Ethereum has been the second-biggest token in the cryptocurrency market for over nine years now, while its blockchain currently accounts for 60.7% of the total value locked (TVL) in of the entire crypto ecosystem.

Considering such factors, this article outlines an Ethereum 5-year prediction, unpacking the coin’s recent growth in order to arrive at an ETH forecast for 2030.

Ethereum 5-Year Prediction: Core Growth Drivers

Ethereum arguably has the strongest fundamentals of any altcoin, something which makes future growth likely.

- Adoption & Utility: as a layer-one blockchain network, Ethereum provides the smart contracts and capabilities that underpin so much of the DeFi, Web3 and NFT sub-sectors. Its TVL – the value of all the tokens locked within its smart contracts – currently stands at $94.74 billion. According to DappRadar, 18 of the 25 biggest DeFi apps run on it, as well as 15 of the 25 biggest decentralised exchanges.

- Technology Upgrades: Ethereum upgraded to a more scalable and environmentally friendly proof-of-stake consensus mechanism in 2022. It also continues to roll out ongoing upgrades that make it more efficient and secure, including the Fusaka upgrade due in November 2025.

- Institutional Interest: Ethereum ETFs have attracted a wave of investment in recent months, with total AUM now standing at $31.9 billion. Demand is also coming from strategic company reserves, and from increasing institutional interest in the tokenisation of real-world assets.

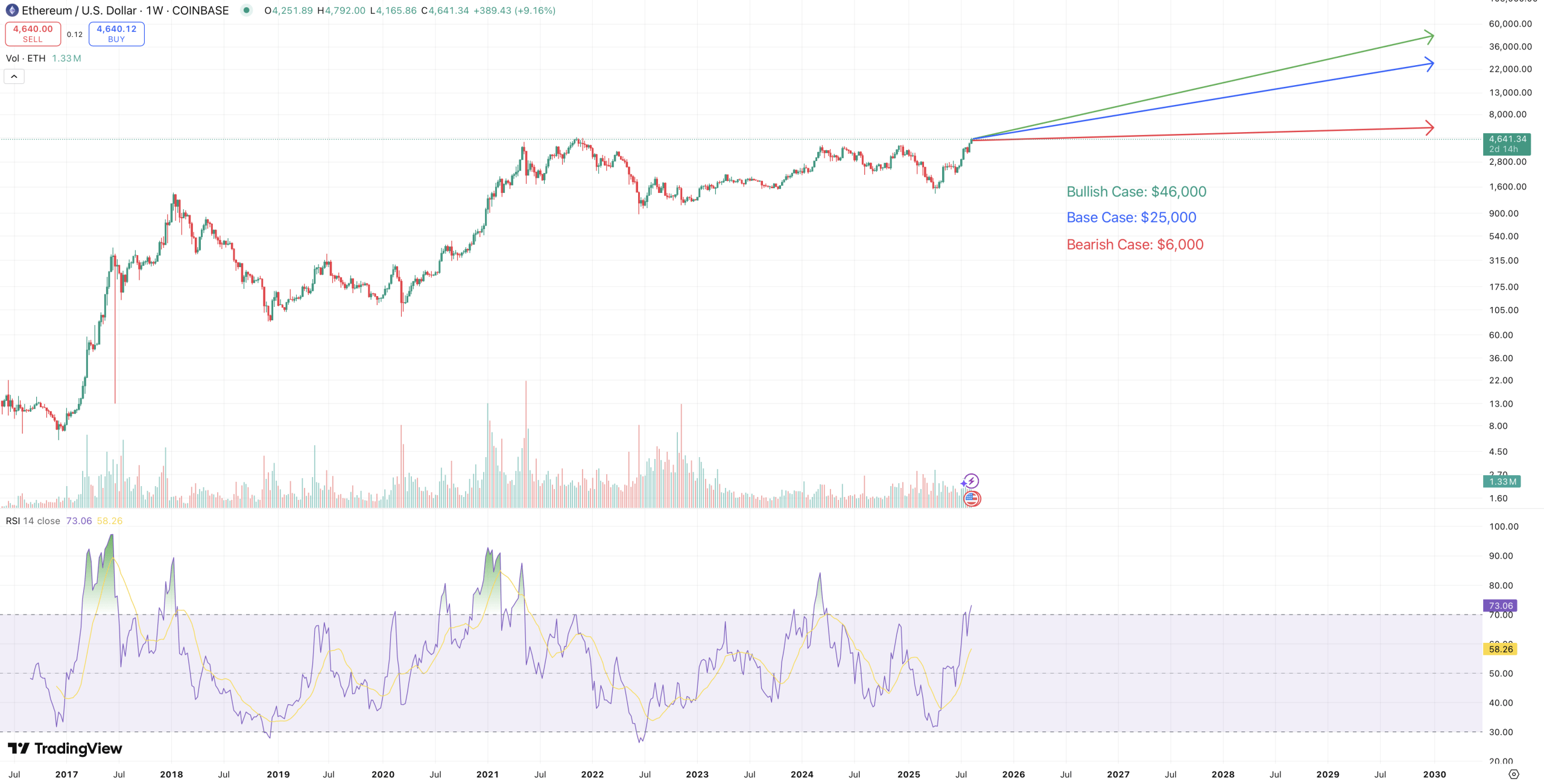

ETH Forecast 2030: Potential Price & Market Scenarios

While the future of Ethereum does look bright, ETH price targets for 2030 could vary depending on macroeconomic and fundamental factors.

- Bullish Case: $46,000. This repeats the percentage gain (roughly 900%) between August 2020 and August 2025. It would be dependent on significant adoption of Ethereum-based DeFi and NFT apps, as well as on the growth of staking ETFs and of tokenisation among financial institutions.

- Base Case: $25,000. This would involve a 440% increase from the current Ethereum price. It’s the price target Standard Chartered have set for Ethereum by 2028, although we may see several corrections along the way in the face of geopolitical disturbances.

- Bearish Case: $6,000. This scenario sees the Ethereum price struggle to make significant headway over the next five years. This could result from ‘Black Swans’ such as a major Ethereum hack, or from a wider cryptocurrency market downturn, potentially caused by global depression or conflict.

For a detailed year-by-year Ethereum price outlook, see our full ETH price prediction forecast.

Risks & Challenges

While some of the risks affecting the Ethereum 5-year prediction were mentioned above, here’s a fuller list.

- Regulation: while the current Trump administration has been very pro-crypto, a succeeding administration in the United States may prove less favourable.

- Competition: newer layer-one networks such as Solana, Sei and Avalanche may prove more efficient than Ethereum over time, attracting away users and adoption.

- Slow technical progress: much-anticipated upgrades such as sharding may not materialise, leading to frustration from users and investors.

- Global headwinds: macroeconomic difficulties (e.g. depression, stock market crashes) may make the investment climate for Ethereum very unfavourable.

Conclusion

The Ethereum five-year forecast will hinge on adoption, upgrades and global market sentiment, and while all of these are largely positive at the moment, investors should be aware that things can change.

In five years, ETH could be a cornerstone of the digital economy or a reminder of how quickly tech shifts.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service, live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)