A final U.S. court resolution removes the main institutional obstacle. That clarity opens custody, payment rails, and ETF channels for XRP.

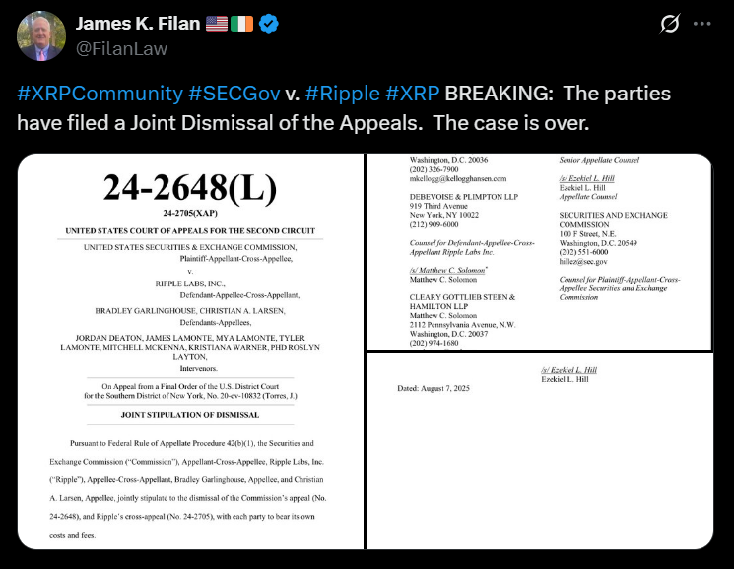

XRP’s single most important short-term catalyst is U.S. legal finality. When the SEC vs Ripple case was dismissed in August 2025, the principal regulatory cloud over exchange trading cleared, letting regulated firms re-evaluate custody, ETF filings and bank use of XRP as a bridge asset.

RELATED: XRP’s Next Explosive Move Might Already Be Underway

Legal Milestone: Appeals Dismissed And What Changed

In August 2025 the parties asked the court to dismiss appeals and the judge approved that request, making the 2024 rulings final.

The court confirmed that XRP sales on public exchanges do not meet the Howey test, while certain institutional sales must comply with securities law, and a civil penalty was fixed at $125 million.

That XRP legal clarity removes the biggest uncertainty that prevented U.S. custodians, broker-dealers and asset managers from offering XRP products.

With clarity, compliance teams can complete risk reviews and exchanges can list XRP with far lower legal risk, opening the door to institutional product approvals.

RECOMMENDED: Is It Too Late to Buy XRP in 2025? What Investors Need to Know

How Clarity Unlocks Real Demand

Clarity converts into usable rails. Ripple documents RippleNet coverage across 90 markets and 55+ currencies and the company still lists 300+ institutional customers, creating a ready pipeline for on-chain liquidity.

Large custodians can now sign agreements, exemplified by BNY Mellon’s announcement to custody Ripple USD reserves, which signals mainstream custody interest.

Regulated investment vehicles already exist in futures form, for example ProShares’ UXRP, and European ETPs give institutions more access without direct spot handling.

These custody, payment and product channels let institutional cash reach the XRP market with far less legal friction than before.

RECOMMENDED: Is XRP a Good Investment? 7 Factors Every Investor Should Know

Market Mechanics That Could Amplify A Rally

Ripple still controls a large share of supply, with roughly 35.3 billion XRP in escrow and a circulating supply shown at about 59.7 billion, so modest, sustained institutional flows can move price sharply once demand is persistent.

To better understand how prices might move, you can check our XRP price predictions.

ALSO READ: 3 Reasons To Buy Ripple (XRP) Like There’s No Tomorrow

Conclusion

Keep close watch on three XRP price catalysts for confirmation that the Ripple regulatory clarity has been meaningful. First, track inflows into proposed or existing XRP ETFs.

Second, monitor growth in On-Demand Liquidity corridors: Ripple says ODL now operates across about 80% of global remittance paths, reducing pre-funding by 65% and remittance cost by 0.3%. Third, examine escrow release and circulating supply.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

When Is The Best Time To Buy XRP?

To get alerts on key time to buy or sell XRP as well as many other crypto assets you should consider joining the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)