While XRP reaching $1,000 makes for an exciting headline, it’s not a realistic target based on current fundamentals. Achieving such a price would require a market capitalization that far exceeds the size of the entire global crypto market. Most credible projections point to steady, gradual growth driven by increased adoption, legal clarity, and real-world utility, not extreme price leaps.

Key Takeaways:

- It is mathematically impossible for XRP to reach $1000 in the near future

- Regulatory clarity, a favourable end to the SEC case, and a crypto-friendlier trump administration to help XRP scale new heights

- XRP could rally by more than 200% before the year-end

In this post, we analyze Ripple’s future and tell you whether it can realistically reach $1000 or if this is a myth.

We also tell you if XRP can flip Ethereum or be the next Bitcoin, look at its past price action, and tell you what analysis shows it will be worth by year-end, next year, and in 2030. Even more importantly, we tell you if XRP is worth buying today.

Read on to learn everything you need to know about XRP.

What is XRP?

XRP is a digital asset created by Ripple Labs. It was designed to facilitate ultra-fast and low-cost cross-border payments.

XRP operates on the XRP ledger, a highly decentralized, and open-sourced, and energy-efficient blockchain that doesn’t rely on mining like Bitcoin.

This one uses the revolutionary XRP Ledger Consensus Protocol (XRP LCP), whereby all transactions are authorized by a validator.

The XRP Ledger was designed to replace legacy systems used to facilitate cross-border money transfers, particularly SWIFT.

The mission of this network is to become the primary system used by banks and other financial institutions to move money across borders.

XRP serves two key roles on this network. First, it is the bridge asset used to facilitate fast and cost-effective exchanges between different fiat and currencies and crypto exchanges.

Secondly, enhances liquidity for cross-border payments.

This ensures platform users achieve seamless transactions without requiring pre-funded accounts.

XRP Price History

XRP launched in 2012 and went by the name OpenCoin, only rebranding to ‘Ripple Labs’ in September 2013 and simply ‘Ripple’ in 2015. All XRP coins (100 billion) were pre-mined at launch, with a large portion of these going to Ripple.

By the time XRP started trading publicly on crypto exchanges, it had a listing price of $0.0058. It only reached parity with the US Dollar in December 2017, during the 2017/2018 bull market.

This remains the most profitable bull market for the altcoin seeing that it rallied by more than 38000% in nine months. It shot from the lows of $0.01 in March 2017 to the current all-time high of $3.84 in early January 2018.

Before it could break out again, the SEC under Gary Gensler brought a case against Ripple Labs, accusing XRP of being an XRP. The court battle has been ongoing since December 2020 and has been the greatest impediment to a meaningful price breakout for the top altcoin.

Why is the XRP Price Going Up?

In Q4 of 2024, XRP exploded by 680% when its prices rallied from $0.5 in early November to a multi-year high of $3.40 in mid-January 2025. The pump can be directly credited to the coming to power of the crypto-friendlier Trump administration.

It should be noted that during the presidential campaigns., Trump promised to make US the crypto capital of the world and that started with the replacement of the anti-crypto Gary Gensler with a crypto friendlier Paul Atkins as the SEC chair.

Top Factors Influencing XRP’s Price Action

Here are a few factors that have had the biggest impact on XRP prices in the recent past:

- XRP Ledger’s Strategic partnerships: Ripple has been growing the ledger into a global network, and this involves partnering with major financial institutions. The number of banks joining Ripple and using the network for cross-border payments has also been on the rise. This strengthens XRPs use case making one of the best RWA coins out there.

- Macroeconomic factors: The likes of inflation, interest rates, and institutional investments in crypto have also had a positive influence XRP’s price action.

- Market trends and correlation to Bitcoin: XRP typically follows Bitcoin’s price movements and the general market trend. The bullishness these two have posted in the last six months has therefore helped lift XRP prices.

- Regulator clarity: Gary Gensler’s exit, a crypto-friendly SEC, and the promise of clearer crypto regulations have also had a positive impact on XRP price.

Is it possible for XRP to hit $1,000?

The short answer is NO. It is highly unlikely that XRP will reach $1000 soon. Let us support this case using simple math:

The total supply of XRP coins currently stands at around 99.98 billion, with a circulating supply of 58.28 billion XRP, according to data from CoinMarketCap.

This implies that were XRP to reach $1000, even without further token unlocks, it would have a market cap of $58.28 Trillion. This is almost equal to the combined GDP (2024) of the 5 richest countries in the world, namely the USA, China, Germany, Japan, and India.

It is also close to 22x the current market cap of the entire crypto industry, which stands at $2.7 Trillion at the time of writing.

Can XRP Reach $500?

It is highly improbable that XRP will reach $500 in the foreseeable future. For starters, this would require a 25000% rally that thrusts its market cap to $29.14 Trillion. There simply isn’t a powerful catalyst or enough buying pressure to push XRP to these levels.

Should You Buy XRP in 2025?

Even though the chances of XRP ever reaching or breaking above $1000 are still low, it remains a viable crypto investment.

Not only because it is hugely resilient and has maintained an uptrending price action. This implies that XRP will continue reporting a positive ROI for all its investors.

Here are a few more reasons why you should buy XRP in 2025:

- Utility in Cross-Border Payments – XRP is fashioned to play a crucial role in facilitating fast and low-cost international transactions. This has positioned it as a key player in the evolving global financial system.

- Regulatory Clarity Progress – Ripple has made significant progress in the SEC case. In fact, Ripple CEO has already stated that SEC will drop the ongoing appeal. This will enhance market confidence around XRP and drive unimaginable adoption.

- Historical ROI and Market Performance – Despite market fluctuations, XRP has delivered solid returns to early investors and continues to offer positive ROI potential. The fact that is still is one of the most undervalued cryptos implies that buying now sets you up for glorious gains in the near future.

Will XRP Flip Ethereum?

It is highly improbable that XRP will flip Ethereum, first because they have wildly distinct ecosystem.

Note that XRP operates in a relatively closed off ecosystem that only deals with finances. Ethereum, on the other hand, boasts a vast and versatile ecosystem, powering smart contracts, decentralized applications (dApps), and the majority of the DeFi and NFT markets.

Image: XRP vs ETH market cap growth comparison (source Tradingview)

Secondly, recent narrowing of their market cap gap is not a sign of XRP surpassing Ethereum. Rather, it is a reflection of XRP’s strong rally—its best in years—coinciding with Ethereum worst market performance since 2022.

Therefore, as soon as the market recovers, you can expect, Ethereum’s superior utility, developer activity, and adoption will likely restore a significant gap between the two assets.

Can XRP be the Next Bitcoin?

It is highly improbable for XRP to supplant Bitcoin as the most valuable digital asset out there. For starters, Bitcoin is the original cryptocurrency and is widely regarded as a store of value and digital gold.

It has the strongest brand recognition and institutional adoption is rising fast. Even more importantly, it is decentralized and deflationary nature gives it a unique appeal as a hedge against inflation and economic instability.

In contrast, XRP is primarily designed primarily for fast and low-cost cross-border transactions. It also lacks the decentralization, scarcity, and first-mover advantage that make Bitcoin the dominant cryptocurrency.

Therefore, while XRP may post unimaginable gain, it is unlikely to ever replace BTC as the most valuable digital asset.

Image: XRP vs BTC price groth comparison (source Tradingview)

XRP Vs Other Cryptocurrencies

XRP is different from other cryptocurrencies in a number of ways. Here are the three that stood out for us the most:

- Centralization vs. Decentralization – Unlike Bitcoin and Ethereum, which are fully decentralized, XRP is more centralized due to Ripple Labs’ significant influence over its development and supply distribution.

- Consensus Mechanism – XRP does not rely on proof-of-work (PoW) or proof-of-stake (PoS) like Bitcoin and Ethereum. Instead, it uses a unique XRP Ledger Consensus Protocol, which allows for faster transactions without the need for energy-intensive mining.

- Use Cases – Most cryptocurrencies serve multiple purposes (e.g., smart contracts, DeFi, NFTs). On the other hand, XRP serves one primarily purpose of facilitating financial institutions and cross-border payments.

What Happens to XRP After the SEC Case?

The Ripple vs SEC case has been ongoing for more than 4 years. Ripple’s first victory came about in 2023 when the courts ruled that XRP is not a security. In October 2024, however, the SEC filed a notice of appeal seeking to overturn this ruling.

And in January 2025, it filed its opening brief, contending that the court erred in ruling that XRP’s programmatic sales did not qualify as an unregistered securities offering.

Today, everything points to a possible withdrawal of the appeal by the SEC. In fact that Ripple Labs CEO, Brad Garlinghouse has claimed that the company has come to an amicable settlement with the SEC.

That they have agreed to pay a $50 Million fine and promise not to countersue the regulatory agencies. Now analysts argue that the agency is waiting for the confirmation of Paul Atkins as SEC Chair before making the announcement official.

When this happens, we expect to see XRP relisted by all the best crypto exchanges in the US, which means increased liquidity. We also expect a rise in institutional adoption and possible approval of the sport XRP ETFs. Even more importantly, it will cause a price surge for the top altcoin.

Does XRP Have Institutional Support?

Yes, there is a wall of institutional investors backing up XRP and teh XRP ledger. The fact that it is specially designed for institutional use makes it particularly interesting to this class of investors. Here are examples of institutions that support XRP:

- Banking institutions – Ripple is currently working with hundreds of financial institutions across the world. These include Santander, Standard Chartered, and SBI Holdings, to facilitate faster and cheaper international transactions using XRP.

- Central Bank Engagement – Ripple has also been pursuing partnerships with central banks ad is already working with close to 10, helping them create Central Bank Digital Currencies (CBDC). This positions XRP as a potential bridge currency in global financial systems.

- Institutional Investment – Companies such as SBI Holdings and other venture firms have invested in Ripple, demonstrating long-term confidence in the XRP ecosystem.

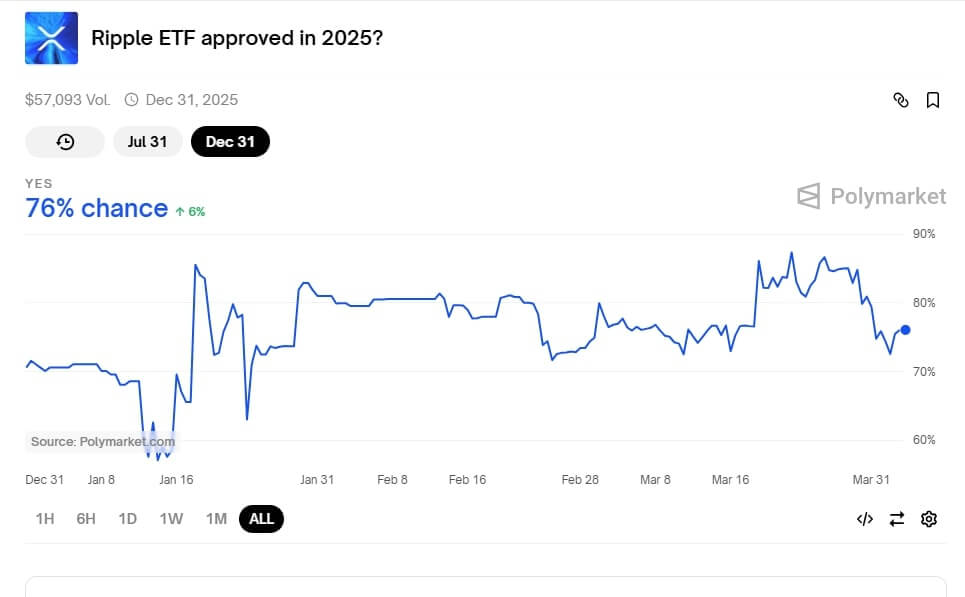

- Spot XRP ETF applications – The demand for XRP by institutional investors is also evidenced by the filing of multiple spot XRP ETF applications.

What Happens After SEC Approves Spot XRP ETFs

At the time of writing, bettors on Polymarkets have a 76% degree of confidence that the Ripple ETF will be approved before year-end. When this happens, we expect these three things to take place. First, there is going to be an explosive growth of institutional investor interest in XRP ETFs.

Secondly, the institutional demand of Ripple ETF will cause an unprecedented price jump for XRP. This will also expand its market cap, helping it cement its position among the 5 most valuable digital assets.

It will also have a global ripple effect and more countries around the world will likely approve Ripple ETFs in their jurisdictions.

XRP Price Prediction 2025, 2026, 2030

We remain hugely bullish about XRP’s future price action. By the end of the year, for example, we are confident that XRP will have rallied by more than 200X to peak at around $4.41 before the end of the year. Much of the expected gains can be attributed to a recovering crypto market and a possible bull run.

XRP’s stellar performance will continue into 2026, mostly fuelled by the approval of the spot Ripple ETF. Before the end of that year, we expect XRP to have peaked at around $6.44.

Between 2026 and 2030, XRP will have undergone multiple high and low cycles but will continue rallying well into the future. By 2030, our analysis shows that XRP will have breached the $12 price level.

Bottom Line: Will XRP Hit $1000?

We have already established that it will be highly improbable for XRP to reach $1000 in the foreseeable future. It will also be highly unlikely for XRP to reach $500.

However, this doesn’t mean that XRP will not rally to new highs. We expect a favorable conclusion of the SEC case, a crypto market bull run, and the approval of the XRP ETFs to continue pushing up the altcoin’s prices.

FAQs

Can XRP reach $1000?

It is mathematically impossible for XRP to reach $1000 primarily because of its bloated circulating supply of 58.28 million XRP tokens.

Can XRP reach $10?

Yes, XRP will eventually reach and break above $10. In fact, our analysis suggests that XRP will reach $10 before 2030.

Should you buy XRP or Bitcoin?

Given Bitcoin’s comparatively stable price action, you would want to buy the legacy digital asset if you are looking for a store of value. XRP is more volatile but also presents you with higher room for growth. Therefore, invest in XRP if you are looking for a greater ROI.

What is the highest XRP could go?

Our analysis shows that XRP prices will continue rising in the near future. We expect it to peak above $12 by the turn of the decade.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- BTC Stronger Than Markets + 3 Key Narratives Emerging (April 20th)

- BTC: From Failed Breakdown To Breakout Attempt On April 13th (April 13th)

- BTC Hanging On A Cliff As Markets Are Retaliating (April 7th)

- BTC Breaching Critical Trendline. Bitcoin’s Message: Politics Are Destroying Markets. (April 6th)

- Bitcoin: Phenomenal Resilience, Watch April 13th. (April 5th)

- BTC Holding Up Well – But Markets Are Turning Very Vulnerable (April 3d)