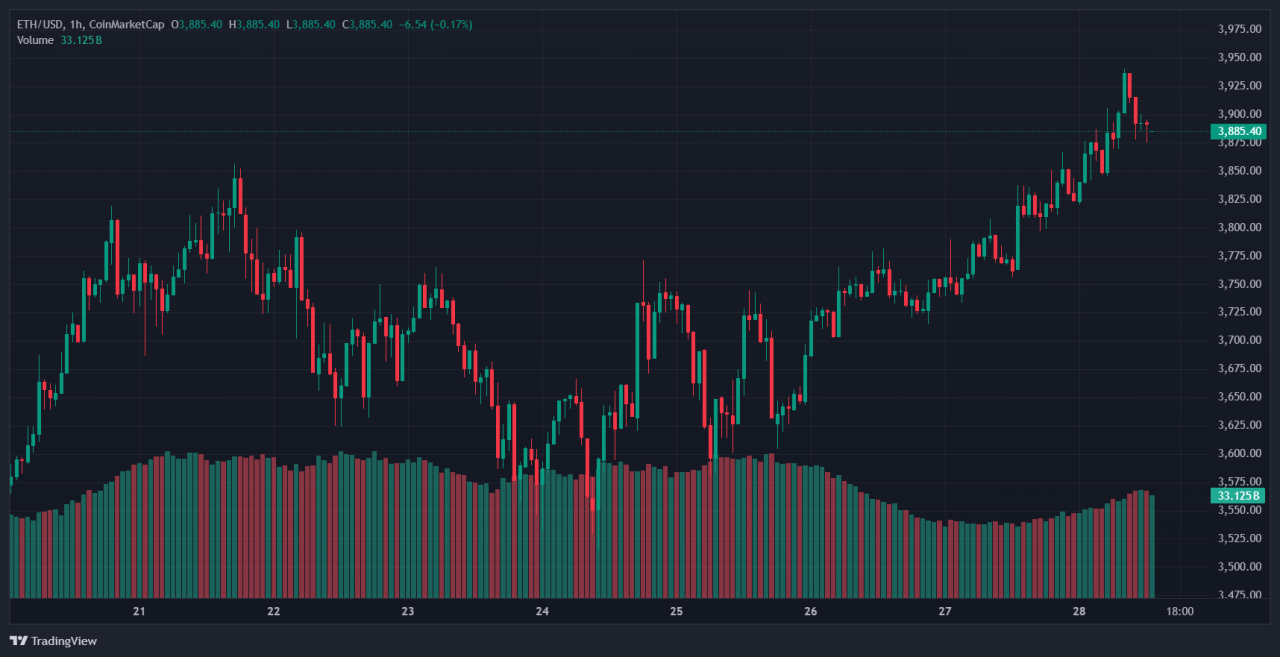

On July 19th 2024, it went above $3,900 and seems to be on a sure road to $4,000. These trends suggest a growing appetite for ETH and broader altcoin exposure heading into the new week.

Market Momentum and Ethereum’s Technical Upside

On‑chain metrics are flashing strong signal: high‑value transactions over $100,000 recently exceeded $100 billion in weekly volume, echoing institutional accumulation. The ETH/BTC ratio has declined roughly 27%, a pattern that historically precedes periods of altcoin dominance.

Technically, Ethereum just floored a structural resistance at $3,900 after outperforming Bitcoin in recent weeks, rising 43% in just two weeks. If ETH breaks above $4,000, momentum could accelerate toward $4,200.

Institutional Rotation into ETH and Altcoins

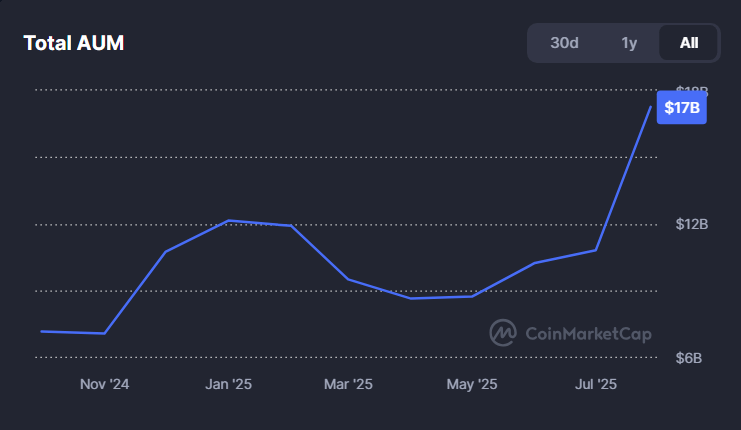

Institutional investors are clearly rotating capital: spot Ether ETFs took in about $2.4 billion over six trading days, compared to $827 million into Bitcoin funds over the same period. That follows record inflows of $726 million in a single session on July 16.

Overall, Ethereum ETF assets now exceed $16–20 billion, capturing over four percent of circulating ETH supply.

With companies like SharpLink and Bitmine adding ETH treasury reserves, broader altcoins such as Solana, Chainlink, and L2 tokens may benefit from ongoing capital rotation.

Catalysts to Watch and Potential Risks

Macro developments – including Fed policy signals and consumer confidence data – are likely to influence risk sentiment this week. Positive headlines could intensify risk-on flows, while hawkish surprises may spark a reversion toward Bitcoin and fiat assets.

The Fear & Greed Index also suggests markets could be prone to short-term exhaustion given current optimism levels. A pullback in ETF activity or regulatory pushback (e.g. delays in staking approvals or tightened SEC guidance) might stall the altcoin advance.

Conclusion

Ethereum’s price outlook is fueled by surging on‑chain activity, ETF demand, and capital rotation away from Bitcoin. If ETH breaks above roughly $4,000, that could confirm expanding altcoin momentum.

Still, if you are thinking of investing in Ethereum should closely monitor macro news, ETF flow continuity, and sentiment shifts that could influence whether this risk-on cycle broadens or fades.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)