KEY TAKEAWAYS

- eToro lists XRP on its U.S. platform and offers an easy buy experience and social features.

- Exchanges may restrict XRP by state; always check each platform’s support pages.

- Bank rails usually deliver the lowest fees; card buys often add roughly 3%+.

- Many exchanges require a destination tag for XRP withdrawals and deposits; missing tags can delay or lose funds.

- Choose a regulated exchange for custody and reporting, a low-fee exchange for active trading, or a simple app for one-off buys.

Regulated U.S. exchanges offer XRP with varying fees, payment methods, liquidity, custody standards, state coverage, and trading tools.

XRP now trades on many U.S. platforms after recent regulatory clarity.

eToro US officially added XRP to its U.S. offering, and major exchanges such as Coinbase and Kraken have relisted or expanded XRP markets.

Still, availability can vary by state, so confirm eToro is supported in your state before signing up.

That said, buying with ACH or a bank wire usually costs the least.

Card and instant buys often add about a 3%+ fee on top of the market price.

Also note that XRP transfers commonly require a destination tag.

In this article, we will look at the top exchanges to buy XRP in the US and help you choose the right one for your needs.

RELATED: 10 Regulated FCA-Approved Crypto Exchanges In The UK (2025)

The Top Exchanges To Buy XRP In The US

1. eToro US

eToro US lists XRP as part of its expanded crypto offering for U.S. users.

The platform supports buying and selling XRP directly, with access depending on state rules.

eToro focuses on simplicity and combines crypto trading with social features that let users view and copy other traders’ portfolios.

XRP purchases settle instantly, and users can move supported assets to the eToro Money wallet.

eToro charges no separate trading commission; instead, costs come from the bid-ask spread, which varies with market conditions.

According to eToro fees disclosures, spreads are wider than advanced trading platforms, especially during volatile periods.

This makes eToro better for simple spot buying than frequent trading.

Pros

- Simple interface

- XRP available to U.S. users

- social trading tools

Cons

- Spread-based pricing

- limited advanced order types

Payment Methods

- ACH bank transfer

- Debit card

Fees

- Variable spread

- No fixed commission

Best For

- Beginners who want an easy way to buy XRP in the US.

>>>>BUY XRP WITH eToro<<<<

RECOMMENDED: eToro Review 2025: Is It Safe, Legit & Worth It?

2. Coinbase

Coinbase supports XRP trading for U.S. customers after relisting it following regulatory developments.

It offers XRP/USD pairs and strong liquidity, which helps reduce slippage on market orders.

Coinbase serves over 100 million verified users globally, making it one of the largest regulated crypto platforms.

U.S. users can buy XRP using ACH transfers with low fees, while card purchases cost more.

Trading fees on Coinbase follow a maker-taker model and typically range from about 0.6% for small trades to much lower rates for higher volumes.

Coinbase also allows users to withdraw XRP to external wallets, which is ideal if you are buying for the long-term.

Pros

- Regulated U.S. exchange

- High liquidity

- Easy access to fiat on-ramps

Cons

- Higher fees for small trades

- Fee structure can feel complex

Payment Methods

- ACH transfers

- Bank wire

- Debit card

Fees

- Maker–taker fee model

- Additional costs for card purchases

Best For

- U.S. buyers who want a trusted, regulated platform

ALSO READ: Coinbase Enters S&P 500 – Is This Wall Street’s Crypto Turning Point?

3. Kraken

Kraken offers XRP trading pairs to U.S. residents and has operated since 2011.

It supports XRP/USD markets and provides advanced order types such as limit, stop-loss, and take-profit orders.

Kraken emphasizes security and reports that it keeps the majority of user funds in cold storage.

The platform uses a tiered fee model, with spot trading fees starting around 0.40% for makers and 0.60% for takers, then dropping as volume increases.

Kraken mainly supports bank transfers, which keeps purchase costs lower than card-based platforms.

Its interface suits users who want more control without unnecessary features.

Pros

- Strong security record

- Advanced trading tools

Cons

- Interface is less beginner-friendly

- Limited support for card payments

Payment Methods

- ACH transfers

- Domestic and international bank wires

Fees

- Tiered maker–taker fees based on trading volume

Best For

- Traders who want more control and lower fees using bank transfers

>>>>BUY XRP With Kraken Now<<<<

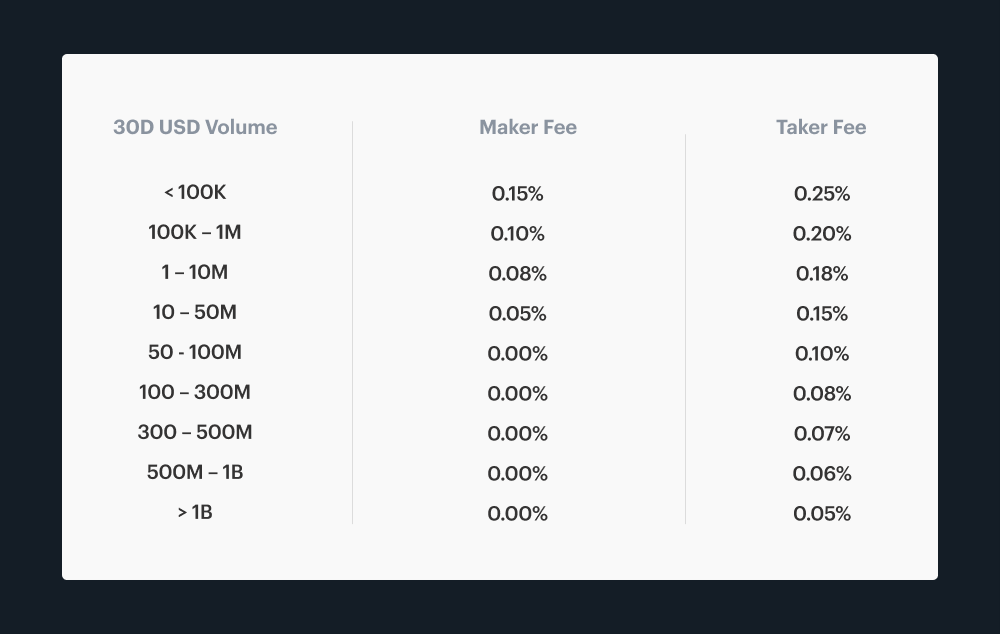

4. Binance.US

Binance.US is the U.S. version of Binance and offers competitive trading fees when XRP is listed and available in a user’s state.

The platform uses a simple spot trading model and supports USD trading pairs.

Binance.US charges some of the lowest fees among U.S. exchanges, with standard spot fees around 0.10%.

Users can reduce costs further by using volume discounts.

ACH deposits are free, which helps lower total purchase costs.

Asset availability can change based on regulatory and state-level rules, so ensure to confirm XRP access before funding an account.

Pros

- Very low trading fees

- Free ACH deposits

Cons

- Asset availability varies by state

- Fewer features than the global Binance platform

Payment Methods

- ACH bank transfer

- Debit card

Fees

- Around 0.10% spot trading fees

Best For

- Cost-conscious buyers who want low fees

RECOMMENDED: How to Buy XRP in Canada: Fast, Safe & Simple Steps

5. Gemini

Gemini is a U.S.-regulated exchange known for compliance and custody services.

It supports XRP trading and focuses on transparency and security.

Gemini offers two interfaces: a basic platform for simple trades and ActiveTrader for lower fees and advanced tools.

On ActiveTrader, trading fees start around 0.20% for makers and 0.40% for takers, which is more competitive than the standard interface.

Gemini supports ACH transfers for U.S. users, making it suitable for direct XRP purchases with USD.

The exchange also provides insured custody options, which appeals to users focused on asset protection.

Pros

- Strong regulatory standing

- Secure custody options

Cons

- Higher fees on the basic interface

Payment Methods

- ACH bank transfer

- Wire transfer

Fees

- Lower fees on ActiveTrader

- Higher fees on the standard platform

Best For

- Users who value regulation, security, and reliable custody options

6. Uphold

Uphold lists XRP and lets U.S. users buy it with fiat or other crypto.

The app shows instant deposits via debit card, ACH, Apple Pay and Google Pay, and it calls out higher fees for card purchases (card fees can be about 3.99% on instant buys).

Uphold also offers an integrated wallet and simple one-step trades between assets, which makes small XRP buys fast.

Check daily limits and fee disclosures before you buy. You can find the fees on the order screen.

Pros

- Fast fiat on-ramps

- Easy-to-use mobile app

- Integrated wallet

Cons

- High fees on card purchases

- Wider spreads on small trades

Payment Methods

- ACH transfers

- Debit and credit cards

- Apple Pay

- Google Pay

Fees

- Around 3.99% for instant card purchases

- Lower fees for ACH and bank transfers

Best For

- Buyers who want instant, card-friendly purchases and a simple app

>>>>Buy XRP With Uphold Now<<<<

RECOMMENDED: Top 10 Richest XRP Whales: Who Owns the Most XRP in 2025?

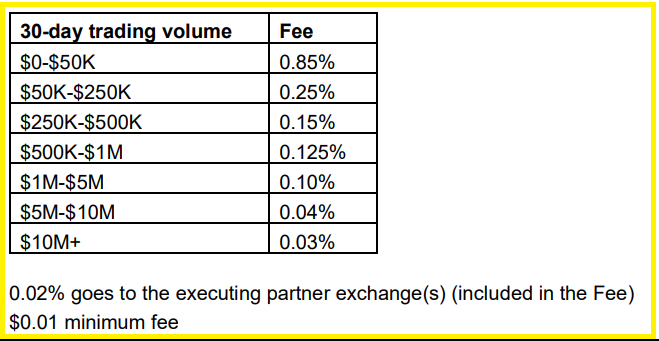

7. Robinhood

Robinhood offers commission-free crypto trading and no deposit or withdrawal fees for many crypto actions.

However, the platform applies spreads and Connect fees that vary by payment method.

Robinhood also updated its fee tiers recently, offering rates as low as 0.03% for high-volume traders.

Note that withdrawal mechanics and custody differ from full exchanges; confirm XRP withdrawal rules before moving assets off platform.

Pros

- Commission-free crypto buys

- Simple, mobile-first experience

Cons

- Limited advanced trading tools

- Withdrawal and custody limits can vary

Payment Methods

- ACH bank transfer

- Debit card

Fees

- No trading commissions

- Spreads and Robinhood Connect fees apply

Best For

- Casual buyers who want quick, low-cost mobile purchases

8. Bitstamp

Bitstamp supports XRP trading pairs and accepts ACH bank transfers for U.S. users.

The exchange has a long track record and shows transparent maker/taker fee tiers that fall as 30-day volume rises (example ranges: maker 0.30% down to 0.00%, taker 0.40% down to 0.03% by volume).

Bitstamp also discloses variable crypto withdrawal network fees shown before confirmation.

Its simple interface and reliable order execution suit straightforward XRP buys for users who prefer a mature exchange.

Pros

- Transparent fee structure

- Long-standing industry reputation

Cons

- Fewer consumer-friendly features compared to large apps

Payment Methods

- ACH transfers

- International wire transfers

- Debit and credit cards via partners

Fees

- Tiered maker–taker fee schedule

- ACH deposits are often free

Best For

- Users who want clear fee tiers and reliable trade execution

RECOMMENDED: 5 Reasons to Buy XRP

9. Crypto.com

Crypto.com supports XRP purchases for U.S. customers through its app and exchange.

It lists bank transfers (ACH) and instant deposits, plus debit card and Apple/Google Pay options.

The platform highlights free deposits via bank rails and you can see withdrawal fees before confirming your order.

Crypto.com pairs app conveniences, card and rewards features, and competitive exchange tier fees that improve with volume or CRO staking.

Check temporary delists or state restrictions since asset availability can change.

Pros

- Broad app ecosystem

- Card and rewards options

- Frequent promotional offers

Cons

- Support response times can vary

- Occasional compliance-related delistings

Payment Methods

- ACH transfers

- Debit and credit cards

- Instant deposits

- Crypto deposits

Fees

- Free bank deposits

- Trading fees vary by user tier and active promotions

Best For

- Users who want app features, cards, and rewards

10. Bybit

You can buy XRP on Bybit’s spot market through multiple fiat rails and card options.

The platform advertises competitive rates and no fees for on-chain crypto deposits; buy-side fees from fiat partners may apply.

Bybit serves active traders with deep liquidity and advanced order types.

However, you should check whether full USD spot services are available in your state before funding.

Bybit also runs promotions that can lower costs for larger trades.

Pros

- Deep liquidity

- Advanced trading tools

- Promotions for high-volume trading

Cons

- U.S. access and spot features vary by state

- Fiat purchases incur fees from providers

Payment Methods

- Crypto deposits

- Debit and credit cards via partners

- P2P transactions where supported

Fees

- No fees for on-chain crypto deposits

- Competitive trading fees

- Provider fees apply for fiat purchases

Best For

- Experienced traders who need liquidity and advanced order features

ALSO READ: 3 Reasons You Should Buy And Hold XRP

How To Pick The Best Exchange For XRP In The USA

Confirm XRP Is Supported In Your State

Some exchanges may restrict service by state. So, check the exchange’s support pages before you sign up so you don’t open an account that you can’t use.

Compare Fees By Payment Method

ACH/bank transfers usually cost the least while card and instant-buy methods often charge a flat fee or a 3%+ markup. Check maker/taker and deposit fees for the exact cost.

Check Liquidity And Typical Spreads

Higher liquidity lowers slippage on market orders. Use order-book depth or 24-hour volume on the exchange to judge likely execution costs.

Confirm Withdrawal Rules And Destination Tag Requirements

XRP transfers require a destination tag on many platforms. Missing or wrong tags can cause you to lose funds or access to support tickets. Read the exchange’s withdrawal help pages for more information on this.

Look At Security, Custody, And Insurance

Go for exchanges that store most funds in cold storage and that publish custody or insurance terms. This lowers counterparty risk.

Match Features To Your Use Case

If you want simple buys, pick an easy app. If you trade often, pick low-fee, high-liquidity platforms with advanced order types.

Do A Small Test Purchase First

If you are unsure, buy a small amount to confirm fees, speed, and withdrawal flow before you commit larger sums.

Frequently Asked Questions

Can U.S. Residents Buy XRP?

Yes. Many regulated U.S. exchanges list XRP for trading and withdrawals.

Is XRP A Security?

U.S. courts and recent settlements have narrowed that risk for public exchange sales, but legal nuance remains.

Do I Need A Destination Tag To Send XRP?

Often yes. Centralized exchanges usually require a destination tag to credit your account correctly.

What Payment Method Costs The Least?

Bank transfers/ACH usually carry the lowest fees versus cards or instant buys.

How Can I Minimize Trading Costs?

Use ACH, avoid instant card buys, and pick exchanges with volume or maker/taker discounts.

Conclusion

XRP is available across several regulated U.S. exchanges, each serving a different type of buyer.

eToro US stands out for simplicity and accessibility, while Coinbase and Gemini focus on compliance and custody. Kraken and Binance.US appeal to users who prioritize trading tools and lower fees.

When choosing an exchange, focus on state availability, payment methods, fee structures, and withdrawal rules instead of brand names.

Bottomline, choosing the right exchange depends on how you plan to buy, hold, and move XRP rather than on price alone .

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.