eToro offers a beginner-friendly way to buy and trade XRP with built-in social tools, though fees are higher than exchanges. U.S. access is restored, and users can withdraw XRP via the eToro Money wallet.

Ripple’s XRP remains one of the most widely adopted utility tokens in 2025, offering fast settlement and deep liquidity. For retail investors looking to invest in XRP without self‑custody headaches, eToro is an attractive bridge between traditional brokers and crypto exchanges.

This guide will walk you through everything you need to know to buy XRP on eToro with confidence. We’ll talk about availability, fees, withdrawal process, real‑world costs, practical steps, and expert insights to help you trade XRP the smart way.

Who Can Buy XRP on eToro? – Availability & Restrictions

As of May 28, 2025, eToro reactivated support for XRP for U.S. users, bringing the total number of available tokens to 15, which now includes XRP, Dogecoin, Cardano and others.

However, crypto trading remains restricted in New York, Nevada, Hawaii, Puerto Rico and the U.S. Virgin Islands. Most residents in EU, UK, Australia and other regulated markets have access.

Note: your ability to trade XRP on eToro may depend on local licensing and AML rules.

How to Buy XRP on eToro

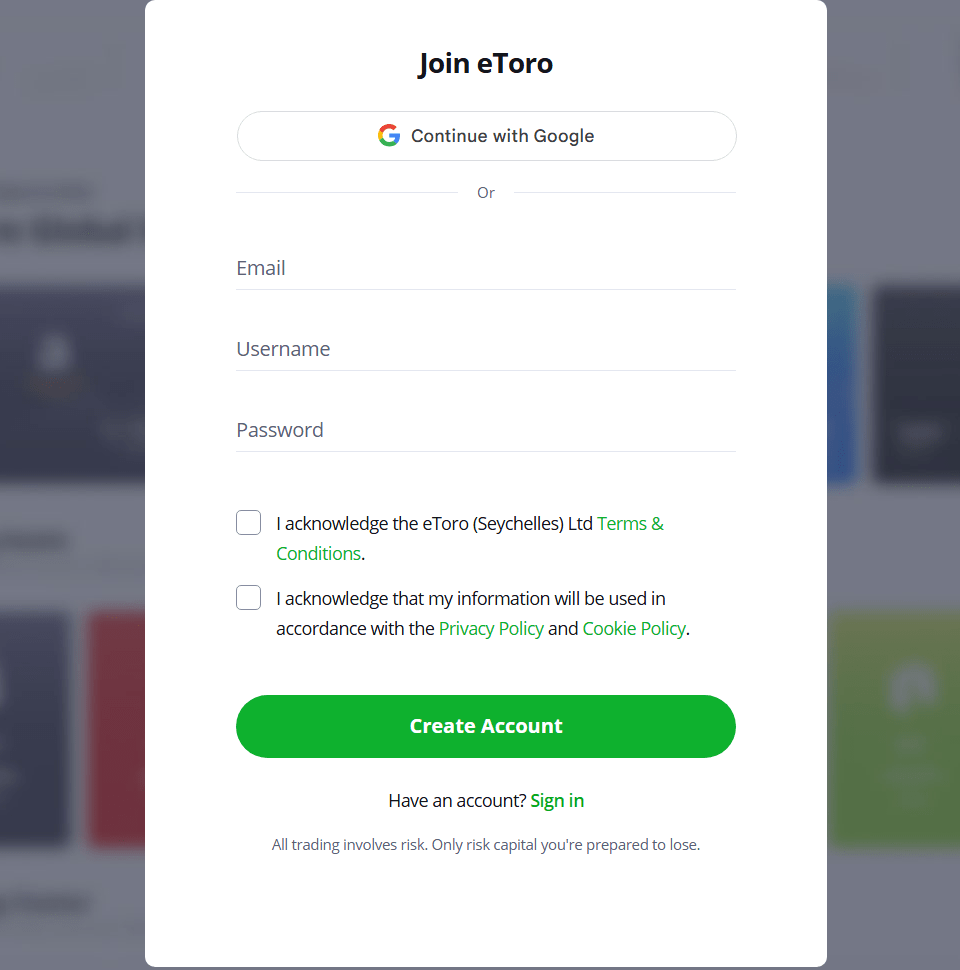

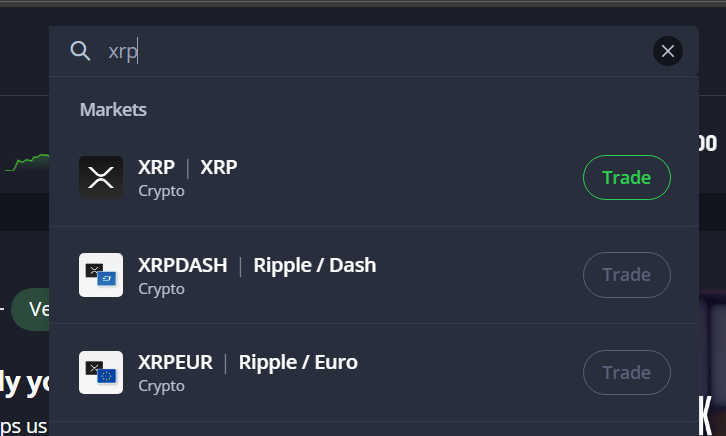

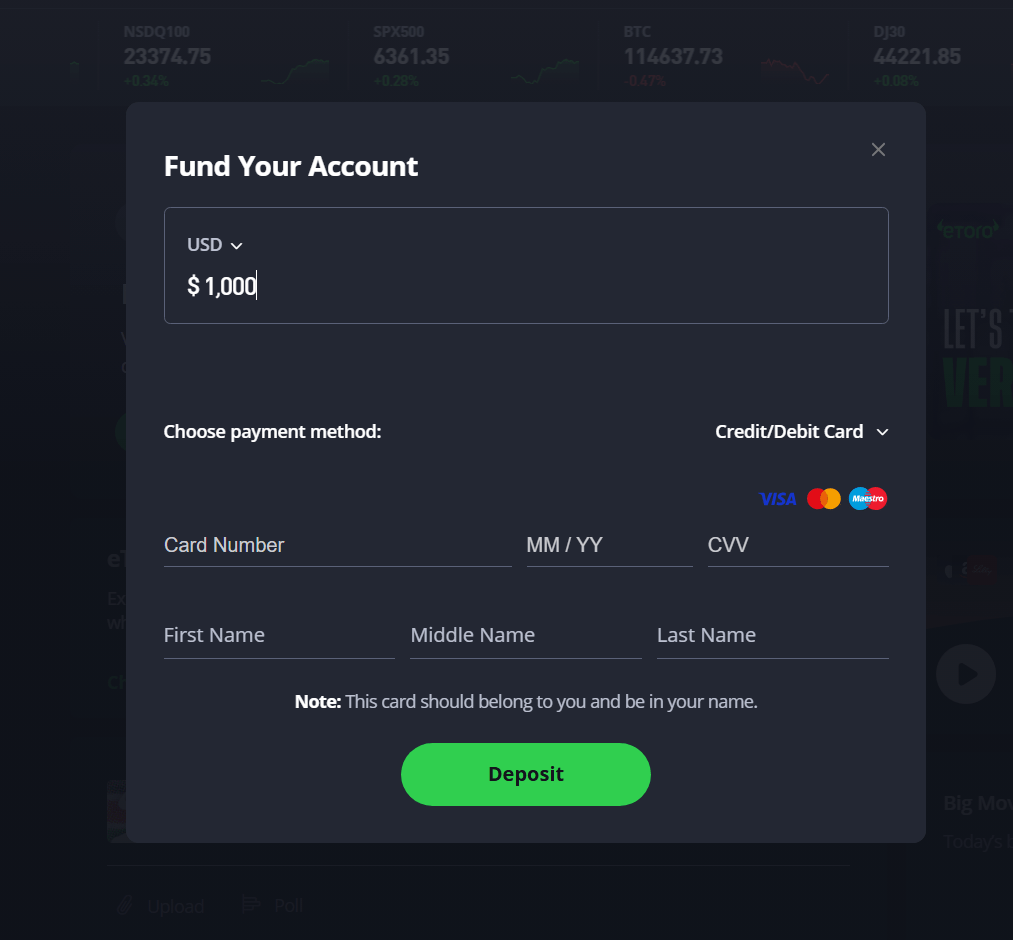

To buy XRP on eToro, start by signing up and verifying your identity. U.S. users must deposit a minimum of $50 before they can trade, though eToro allows an XRP purchase for as little as $10 per position (similar rules apply in other countries).

After funding your account via ACH, debit card or PayPal, search for “XRP” in the Markets tab and click Invest.

PayPal and Credit Cards are not available for UK/FCA users

You can enter a dollar amount, choose leverage 1x for spot ownership, or set a limit Order if you want to buy at a specific price. The trade confirmation screen shows the exact cost including spreads and FX conversions.

Cost Breakdown: Fees, Spreads & Hidden Charges

eToro charges no separate commission, but applies a straight 1% crypto trading fee built into the spread – this means you pay that margin both when you open and close an XRP position.

So for a $100 XRP trade, you pay roughly $1 up front and another $1 when you exit. If your deposit is not in USD, expect a currency conversion markup of around 0.75 %.

Other potential charges include inactivity fees ($10 per month after 12 months of zero activity) and automated spread widening during illiquid periods for low market cap tokens.

Withdrawing Your XRP – eToro Money Wallet & Transfers

If you wish to take full custody of your XRP tokens, you must transfer them from your eToro investment account into the eToro Money wallet.

eToro charges a 2% coin‑transfer fee for this (deducted in XRP units) with a minimum requirement of about 47.81 XRP and a cap of $100 in crypto value.

Beyond that, if you want a fiat off‑ramp, withdrawals cost a flat $5 per request (subject to a minimum $30 cash balance) and conversion fees if not USD.

XRP Ownership Options: Spot vs CFD & CopyTrader

You have two ways to access XRP on eToro.

- Trading at 1x leverage gives you real, spot XRP that can be transferred later.

- You can also choose the CFD version, which mirrors XRP’s price without true token ownership.

Remember that 61% of retail investor accounts lose money when trading CFDs on eToro due to leverage risk. You can also benefit from social trading by following and learning how to copy XRP traders on eToro, but your performance will mirror theirs and fees still apply.

Regulatory & Security Overview

eToro is regulated by multiple authorities including the FCA, CySEC, ASIC, and eToro U.S. LLC is registered with FINRA.

After settling with the SEC in early 2025, eToro reinstated XRP and other crypto tokens for U.S. customers in May 2025.

Security features include MFA, segregated client funds, and optional crypto custody via the eToro Money wallet. Note that crypto held on eToro is not covered by SIPC or FDIC insurance in the U.S.

Quick Pros & Cons

The main advantages include:

- A simple interface

- Minimum $10 position size

- Integrated stock-and-crypto dashboard,

- Built‑in social trading for transparency.

- You can combine equity and crypto portfolios in one account.

On the downside:

- Your eToro XRP fees and spreads are higher than institutional platforms

- No live order‑book access

- Fewer token listings than major exchanges

- Withdrawing XRP is restricted for copy‑trader and SmartPortfolio users unless you sell out first.

Conclusion

Buying XRP on eToro is ideal for beginners or casual investors who want a unified platform. If you follow best practices – deposit in USD to avoid conversion fees, trade during global crypto liquidity hours, and use 1x leverage for true XRP ownership – you can minimize costs.

Only transfer out XRP if you need self‑custody. This platform isn’t cheapest, but it excels in ease of use and social trading features.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)