KEY TAKEAWAYS

- XRP is legal to buy and sell in the U.S. on many platforms, following court decisions that clarified its status in public market trading.

- eToro offers one of the simplest ways for beginners to buy XRP, while exchanges like Kraken and Bitstamp suit users who want lower fees and more control.

- Liquidity for XRP is strong, with millions of dollars in daily U.S.-accessible trading volume, which helps reduce slippage for most retail trades.

- Secure storage matters, as XRP transfers require both a wallet address and a destination tag.

XRP is widely available again on major platforms after U.S. legal clarity, with strong liquidity, fast settlement, and multiple regulated buying options.

XRP is currently trading around 2.09 and remains one of the most actively traded digital assets globally, with daily trading volumes often exceeding $1 billion across major exchanges.

It sits consistently among the top cryptocurrencies by market value and is built on the XRP Ledger, a network designed for fast, low-cost transactions that typically settle in 3–5 seconds.

For U.S. buyers, access to XRP improved significantly after court rulings clarified how the asset should be treated in secondary market trading, leading to renewed exchange support and deeper liquidity.

This guide will take you through how to buy XPR in the USA.

RELATED: How to Buy XRP in Canada: Fast, Safe & Simple Steps

Where To Buy XRP In The USA – Best Exchanges For XRP

eToro

eToro is a multi-asset trading platform known for its simple interface and social trading features.

It allows U.S. users in supported states to buy XRP with a clear, beginner-friendly process and relatively small minimum purchase sizes.

The platform combines account setup, funding, and trading into a single dashboard that works well on both desktop and mobile.

This makes it attractive to first-time crypto buyers who want to place a straightforward XRP trade without learning complex order books.

The trade-off is cost and flexibility.

eToro uses spreads rather than a classic maker-taker fee model, which can be higher than fees on advanced exchanges.

Order types are also more limited, which may not suit active traders.

Pros

- Simple interface,

- Low learning curve

- Small minimum buys

Cons

- Higher spreads

- Fewer advanced trading tools

Kraken

Kraken is one of the longest-running crypto exchanges in the U.S. and offers spot XRP trading with strong liquidity.

It supports bank transfers and provides detailed market data for users who want more control over their trades.

Kraken stands out for its transparent fee structure and wide range of order types, including limit and stop orders.

Trading fees often fall below 0.4% for retail users and decrease with higher volume, which can make a meaningful difference over time.

The platform can feel complex for beginners.

Account verification and funding may take longer than on app-focused platforms, especially for users seeking higher limits.

Pros

- Competitive fees

- Advanced order types

- Strong security record

Cons

- Steeper learning curve

- Less beginner-focused design

Coinbase (Regulated XRP Products)

Coinbase provides access to XRP-related products through regulated markets, including futures offered via its derivatives platform.

These products track XRP’s price but do not involve direct ownership of the token.

This structure appeals to users who want regulated exposure and are familiar with derivatives trading.

Coinbase’s compliance standards and reporting tools are also a key advantage.

Pros

- Regulated products

- Strong compliance standards

Cons

- No direct XRP ownership

- Higher complexity

Uphold

Uphold combines exchange features with a custodial wallet, allowing users to buy, hold, and transfer XRP within the same platform.

It supports multiple funding options, including cards and bank transfers where available.

The platform works well for users who want convenience and a unified account for multiple assets.

XRP purchases can be completed quickly, often within minutes when using instant payment methods.

Pros

- Fast purchases

- Integrated wallet

- Simple setup

Cons

- Variable spreads

- Limited advanced trading tools

Binance (Global Platform)

Binance offers deep XRP liquidity and low trading fees on its global platform, with multiple XRP trading pairs available.

Fee rates often start around 0.1%, which appeals to frequent traders.

Access for U.S. users depends on state rules and the specific Binance service available to them.

Not all features or trading pairs are accessible from the U.S., and availability can change.

Pros

- Low fees

- High liquidity

- Many trading pairs

Cons

- U.S. access varies by state

- Regulatory limits on features

Bitstamp

Bitstamp is a long-established exchange with a focus on spot trading and regulatory compliance.

It provides XRP trading with a straightforward fee schedule and reliable execution.

The platform prioritizes stability and clarity over feature depth.

This suits users who want a simple spot exchange without complex extras, though liquidity is lower than on the largest venues.

Pros

- Strong reputation

- clear fee structure

Cons

- Fewer features

- Lower liquidity than top-tier exchanges

RECOMMENDED: Banks Bet On XRP Again – Which Institutions Are Quietly Accumulating?

How To Buy XRP In The USA On eToro

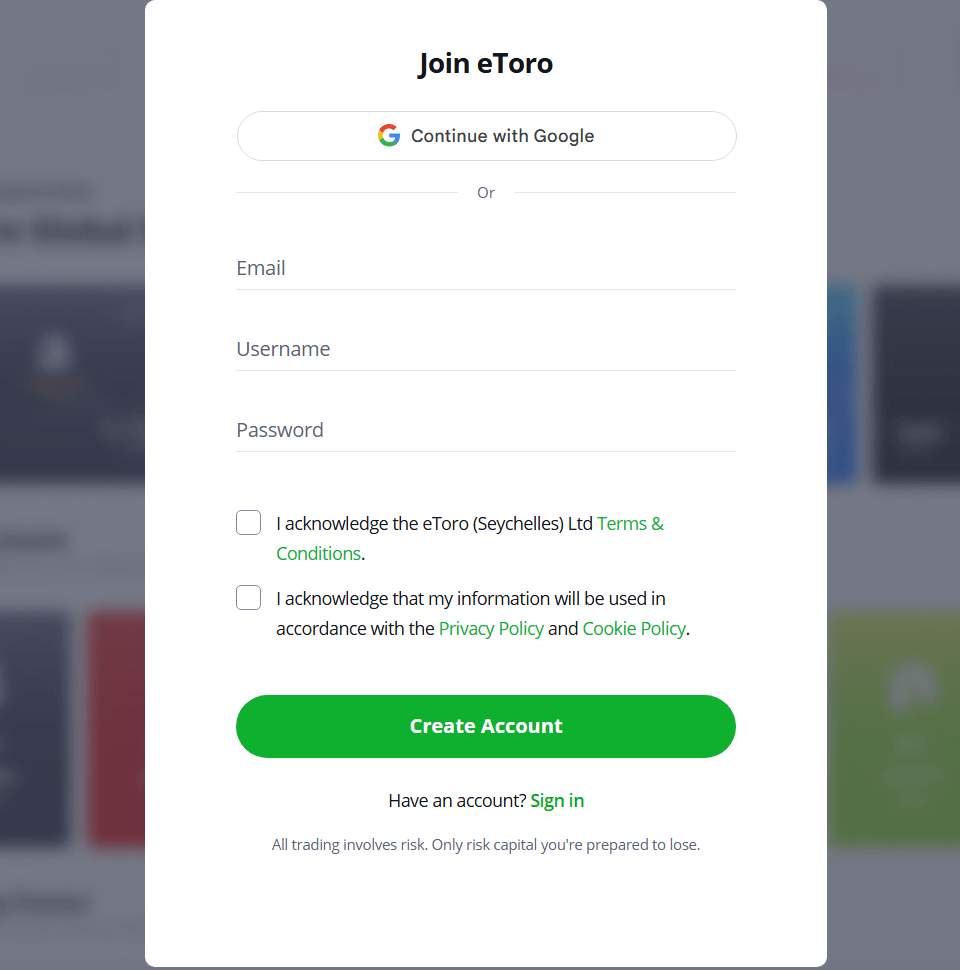

1. Create Your Account

Go to eToro and sign up with your email or social login.

Choose a strong password and enable two-factor authentication (2FA) immediately.

Keep your login details private and save your recovery codes in a secure place.

2. Verify Your Identity (KYC)

Complete identity checks by uploading government ID and proof of address.

Typical documents include a driver’s license or passport and a recent utility bill or bank statement.

Verification may take minutes to a few days depending on demand and the accuracy of your documents.

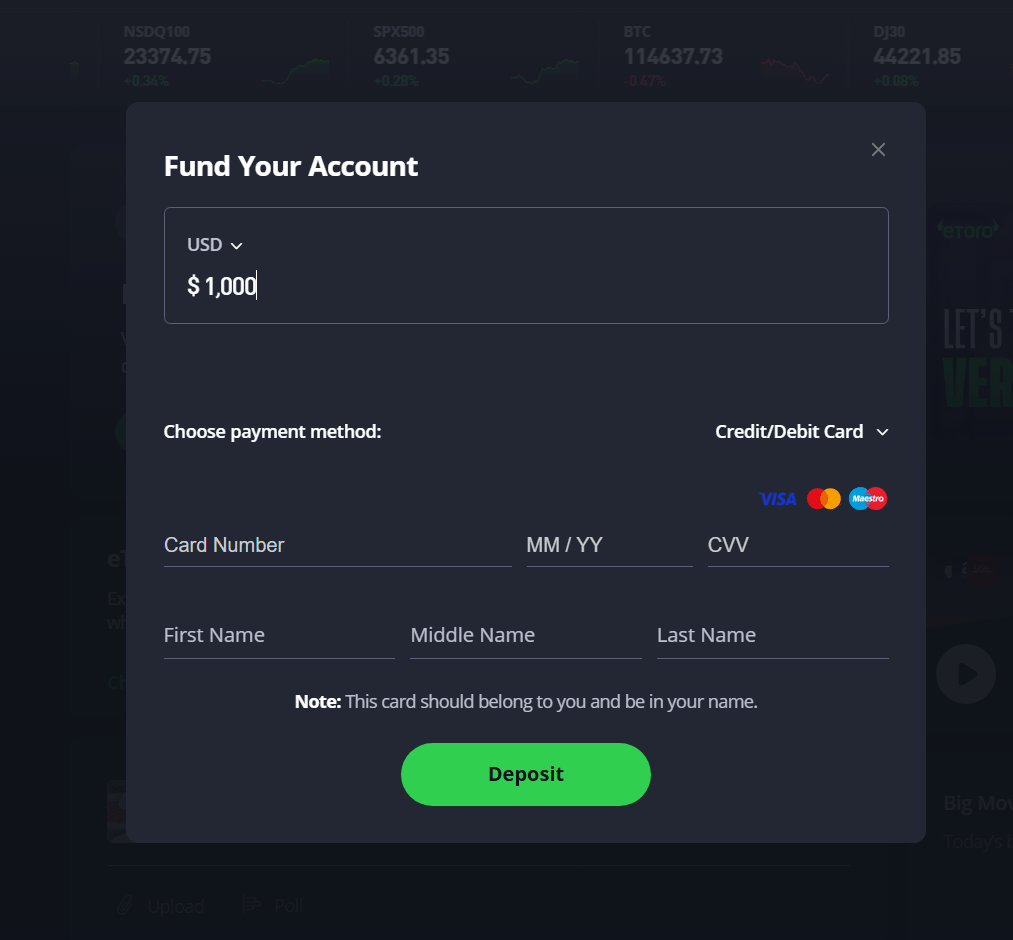

3. Fund Your Account

Link a U.S. bank account, use a debit card, or pick another supported funding method.

Bank transfers (ACH) usually cost less but take longer.

Debit or credit card payments post faster but may incur higher fees.

Enter a small initial deposit to test the flow before moving larger amounts.

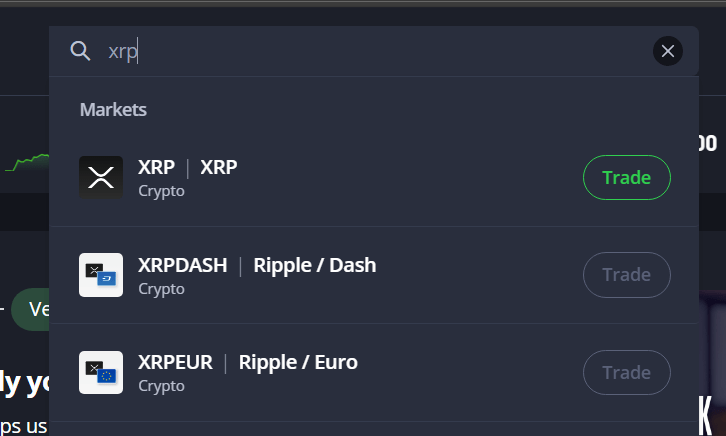

4. Find XRP

Use the search box and type “XRP.” Open the token’s page to view current price, recent volume, and available order options.

eToro shows an order preview with the total cost, including the spread.

5. Place Your Order

Choose Market to buy immediately at the displayed price or Limit to set a target price.

Enter the USD amount you want to spend rather than the XRP amount if you prefer simplicity.

Review the estimated fees shown in the order preview, then confirm the trade.

6. Decide Where To Keep Your XRP

You can hold XRP in eToro’s custodial wallet or withdraw to an external wallet.

For short-term trades, keeping tokens on the platform is acceptable.

For long-term holding, withdraw to a private wallet you control.

7. Withdrawal Checklist

To withdraw, copy the receiving wallet address and include the destination tag exactly as provided.

Send a small test withdrawal first to confirm the address and destination tag match.

Verify the blockchain transaction ID after transfer and keep records of receipts and transaction hashes.

RECOMMENDED: An In‑Depth Review of Buying XRP on eToro

XRP Payment Methods and Fees in the US: What to Expect

US exchanges support several ways to fund an XRP purchase, each with different costs and timelines.

- Bank transfers via ACH – Usually the cheapest option. Most platforms charge $0 in deposit fees, but funds typically settle in 1 to 4 business days.

- Debit and credit cards – Much faster, often crediting your account instantly, but convenience comes at a price. Card fees commonly range from 2% to 4% per transaction.

- Wire transfers – Best for large purchases, with higher bank fees, often $15 to $30, and longer processing times.

Some exchanges also accept stablecoin deposits like USDT or USDC.

This avoids traditional banking delays but requires prior crypto experience and on-chain transfer fees.

Exchange costs fall into three categories.

- Funding fees cover deposits.

- Trading fees include spreads or maker and taker fees, usually between 0.1% and 0.6% per trade. Platforms like eToro bundle costs into the spread, while others charge separate fees for market and limit orders.

- Withdrawal fees vary by network conditions. Before committing, review the fee schedule and place a small test trade to see the true, all-in cost.

RECOMMENDED: Top 10 Richest XRP Whales: Who Owns the Most XRP in 2025?

Where To Store XRP: Best Wallets For XRP

Choosing where to store XRP comes down to custody versus control.

Custodial wallets are easier to use but rely on a third party.

Self-custody wallets give you full ownership, but also full responsibility.

Custodial Wallets (Exchanges)

What they are: XRP held on centralized platforms like exchanges, where the company controls the private keys.

Pros

- Fast access for trading and conversions

- No private key or backup management

- Often insured against limited losses

Cons

- Counterparty risk if the exchange is hacked or offline

- Withdrawals can be paused during outages or compliance reviews

- You do not fully control your XRP

Software Wallets (Self-Custody)

What they are: Mobile or desktop wallets where you control the private keys, connected to the internet.

Pros

- Full control of XRP and withdrawal paths

- Convenient for everyday payments and transfers

- Most support XRPL features like destination tags

Cons

- Exposed to malware or phishing if the device is compromised

- Requires secure backups of recovery phrases

- User error can lead to permanent loss

Hardware Wallets (Cold Storage)

What they are: Physical devices that store private keys offline and require manual confirmation.

Pros

- Highest security for long-term holding

- Private keys never touch the internet

- Strong protection against remote attacks

Cons

- Upfront cost, usually $70–$150

- Less convenient for frequent transactions

- Requires safe storage of the recovery phrase

Best Wallets for XRP

- Ledger Nano X: Industry-leading hardware wallet with full XRPL support

- XUMM: Popular XRP-native mobile wallet built specifically for XRPL

- Trust Wallet: Easy-to-use mobile wallet with XRP support

- Exchanges (eToro, Binance, Kraken): Suitable for active traders, not long-term storage

For safety, always test withdrawals with a small amount and confirm destination tags match exactly.

Tips For Buying XRP In The U.S.

- Start small and scale up: test the whole flow – sign-up, deposit, buy, withdraw – before committing larger sums.

- Use limit orders for bigger buys to avoid paying wide spreads on market orders.

- Split large purchases into several smaller buys (dollar-cost averaging) to reduce timing risk.

- Always double-check the destination tag and receiving address before withdrawing. A single wrong digit can cause a lost transfer.

- Enable 2FA and use a unique password for each exchange account.

- Keep a secure offline backup of any recovery phrases and never share them.

- Review the exchange’s fee page and do a test buy to confirm the effective all-in cost.

- Confirm that the exchange supports XRP spot withdrawals in your U.S. state before funding your account.

RECOMMENDED: Could Central Banks Quietly Be Testing XRP For Settlement?

Pros And Cons Of XRP

Pros

- Fast settlement times, typically 3–5 seconds per transaction on the XRP Ledger

- Low transaction costs, often fractions of a cent per transfer

- Strong liquidity, with daily global trading volume frequently above $1 billion

- Designed for cross-border payments, a real-world use case adopted by banks and payment firms

- Energy-efficient consensus model compared with proof-of-work networks

Cons

- Centralization concerns, as a large share of XRP supply remains associated with Ripple-controlled escrow

- Regulatory history that still affects exchange availability in some U.S. states

- Limited smart contract functionality compared with newer blockchain platforms

RECOMMENDED: 5 Reasons to Buy XRP

FAQs

Can I legally buy XRP in the U.S.?

Yes. You can buy and sell XRP on U.S.-accessible platforms where spot trading is supported.

Availability depends on the exchange and your state.

Do I own XRP when I buy it on eToro?

When you buy XRP on eToro, you gain exposure to the asset and can withdraw it to a private wallet where supported.

Holding it on the platform means eToro provides custody.

What is a destination tag and why does XRP need one?

A destination tag identifies the recipient account within a shared wallet.

Many exchanges use a single address for all users, so the tag ensures funds reach the correct account.

How long does an XRP transfer take?

Most XRP transfers settle in seconds, though exchanges may delay withdrawals for internal security checks.

What is the minimum amount of XRP I can buy?

Minimum purchase sizes vary by platform. eToro allows relatively small USD-based buys, which suits beginners.

Is XRP suitable for long-term holding?

XRP’s speed, low fees, and established use case appeal to long-term holders, but price volatility and supply structure remain key considerations.

Conclusion

XRP is accessible again to U.S. buyers through several compliant platforms, with eToro offering one of the simplest entry points.

Strong liquidity, fast settlement, and low transaction costs makes it one of the best crypto to buy now.

Choosing the right exchange, understanding fees, and securing your storage setup remain the most important steps for buying and holding XRP with confidence.