XRP’s 2025 breakout above $2.20, backed by regulatory wins, institutional adoption, and RWA innovation, signals strong upside potential amid bullish technicals and macro trends. Strategic investors eye $4+ targets as ETF approval odds rise and utility expands.

XRP has recently surged past the $2.20 resistance level, marking a significant breakout with triple the average trading volume—a strong signal of renewed investor confidence.

With a combination of bullish technical patterns, improving regulatory clarity, real-world utility, and upcoming ecosystem developments, XRP presents a compelling case for investment in 2025.

This article explores five key reasons to buy XRP now.

1. Technical Breakout Signals Momentum on the Upside

XRP’s recent price action has caught the attention of traders and analysts. After breaking above the $2.20 resistance level, the cryptocurrency has shown strong momentum, supported by a surge in trading volume.

Data from CoinMarkketCap shows XRP is bringing in close to $3B in daily trading volume. This breakout suggests a potential trend reversal, with buyers stepping in aggressively.

A long-term symmetrical triangle formation has been identified on the charts, a pattern often preceding major price moves.

If XRP holds above the $2.15 support level, analysts predict a near-term rally toward $2.60, with further upside potential toward $4 or higher in a broader market rally.

Key indicators like MACD and RSI currently show consolidation, but hidden whale accumulation near $1.90–$2.00 suggests strong underlying demand.

2. Macro & Regulatory Tailwinds: Institutions Gaining Confidence

Macroeconomic conditions are favoring risk assets like cryptocurrencies. For instance, a weakening U.S. dollar and anticipated Federal Reserve rate cuts are driving capital into alternative investments, including XRP.

On the regulatory front, the Securities and Exchange Commission (SEC) recently dropped its appeal in the Ripple case, removing a major overhang on the token.

This decision triggered an immediate 10% price jump to around $2.53, signaling improved market sentiment and increased probability for a potential XRP ETF approval this year.

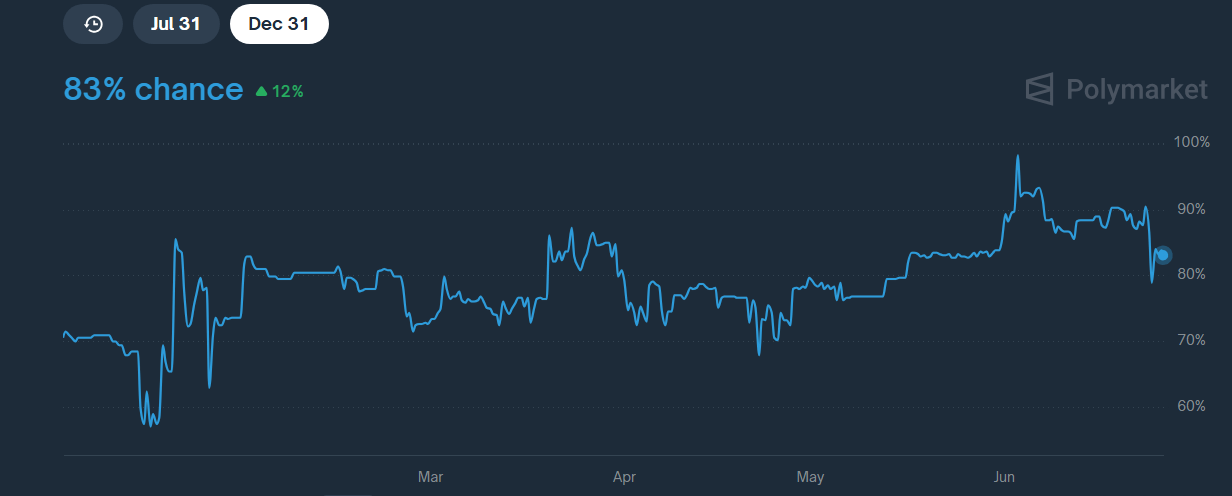

In fact, Polymarket data indicates an 83% probability of a U.S. XRP Spot ETF approval in 2025—a development that could unlock significant institutional inflows.

3. On-Ledger Utility & Real-World Asset Tokenization

Unlike many speculative cryptocurrencies, XRP has established real-world utility through Ripple Payments (formerly ODL), which has processed over $50 billion in cross-border transactions across 55+ countries. This institutional adoption reinforces XRP’s role in global remittances.

Beyond payments, the XRP Ledger (XRPL) is emerging as a hub for real-world asset (RWA) tokenization, including treasury bills, DeFi integrations, and AI-driven payment solutions.

These innovations position XRP as a fundamental player in the next wave of blockchain adoption, moving beyond mere speculation into tangible financial infrastructure. This makes it an attractive option for long term investors looking to diversify their crypto portfolios.

4. Imminent Catalysts: Summits & Product Launches

The XRPL Apex Developer Summit in Singapore (June 2025) unveiled major upgrades, including AI-powered payment rails, cross-chain swaps, and expanded RWA capabilities—all of which enhance XRP’s long-term viability as an investment.

Another key catalyst is Ripple’s launch of RLUSD, a U.S. dollar stablecoin on XRPL. This development is expected to deepen liquidity within the ecosystem, making XRP more attractive for institutional and retail use cases.

5. Bullish Analyst Forecasts & Undervalued Potential

Analysts remain optimistic about XRP’s trajectory, with price targets ranging from $4.50 to $75 in the coming months. Fibonacci extensions and historical accumulation patterns suggest strong support near $1.90–$2.00, providing a favorable risk-reward setup.

While short-term targets hover around $2.30–$2.65, long-term projections—especially in a full-blown bull market—could see exponential gains.

For instance, our predictive analysis projects XRP to trade between $1.81 and $4.10 in 2025, with the average price hovering near $2.91.

We estimate that a breakout above its previous all-time high of $3.30 could spark a strong upward surge. Over the longer term, our analysts maintain a bullish outlook, targeting $9 before the end of the decade.

However, investors should remain cautious of crypto volatility and shifting regulatory landscapes.

Conclusion

XRP stands at a critical juncture, supported by technical strength, macroeconomic tailwinds, regulatory progress, real-world utility, and upcoming innovations.

For investors with a higher risk tolerance, the current price levels offer an attractive entry point with significant upside potential.

While risks remain—such as market volatility and unforeseen regulatory hurdles—the combination of these five factors makes XRP a strategic bet for 2025 and beyond. As always, diversification and due diligence are key when making your investment decision.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)