Legal clarity and live market products make XRP an attractive investment. Settlement, RLUSD, tokenized Treasuries, and futures widen access.

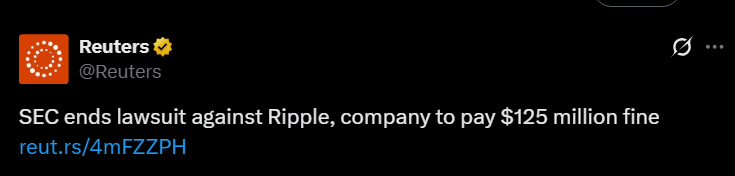

The SEC and Ripple ended their high-profile dispute with a $125 million settlement and dismissal of appeals, removing a major regulatory overhang and allowing faster market development.

The ruling preserves earlier court distinctions between programmatic sales and institutional offerings, which matters for custody and product design. This among many other reasons, makes XRP the best crypto to buy today.

RELATED: 3 Reasons To Buy Ripple (XRP) Like There’s No Tomorrow

1. Regulatory Clarity Removes The Biggest Overhang

The court outcome and settlement make U.S. market participation clearer for secondary-market XRP, reducing headline risk that limited listings since 2020.

Exchanges and custodians can now reassess listings and compliance programs, while allocators can model XRP exposures with fewer legal tail risks.

For allocators this lowers capital charges and allows institutions to price XRP exposures more like other regulated digital assets.

RECOMMENDED: Is It Worth Buying XRP in 2025?

2. Utility Is Turning Into Measurable Flows

Ripple’s RLUSD stablecoin launched in 2025, creating native dollar liquidity on XRPL and enabling on-chain mint and redeem cycles for institutional products, with reported custodial arrangements for reserves.

Ondo Finance also launched OUSG, a tokenized short-term U.S. Treasury fund on XRPL with round-the-clock mint and redeem using RLUSD. This shows a clear path for tokenized treasuries and on-ledger settlement demand.

These live products convert abstract utility into measurable market flows and provide institutional-grade settlement and treasury primitives.

RECOMMENDED: Want to Make $1M with XRP? Here’s How in 10 Years or Less

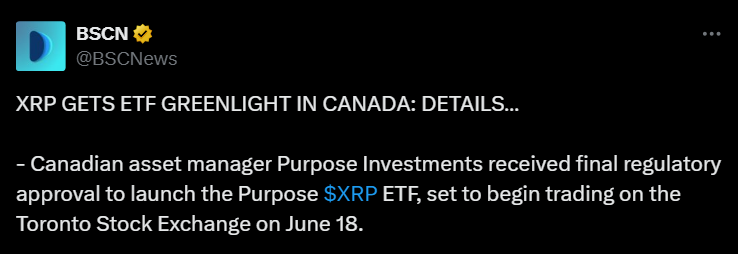

3. Institutional Access Catalysts Are Lining Up

A CFTC filing shows XRP futures listed for trading on or after Apr 21, 2025, with contract specs that enable standardized hedging and price discovery.

Canada listed an XRP ETF in June 2025, providing an exchange-traded vehicle with regulated custody and a public performance track record.

Together, these instruments expand liquidity, enable hedging, and shorten the path to further institutional allocations, a precondition for larger-scale capital inflows.

RECOMMENDED: An In‑Depth Review of Buying XRP on eToro

Conclusion

Legal clarity, tangible on-ledger products, and regulated institutional tools reduce barriers to investment, making XRP the best crypto to buy today.

That said, risk remains, including execution and macro risks, but those three factors materially make XPR more attractive for investors.

If you would like to read more on XRP check out the full XRP Price Prediction

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)