KEY TAKEAWAYS

To buy Ripple XRP today, pick a regulated exchange, create an account, and complete KYC.

Deposit via bank, card, or PayPal, then place a market or limit order for XRP.

After purchase, move XRP to a secure wallet and compare fees/availability by region.

You can buy XRP today easily through major cryptocurrency exchanges like eToro, Binance, or Coinbase. As one of the world’s largest and most valuable digital assets, Ripple (XRP) is widely listed, giving investors multiple secure, regulated options to purchase, trade, and store XRP instantly with various payment methods.

In this guide, we provide you with a comprehensive guide on how to buy Ripple. We tell you where to buy Ripple, introduce you to the best Ripple exchanges, teach you how to buy Ripple with cash, and how to keep your XRP tokens safe.

Step-by-Step Guide on How to Buy XRP Today

Step 1: Choose a Reliable Cryptocurrency Exchange

The first step to buying Ripple involves identifying and registering with a crypto exchange that works for you. And the first consideration when choosing an exchange is your trading experience.

If you are a beginner, choose a platform with a friendly user interface, and if you are a pro trader, the best altcoin exchange for you should prioritize advanced trading tools. Below, we look at other top considerations when searching for a crypto exchange.

What to Look for in a Cryptocurrency Exchange

Trading fees:

Confirm the trading and non-trading fees charged by the top Ripple exchange. These include transaction costs, withdrawal fees, and deposit processing fees, as they have a huge impact on how much you take home.

Regulation and registration:

Where possible, only consider trading platforms that are regulated and have operating licenses.

User interface:

If you are new to crypto, register with beginner-friendly crypto exchanges. These have intuitive trading interfaces with clean dashboards and key tools are easily accessible.

Security features:

The best crypto trading platform should integrate key security measures like two-factor authentication. They should provide users with free and safe wallets and fund insurance.

Deposit methods:

The best crypto exchange should accommodate your preferred deposit methods.

Trading options:

A good trading platform should present you with as many XRP trading and investment options as possible. These include spot crypto trading, margin trading, staking, lending, and savings.

Comparison of Top Crypto Exchanges

This table compares the key features of the best Ripple exchanges.

| Feature | eToro | Kraken | Coinbase | Binance | Uphold |

| Trading fees | 1% transaction fee (FIXED) | 0% – 0.4% per trade | 1.49% per trade | 0.1% – 0.00825% per trade | 0.99% per trade |

| Regulation and registration | SEC-regulated | SEC-regulated | SEC-regulated | SEC-regulated | SEC-regulated |

| User interface | Beginner friendly | Beginner friendly | Beginner friendly | Beginner friendly | Beginner friendly |

| Security features | 2FA, insurance, free wallet | 2FA, insurance, free wallet | 2FA, insurance, free wallet | 2FA, SAFU, free wallet | 2FA, insurance, free wallet |

| Deposit methods | Bank, ACH, credit/debit cards, PayPal | Bank, ACH, credit/debit cards, PayPal | Bank, ACH, credit/debit cards, PayPal | Bank, ACH, credit/debit cards, PayPal | Bank, credit/debit cards |

| Trading options | Spot, staking | Spot, staking, margin trading | Spot, staking, margin trading | Spot, staking, margin trading, saving | Spot, staking |

Buying Ripple on eToro Today

eToro has positioned itself as one of the best places to buy XRP coins for beginners in the US.

It achieves this by oversimplifying not just the trader account registration process.

The regulated crypto brokerage has also simplified the process of buying Ripple and all of the best cryptos for beginners listed here.

Today, you only need $10 to start buying digital assets on eToro.

You also get to decide whether you wish to buy these assets instantly or using the account balance. Furthermore, you have a choice of using either the eToro mobile trading app or the eToro web trader. Both platforms are user friendly with all the necessary tools easily accessible.

It is also worth pointing out that eToro doesn’t just cater to beginner crypto investors. It has also integrated tools, features, and enhancements that make it appeal to expert traders.

These include 75+ advanced trading tools. These include charting tools, technical indicators, and risk management tools. The platform is also deeply liquid and has some of teh fastest transaction processing speeds, ensuring minimal-to-zero slippage when trading.

But eToro is perhaps more popular because of its copy trading tools. The copy trading tools lets anyone profit from XRP passively, even if they don’t know how to analyze the market.

They simply have to copy the trade settings of profitable popular investors. And if you let others copy your trades, eToro will pay you a commission depending on assets under management. A

Here are a few more key features that help the regulated altcoin exchange stand out:

Multiple payment methods:

eToro supports virtually all the popular payment methods and doesn’t charge a deposit processing fee. These include PayPal, ACH, Bank transfer, PayPal, Skrill, Neteller, Credit cards, and Debit cards, and the deposit minimum is only $10.

Social trading:

The eToro social trading platform allows for seamless interactions between traders. You get to learn about different markets and even new trading strategies here.

*eToro Club:

Gves you acces to faster customer support services. You get to contact support team directly on live chat or even request a call back.

*Transparent fees:

eToro is regularly praised for maintaining one of the most transparen fee structure. It also charges fixed crypto transaction fees – set at 1% the trade trade volume. Plus, you get to view and review all the fees and charges affecting your trade before yout the buy/sell button.

Buying Ripple on Binance Today

Binance appeals largely to experienced traders as it integrates a wide range of advanced trading tools and features. These include margin trading, fast transaction processing speeds, and trading bots. Here are some of the features that help Binance stand out:

Low fees:

Binance maintains some of the most competitive crypto trading fees. When buying Ripple on Binance, for example, you will pay a transaction fee of between 0.1% and 0.011%. You also qualify for a 25% discount if you pay using BNB coins.

Automated trading:

Binance allows traders to automate their trades by integrating trading bots or through coy trading.

Derivative trading:

Binance also supports crypto derivative trading. It allows users to margin-trade Ripple future and options with leverages of up to 100x.

Deep liquidity:

Binance is also massively liquid. For years, Binance has emerged as the most liquid crypto exchange in the world.

Buying Ripple on Coinbase Today

Coinbase is one of the most popular and one of the most beginner-friendly crypto exchange in the US. Here are some of its standout features:

Straightforward buy process:

Coinbase makes it possible for users to buy cryptos like XRP instantly with credit cards or debit cards.

Security:

Coinbase has put in place multiple security measures around user funds, including 2FA. It also provides users with a free crypto wallet app for iPhones and Android. Plus, it holds 98% of user funds in offline wallets while insuring the remaining 2%.

Staking:

You can also earn passively when you stake Ripple and other popular digital currencies on the Coinbase exchange.

Multi-platform trading:

Coinbase presents its platform users with multiple trading platforms. These include the Coinbase app and web trader for beginners. Coinbase PRO for professional traders and the Coinbase wallet app.

Which is the Best Exchange for You?

This is how you go about choosing the best crypto trading platform for you:

Inexperienced traders:

Consider registering with altcoin exchanges with the most intuitive interfaces, such as eToro and Coinbase.

Expert traders:

Consider registering with a crypto exchange that gives you access to advanced trading tools, such as Binance and Kraken.

Cost-conscious traders:

Consider registering with a crypto exchange that charges low trading fees, like Uphold and Binance, who offer discounts on trading fees.

Step 2: Create and Secure Your Account

After identifying the best crypto trading platform for you, you now need to create a trader account with them. Most of these have a quick and straightforward account creation process that takes no more than a few minutes.

Step-by-Step Account Creation

Step 1: Create a free crypto trader account

Start by opening the official website of the preferred crypto trading platform – such as eToro or Coinbase.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Take 2 mins to learn more here.

Alternatively, download the crypto trading app for either of these crypto exchanges and hit the “Create Account/Join Now” icons.

Proceed to complete the registration form that pops up asking for such basic information as your name and address, phone number, and trading experience.

Step 2: Verify your identity

Most of these platforms only consider the account registration process complete after you have verified your identity. This is done by simply submitting a copy of your driver’s license or passport to the exchange. Only after identity verification can you start depositing funds or buying Ripple and other promising cryptos on these exchanges.

Step 3: Set up 2FA

When creating a crypto trader account, you will be asked to come up with a strong and unique password for your account. In addition to the password, you may want to activate two-factor authentication (2FA). This restricts unauthorized account access by binding your account to a mobile or authenticator app- or both.

Security Tips to Keep Your Account Safe

Here are a few more crypto security best practices:

Don’t disclose account holdings:

Do not disclose how much crypto you have accumulated to friends, family, and online. Telling people how much you own in crypto can make you a target for criminals.

Minimize the amount held in exchanges and DeFi platforms:

Crypto exchanges and DeFi Platform aren’t infallible. They are prone to collapse, as was the case with FTX or hacks, as was the case with ByBit. Where possible, consider self-custody by investing in a reliable hardware wallet.

Learn about scams and how to avoid them:

To avoid falling victim to such brutal scams as pig butchering and Ponzi schemes, keep up to date with new and emerging crypto scams. Also, learn how to spot and avoid them.

Don’t keep digital copies of your seed phrases or private keys:

Hackers have come up with sophisticated and often undetectable viruses that spy on target’s phones and computers and steal digital copies of their seed phrases and private keys.

Step 3: Deposit Funds Into Your Account

Now that you know how to pick the best Ripple exchange and how to create a secure trading account, we now need to discuss the XRP buying process. This starts with depositing funds into the crypto trading account you just created.

How to Fund Your Crypto Trading Account

Step 1: Log into your account

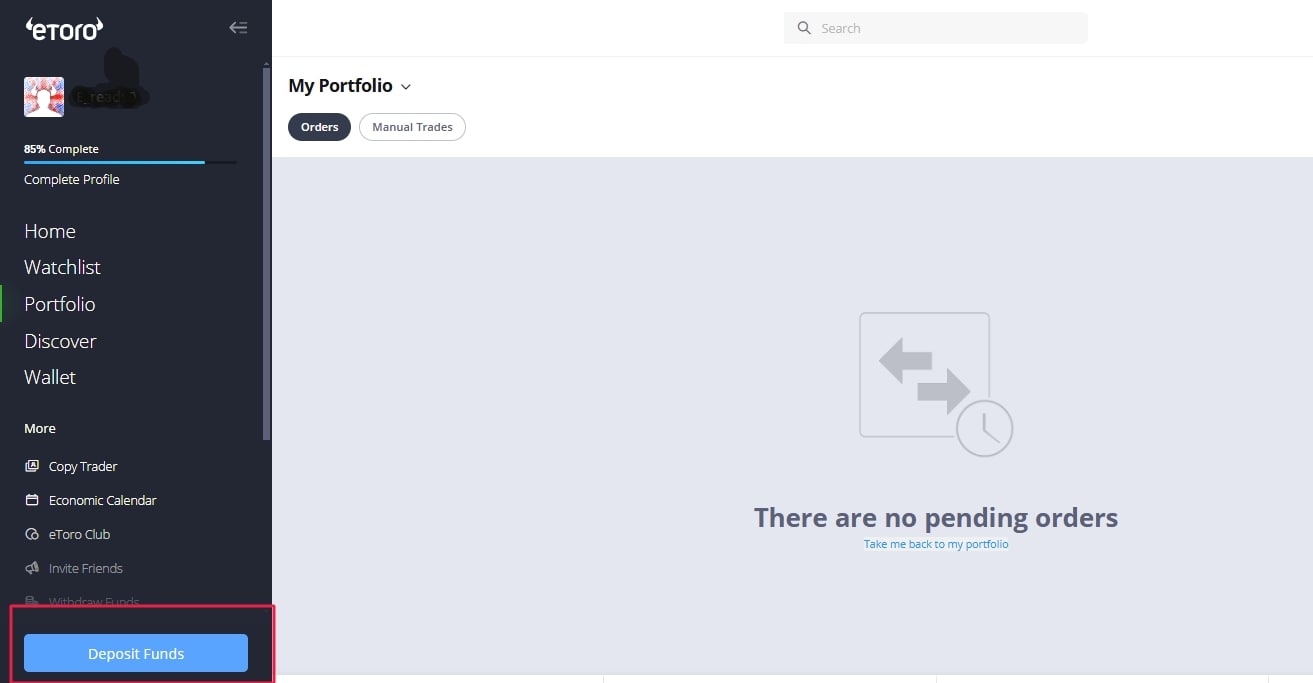

Start by logging back into your preferred crypto trading account, such as eToro.

Step 2: Choose the deposit option

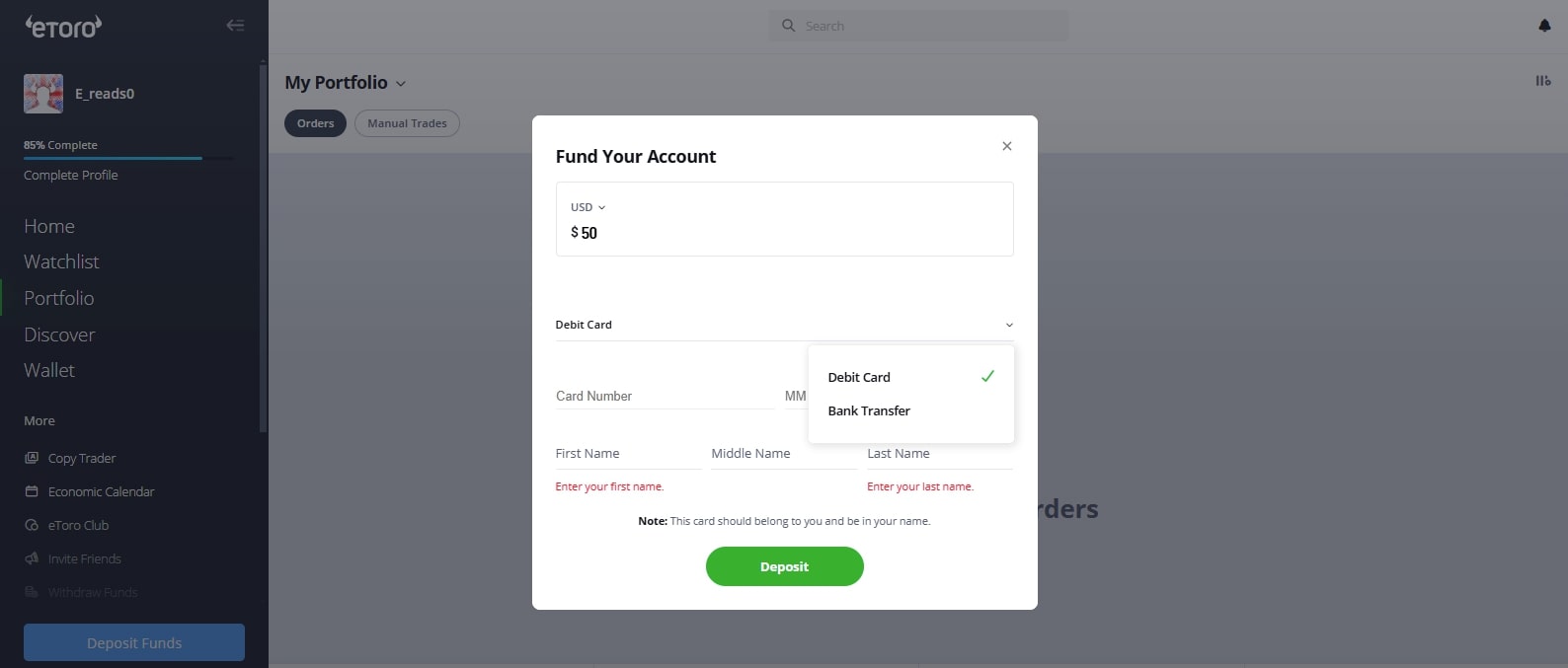

On your user dashboard, hit the “Deposit Funds” icon. This should bring up a tab that indicates the payment methods available to you. Click on your preferred payment option.

Step 3: Enter the deposit amount

Enter the amount you wish to deposit into your trading account while keeping in mind the minimum deposit limit of your preferred crypto exchange. For example, eToro has a minimum deposit limit of $10.

Step 4: Authorize the payment

You may be redirected to your bank or card provider website or the PayPal interface, where you will need to authorize the payment. Then, wait for it to reflect in your trading account, which is often instant if using card or eWallets payment options.

Popular Payment Methods and Their Pros/Cons

eToro accepts deposits from all the popular payment processors. These include credit cards, debit cards, bank transfers, ACH transfers, PayPal, Skrill, Neteller, Google Pay, and Apple Pay. Here is a table comparing some of their fees and payment processing speeds.

| Payment method | Processing Speed | Fees | Maximum single deposit limit | Best for: |

| Bank Transfer | Up to 72 hours | Free | Unlimited | Large deposits |

| Cards (debit and credit) | Instantly | Free | $10,000 | Fast transfers |

| eWallets (PayPal, Skrill, and Neteller) | Instantly | Free | $10,000 | Fast transfers |

Step 4: Place Your Buy Order for XRP

Once your deposit is reflected in your crypto trading account, you begin the process of buying XRP. Most exchanges have simplified this buying process. They have also introduced multiple ways of buying the top crypto, which range from buying Ripple instantly to spot trading Ripple with either cash or other digital assets.

In this section, we go over the quick and straightforward process of buying Ripple on eToro.

Step-by-Step Guide to Buying XRP

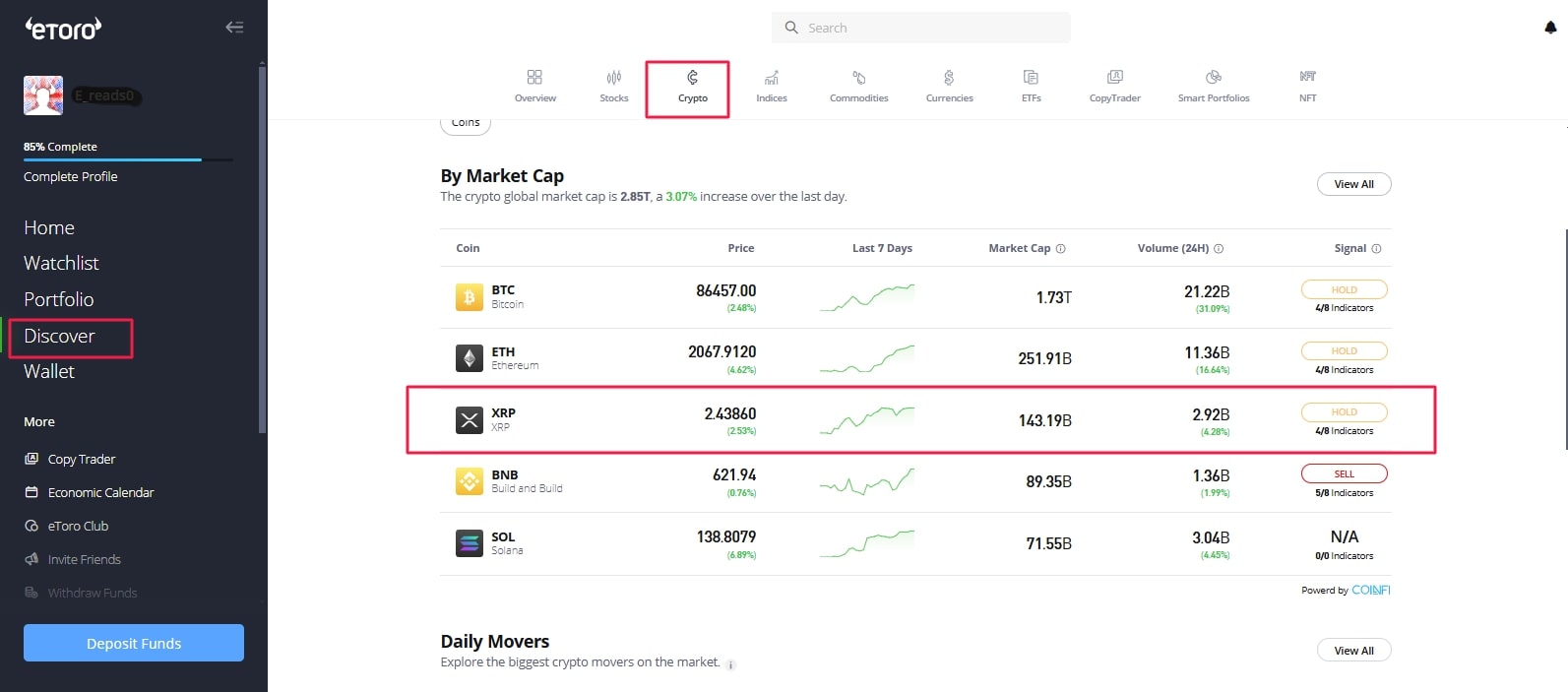

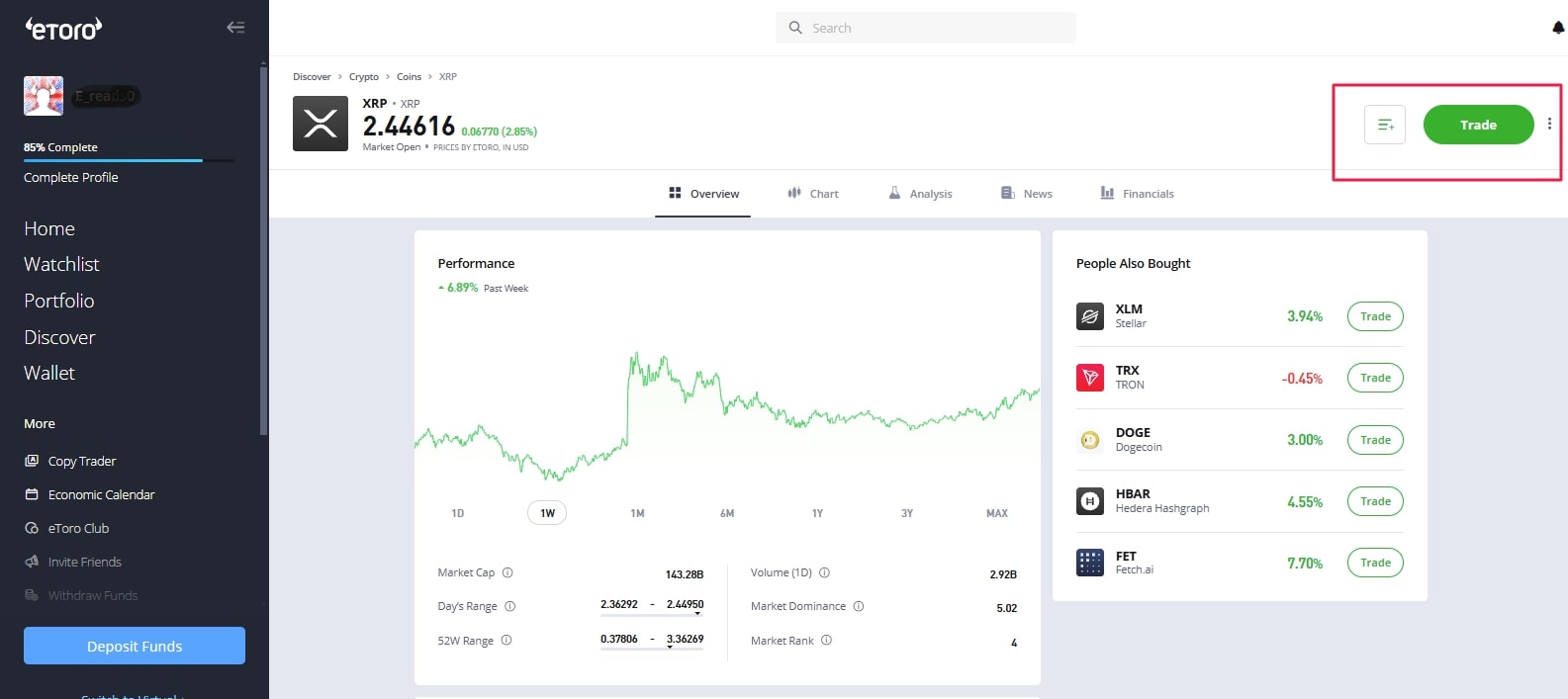

Step 1: Find Ripple on the eToro trading platform

Start by logging into your eToro trading account and hitting the “Discover” icon on your user dashboard. A window showing all the financial instruments supported on eToro will pop up, and you will need to choose ‘Cryptos.’ From the list of supported digital assets that pop up, click on Ripple.

Step 2: Choose the Buy Option

Click on the “BUY” option against Ripple.

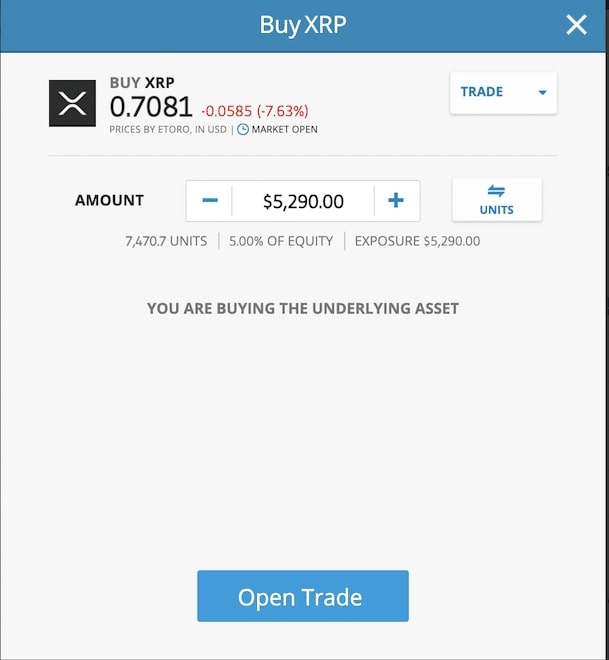

Step 3: Decide the order type you wish to place

Most exchanges will give you the option of a limit and market order. Limit order lets you decide the price at which you wish to buy the crypto, while market order lets you buy cryptos at the prevailing price in the market. eToro uses the market order.

Step 4: Decide the investment amount

After pressing the “BUY” option, a trading tab will pop up. Here, indicate how much cash you wish to invest in Ripple. It also lets you decide the number of XRP coins you wish to add to your portfolio.

Step 5: Buy XRP

Before executing this investment, review this XRP buy order. Check that the buy amount is correct. The top crypto brokerage will even let you see the trading fees acting on your trade. Once satisfied with the order, hit the “Open Trade” button to execute the investment.

Cost of Buying Ripple on eToro

Here are a few important things you need to keep in mind when assessing the cost of buying XRP on eToro. For starters, eToro has a minimum crypto buying limit of $10.

The cost per trade is then fixed at 1% of the trade volume. You, therefore, need to have enough in your account balance to cover the cost of XRPs and the trading fees.

Here is an example of what a $100 buy order for XRP on eToro would look like:

| Detail | Example Value |

| Amount to invest in Ripple | $100 |

| Current XRP Price | $2.30 |

| Trading fees (1%) | (1% of $100)=$1 |

| XRP Purchased | 43.48 XRP |

| Account balance required (investment amount +trading fee) | ($100+$1)=$101 |

Tips for Buying XRP Effectively

Here are a few factors you need to consider when buying XRP:

Consider DCA:

Dollar-cost averaging is a beginner-friendly investing strategy of buying a fixed amount of XRP at regular intervals. It helps you avoid bad market timing – buying XRP while it’s at peak value. For example, you may commit to buying $50 worth of XRP bi-weekly or weekly.

Beware of non-eToro transaction fees:

Note that while eToro doesn’t charge deposit fees, your payment processor may charge a processing fee. For example, some card providers will charge up to 4% of the deposit amount in transaction processing fees.

Start small:

Even when dollar cost averaging, you are encouraged to start with a small investment and grow it steadily as you gain a better understanding of the crypto markets. Above all, invest only what you can afford to lose.

Do your own research:

Before investing in Ripple or any other cryptocurrency, do your own research and confirm whether it aligns with your investing goals. Also, confirm that you can stomach its volatility.

Step 5: Store Your XRP Safely

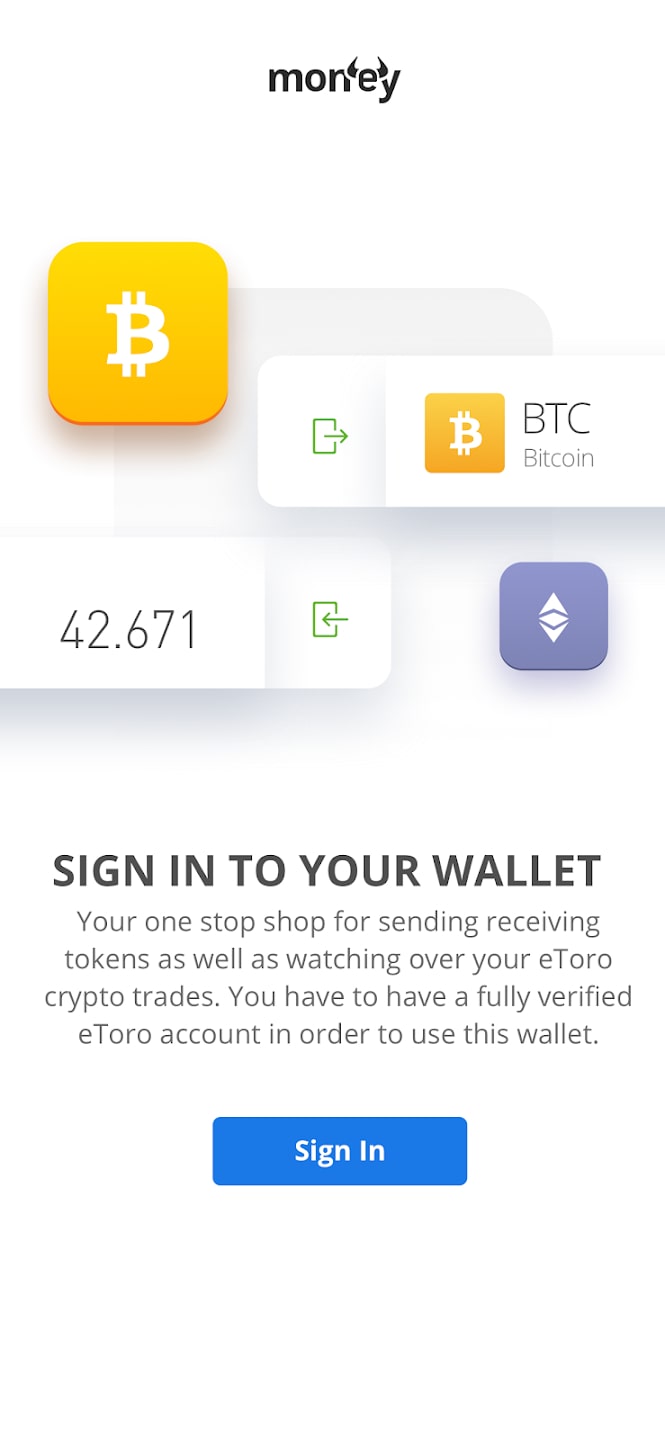

Most crypto trading platforms will provide you with a free digital wallet. eToro, for example, provides a custodial wallet that holds 90%+ of your cryptos in a secure offline wallet.

Secondly, eToro provides its platform users with a free mobile wallet app – eToro Money.

We, however, encourage our readers not to leave their crypto assets in an exchange or hot wallet. Instead, they should consider investing in a safe and reliable hardware wallet.

Why Storing XRP Off an Exchange Is Important

Here are three reasons why storing your digital assets off crypto exchanges and DeFi platforms is better:

Minimizes risk of hacks:

Exchanges and DeFi platforms aren’t immune to hacks. Though eToro has never been hacked some prominent exchanges and DeFi platforms have been hacked and Billions worth of digital assets lost. The most recent was the ByBit exchange breach that led to loss of $1.4 Billion worth of Ethereum.

Avoid panic-decision during volatile markets:

Holding your XRP coins off the exchange helps you avoid making often costly, panic-driven buy/sell decisions during periods of high volatility.

Gives you greater control:

Holding your XRP coins and other cryptos off the exchanges will also give you greater control over your digital assets.

Types of Wallets for Storing XRP

There are four primary types of crypto wallets: hardware wallets, software wallets, exchange-based wallets, and mobile wallets.

In the table below, we provide examples of these wallets and compare their core features:

| Wallet Type | Example | Security Level | Cost | Accessibility | Best for: |

| Hardware wallet | Ledger, Trezor, keepkey, and safepal | Very high | Up to $500 | Moderate | Long term storage |

| Software/Desktop wallets | Metamask, Electrum, Exodus, Armory | Medium | Free | High | Frequent transactions |

| Exchange-based | Coinbase wallet, Kraken Wallet, eToro Wallet, Binance wallet | Low | Free | Very High | Temporary storage/active trading |

| Mobile Wallet | eToro Money, Coinbase wallet app, Trust wallet, Phantom | Medium | Free | Very High | Daily use/active trading |

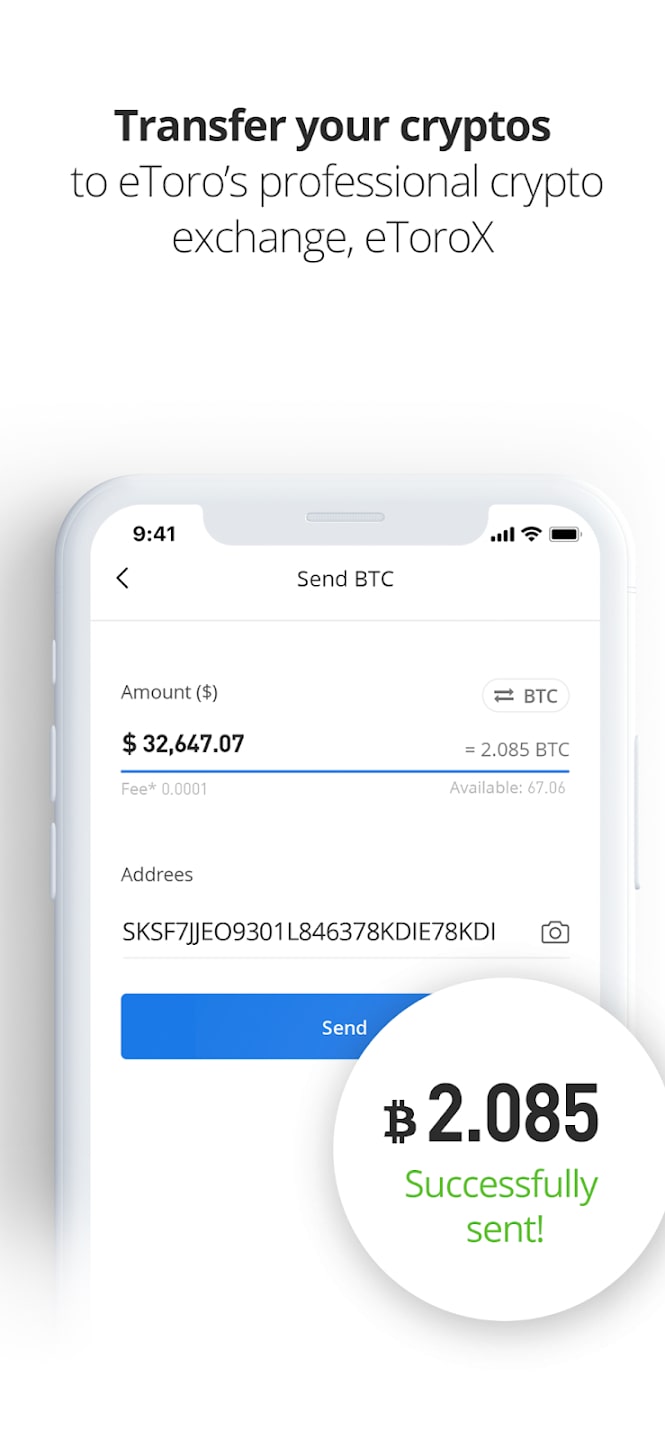

Step-by-Step Guide to Transferring XRP to a Wallet

Here is a step-by-step guide on how to transfer the XRP coins you purchased on eToro to a safe and secure hardware wallet. Note that you first need to download the eToro Money wallet as eToro doesn’t process crypto deposits or transfers to or from third-party wallets.

Step 1: Acquire a safe hardware wallet

Start by acquiring a shared and reliable hardware wallet. Before buying one, check user reviews to confirm that it is safe and reliable. Buy the wallet and activate it while remembering to write down its seed phrase and keep it safe. Once active, find the XRP-specific wallet address – which is a ping string of alphanumeric characters. Copy this address.

Step 2: Download and set up the eToro Money Wallet app

Download the eToro money wallet app from the App Store or Play Store and install it on your phone. To log in, use the credentials used to create an eToro trading account.

Step 3: Initiate the transfer on eToro account

On your eToro trading account, hit the transfer icon and choose to move the funds to the eToro Money wallet app. The process is straightforward. Note, however, eToro charges a crypto transfer fee of 0.5% (maximum $50).

Step 3: Initiate a transfer from the eToro Money wallet app

Once the crypto is reflected in your eToro Money wallet, hit the transfer icon on the wallet. A transfer tab will pop up asking for the receiving address. Paste the XRP address you had copied from the hardware wallet in Step 1 above. Customize the transfer by indicating how many XRP coins you wish to transfer to the hardware wallet.

Step 4: Receive the Funds in your hardware wallet

Wait for the digital currency to reflect in your trading account.

Where to Buy XRP in 2025?

Here are some of the best places to buy Ripple and some of the most undervalued cryptos.

eToro – The Most Beginner Friendly Crypto Friendly Trading Platform

Pros

- Supports Copy trading and social trading

- Features a highly intuitive trading interface

- Is home to tens of the most popular cryptos, including XRP, BTC, and ETH

- You only need $10 to start buying Ripple on eToro

Cons

- eToro charges comparatively higher trading fees than rivals

- Doesn’t support crypto deposits

- No crypto derivative trading

Coinbase – The Best Place to Buy XRP and Top Cryptos With $2

Pros

- Buy XRP instantly with PayPal or account balance on Coinbase

- Engage with 100+ of the most promising cryptos on Coinbase

- Pro traders can access more tools and features on Coinbase PRO

- Buy cryptos on the Coinbase web trader or mobile app

Cons

- Charges higher trading fees

- Accused of restricting and closing users account arbitrarily

- Coinbase wallet app have been hacked in the past

What is XRP?

XRP is a digital asset created by Ripple Labs in 2012 to streamline cross-border payments. It acts as a bridge currency, enabling fast, low-cost transactions between different fiat currencies.

Built on the XRP Ledger, it settles payments in 3–5 seconds with fees costing a fraction of a penny, making it ideal for global money transfers.

Unlike Bitcoin, XRP doesn’t rely on energy-intensive mining, as all 100 billion tokens were pre-mined. It processes over 1,500 transactions per second, far exceeding Bitcoin’s capacity, and is highly scalable.

With its speed, low cost, and eco-friendly design, XRP is a practical solution for modernizing global payments.

How XRP Transactions Work

XRP transactions operate on the XRP Ledger, using the Ripple Consensus Protocol Algorithm (RCPA) instead of traditional mining.

Validator nodes independently confirm transactions, requiring an 80% consensus rate to ensure security and prevent fraud.

This system allows transactions to settle in 3–5 seconds with minimal fees (a fraction of a penny), making XRP ideal for fast, low-cost cross-border payments.

By eliminating intermediaries and avoiding energy-intensive mining, XRP offers a secure, efficient, and eco-friendly solution for global transactions.

How to Use XRP

Here are a few ways through which you can use XRP:

Cross-border payments:

Send money internationally quickly and affordably, as XRP settles transactions in 3–5 seconds with minimal fees.

Pay for goods and services:

Use XRP to pay for goods and services at merchants or platforms that accept it as payment.

Hodling:

Hold XRP as a long-term investment and grow your portfolio several-fold when XRP rebounds and rallies to all-time highs.

Trading:

You can buy, sell, or trade XRP on cryptocurrency exchanges like Coinbase, Binance, or Kraken to capitalize on price movements.

Ripple vs. XRP: What’s the Difference?

Well, XRP is the cryptocurrency used for fast, low-cost transactions on the XRP Ledger. On the other hand, Ripple is the company (Ripple Labs) that developed the technology and promotes the use of XRP for cross-border payments and financial solutions. While XRP is a digital asset, Ripple focuses on creating tools and partnerships to integrate XRP into global financial systems.

How XRP Compares to Other Blockchains

The table below compares how the Ripple Ledger (XRPL) fairs in comparison to the two most popular blockchain networks – Bitcoin and Ethereum:

| Feature | XRP Ledger | Bitcoin | Ethereum |

| Consensus protocol | RCPA (No Mining) | Proof-of-work (mining) | Proof-of-stake (staking) |

| Transaction fees | <$0.1 | High | Medium |

| Energy use | Low | Very high | Medium |

| Transaction speeds | Up to 5 secs | 10+ mins | ~12 secs |

| Scalability | 1500 TPS | 7 TPS | ~30 TPS |

Pros and Cons of XRP

Here are some of the pros and cons of using XRP

Pros

Fast transaction processing speeds:

XRP settles transactions in 3–5 seconds, far faster than Bitcoin or Ethereum.

Low transaction fees:

XRP maintains some of the lowest transaction fees and is more affordable than Bitcoin and Ethereum, making it the better option for micropayments.

Real-world use case:

Unlike most of the competitor cryptos that are designed for speculative purposes, XRP is designed for financial institutions, enabling seamless global money transfers.

Stability:

Ripple focuses on the utility of the coin rather than speculation, which will ultimately make it a more stable digital asset.

Scalability:

The ripple blockchain can process 1500+ transactions per second, making it more scalable than most competitor blockchains.

Cons

Regulatory uncertainty:

The ongoing legal battles between Ripple and the SREC have cast a large shadow of doubt on XRP’s future as the regulatory authority claims it is an unregistered security.

Centralization concerns:

Critics argue that Ripple Labs holds a significant portion of XRP, raising questions about decentralization.

Market volatility:

Like all other cryptocurrencies, XRP coins aren’t immune to volatility, and their prices crash regularly.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.