KEY TAKEAWAYS

- Australians can buy XRP on AUSTRAC-registered local exchanges and global platforms.

- Fees differ widely between instant buys, broker spreads, and order-book trading.

- eToro favors simplicity but charges a transfer fee to move crypto off-platform.

- Local exchanges offer fast AUD deposits and clear compliance.

- Order-book platforms suit users who want lower fees and more control.

XRP remains one of the most liquid cryptocurrencies available to Australian buyers.

Access depends on exchange fees, AUD support, and custody options.

XRP is widely available to Australian investors through both local and global exchanges that support AUD deposits.

Liquidity remains deep across major platforms, which reduces slippage and allows users to buy or sell without large price gaps.

In Australia, exchanges that handle fiat must register with AUSTRAC and apply identity checks, transaction monitoring, and reporting rules.

This framework shapes how Australians access XRP, which payment methods they can use, and how quickly funds move.

Fees vary more than most first-time buyers expect.

Broker-style platforms charge spreads and withdrawal or transfer fees, while order-book exchanges use maker and taker fees that reward limit orders and higher volume.

In this guide, we take you through how to buy XRP in Australia, the best exchanges to use, wallet types, regulations and general tips to help you stay safe.

RECOMMENDED: 5 Reasons to Buy XRP

Where To Buy XRP In Australia – Best Exchanges For XRP

In Australia, you can buy XRP through broker-style platforms and traditional exchanges.

Brokers focus on ease of use, while exchanges prioritize lower fees and deeper trading tools.

Below are the best exchanges to buy XRP in Australia:

1. eToro: Beginner-Friendly Broker With Integrated Wallet

eToro combines crypto trading with a broader investing platform that also supports shares and ETFs.

Australians can buy XRP using AUD and manage holdings through eToro’s ecosystem, including its branded crypto wallet.

The platform favors simplicity over fine-grained trading controls.

Best For

- Beginners who want a simple interface and multi-asset access.

Fees

- Spread-based pricing on crypto buys

- 2% fee to transfer crypto from platform to eToro Money wallet

- Blockchain network fees apply on withdrawals

Pros

- Very easy to use

- Supports AUD deposits

- Integrated wallet option

Cons

- Higher overall costs than order-book exchanges

- Transfer fee to move XRP off-platform

>>>>BUY XRP WITH eToro Now<<<<

RECOMMENDED: eToro Review 2025: Is It Safe, Legit & Worth It?

2. Swyftx – Low-Spread Australian Exchange

Swyftx is an Australian exchange built around AUD trading pairs and clear pricing.

It offers XRP through live order books and supports fast local bank transfers.

The platform balances ease of use with relatively low trading costs, making it popular with retail users.

Best For

- Australian users who want low spreads and fast AUD on-ramps.

Fees

- Tiered trading fees that decrease with volume

- Spreads displayed before trade confirmation

Pros

- Competitive fees for regular traders

- Local support and AUD funding

- Simple interface with order-book access

Cons

- Custodial storage by default

- Instant buys cost more than limit orders

3. CoinSpot – Trusted Local Exchange With Instant Buys

CoinSpot is one of Australia’s longest-running crypto exchanges. It offers instant XRP purchases, multiple payment methods, and a beginner-focused dashboard. Users can also place market and limit orders to reduce fees compared with instant buy options.

Best For

- First-time buyers who value speed and local support.

Fees

- Low fees on market and limit orders

- Higher fees on instant buys and swaps

Pros

- Very easy onboarding

- Wide range of AUD payment methods

- Strong local reputation

Cons

- Instant-buy fees are higher

- Custodial wallet unless withdrawn

4. Independent Reserve – Regulated Exchange For Traders

Independent Reserve is an Australian exchange with a strong compliance focus and transparent pricing.

It supports XRP trading via AUD order books and uses tiered fees that reward higher volumes.

The platform suits users who want predictable costs and advanced trading features.

Best For

- Active traders and higher-volume buyers.

Fees

- Tiered maker and taker fees

- Lower fees for higher monthly volume

Pros

- Clear fee structure

- Strong regulatory standing

- Suitable for large trades

Cons

- Less beginner-friendly interface

- Fewer instant-buy options

5. Kraken – International Exchange With Advanced Tools

Kraken is a global exchange available to Australians that offers deep liquidity and advanced trading tools.

You can access XRP through both instant purchases and professional trading interfaces.

The platform emphasizes security and transparency but assumes some trading experience.

Best For

- Experienced users who want advanced order types.

Fees

- Fixed fees for instant buys

- Lower maker and taker fees on spot trading

Pros

- Advanced trading features

- Strong security practices

- Competitive fees on pro interface

Cons

- Steeper learning curve

- Product availability can vary by region

>>>>BUY XRP WITH Kraken Now<<<<

RECOMMENDED: 10 Best Crypto Exchanges in 2026

How To Buy XRP In Australia On eToro

eToro gives you a simple way to buy XRP in Australia without needing advanced trading skills.

If you plan to move XRP off eToro, remember that the platform charges a transfer fee in addition to the XRP Ledger network fee, so review the live fee schedule before withdrawing.

Follow these steps to buy XRP on eToro

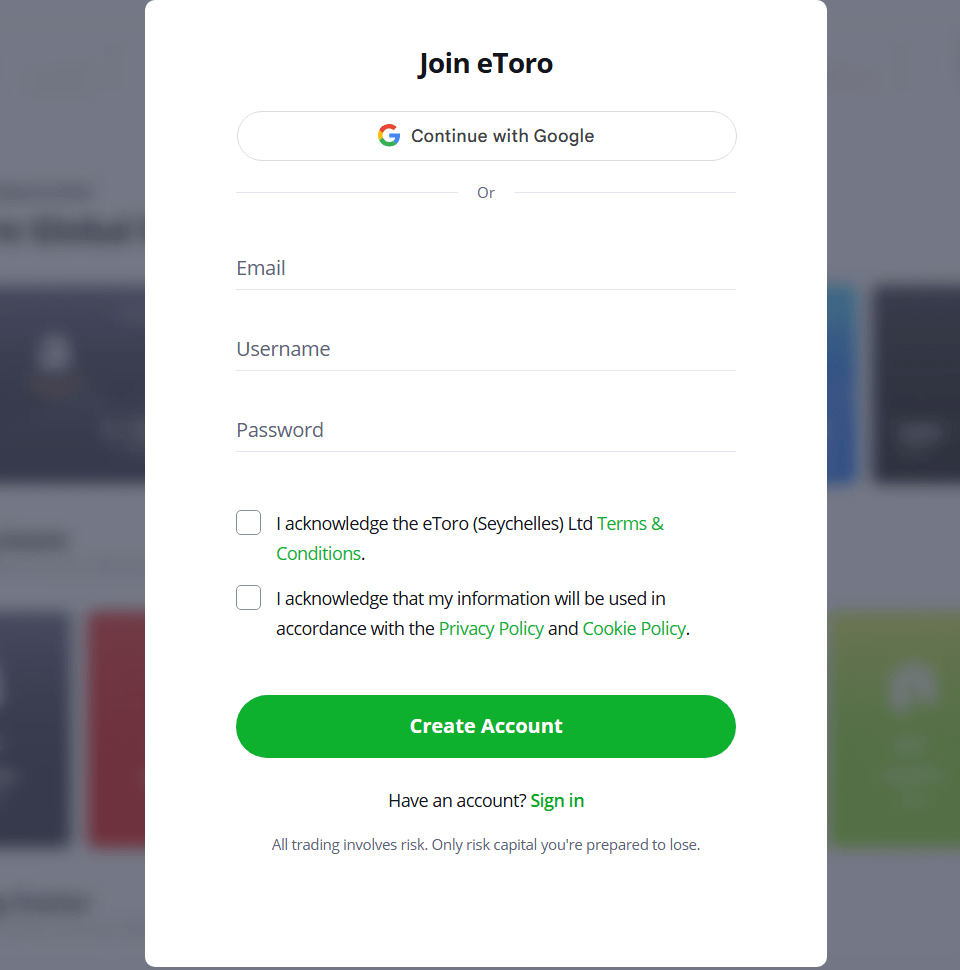

Step 1: Create And Verify Your eToro Account

Start by opening an eToro account using your email address.

To unlock AUD deposits and crypto trading, complete identity verification.

Upload a government-issued photo ID, such as a passport or driver’s licence, and provide a recent proof of address.

Once verification is approved, eToro enables local payment methods and shows any minimum deposit requirements for Australian users.

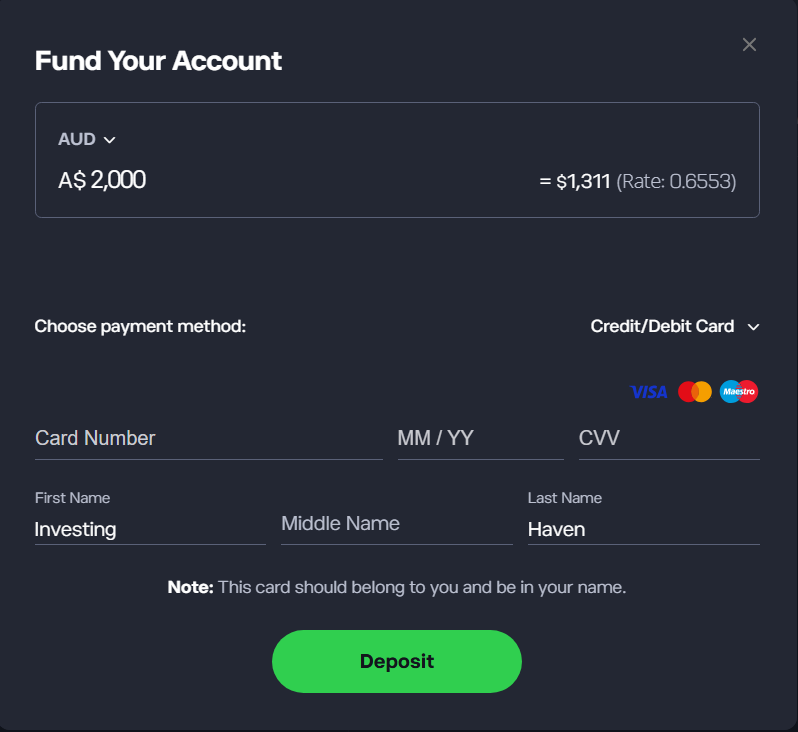

Step 2: Deposit AUD Using Your Preferred Payment Method

After verification, fund your account with AUD.

eToro supports bank transfer options such as PayID or BPay, as well as debit or credit cards and selected instant methods where available.

Bank transfers usually cost less and suit planned purchases.

Card and instant methods credit funds immediately but often come with higher fees.

Choose the option that fits your timing and cost preferences.

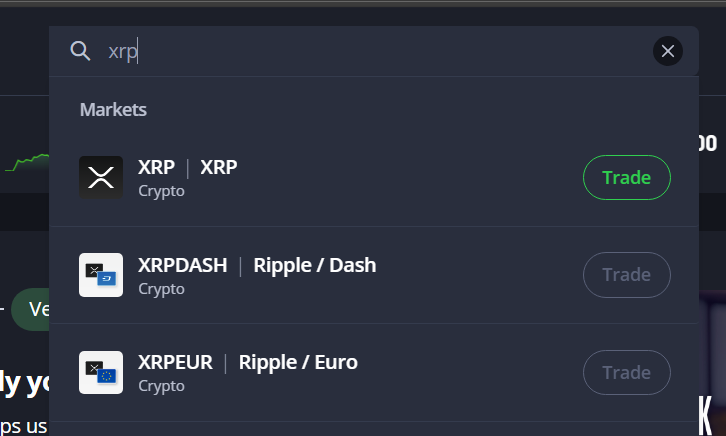

Step 3: Find XRP And Choose Your Order Type

Search for “XRP” on the eToro platform to open the asset page.

You can buy XRP using a market order for immediate execution or a limit order if you want to buy at a specific price level.

Enter the amount in AUD you want to spend or the amount of XRP you want to receive.

Before confirming, review the displayed spread so you understand the cost of the trade.

Step 4: Confirm Your Purchase And Review Fees

Confirm the order once you are satisfied with the details. eToro then shows your XRP position along with a breakdown of fees.

For short-term exposure or small holdings, keeping XRP on the platform may be sufficient.

Always review trade confirmations to ensure the order executed as expected.

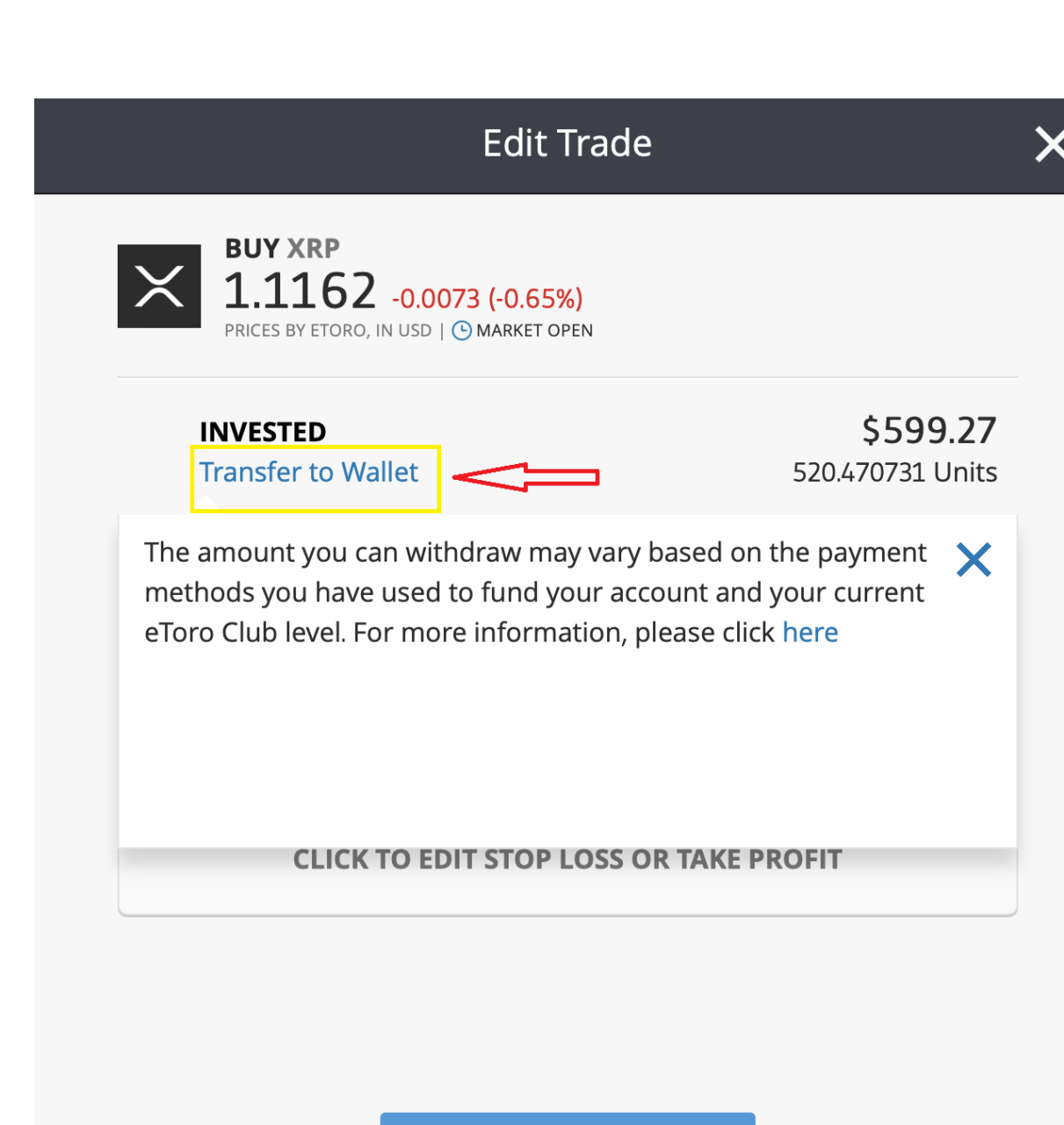

Step 5: Store XRP On eToro Or Transfer To A Private Wallet

For long-term holding or full control, transfer XRP to a private wallet. eToro allows transfers to its eToro Money wallet or to external XRPL-compatible wallets.

Double-check the wallet address and include a destination tag if required.

Transfers incur a platform fee plus the XRPL network fee, so factor this into your decision.

Step 6: Keep Records For Tax And Reporting

Save records of deposits, trades, and withdrawals.

In Australia, many crypto transactions can trigger capital gains obligations.

So, export transaction histories regularly and consult a tax professional if your situation requires tailored advice.

RECOMMENDED: An In‑Depth Review of Buying XRP on eToro

Where To Store XRP: Best Wallets For XRP In Australia

Wallets differ by custody model and security trade-offs.

Choose a wallet based on whether you prioritise ease of use, control of private keys, or maximum security for long-term holdings.

Custodial Exchange Wallets

Custodial wallets are provided by crypto exchanges.

The exchange holds your private keys for you, which makes buying, selling, and moving AUD very easy.

This setup suits people who trade often or want the simplest experience.

The trade-off is control. Because the exchange holds your keys, you rely on its security systems and financial stability.

Pros

- Fast AUD deposits and withdrawals.

- Simple user experience for beginners.

- Integrated trading and instant buys.

Cons

- You don’t control the private keys.

- Platform outages or insolvency can block access.

- Not ideal for long-term cold storage.

Custodial Exchange Wallet Options

- CoinSpot Custodial Wallet

- Swyftx Custodial Wallet

- Independent Reserve Custodial Wallet

Mobile / Software (Non-Custodial) Wallets

Non-custodial wallets run on your phone or computer and store private keys on your device.

You control your XRP directly and sign transactions yourself.

This gives you more freedom but also more responsibility.

These wallets are good for users who want control and plan to move XRP regularly.

Pros

- You control private keys and recovery seed.

- Easy access to XRPL features and apps.

- Free to use and convenient for regular transfers.

Cons

- Device theft, loss, or malware can expose keys.

- You must back up seed phrases securely.

Non-Custodial Exchange Wallet Options

- Xaman (formerly XUMM)

- Other XRPL-native non-custodial wallets verified from official sources

Hardware (Cold) Wallets

Hardware wallets store private keys offline on a physical device. Transactions are signed on the device, keeping keys away from the internet. This makes them one of the safest options for holding XRP.

They are best for Australians holding larger amounts or planning to store XRP long term.

Pros

- Strong protection against online theft.

- Ideal for long-term holdings.

- Compatible with XRPL via companion apps.

Cons

- Upfront cost to buy the device.

- Slightly slower for frequent transfers.

Hardware (Cold) Wallet Options

- Ledger Nano family

- Trezor models that explicitly support XRP

Paper / Seed-Only Backups

Paper wallets store your recovery phrase offline on paper or metal.

They remove online risk entirely but require careful handling.

Pros

- Air-gapped, no digital footprint.

- Low technical complexity to create.

Cons

- Vulnerable to fire, theft, or loss.

- Harder to use for regular transactions.

Recommended Approach

- Store multiple encrypted copies in separate secure locations; consider metal seed storage for fire resistance.

ALSO READ: How to Buy XRP in the UK: Cheapest & Fastest Methods (2026)

Crypto Regulation in Australia

Crypto in Australia operates under a clear but evolving regulatory framework.

These rules affect where you can buy XRP, how fast you can move AUD, and what records you need to keep.

AUSTRAC and Exchange Registration

Any business in Australia that offers fiat-to-crypto services must register with AUSTRAC as a Digital Currency Exchange (DCE).

Registered exchanges are required to verify customer identities (KYC), monitor transactions, and report suspicious activity.

This means you will be asked for ID before you can deposit or withdraw AUD.

ASIC and Crypto Platform Rules

ASIC oversees how crypto products fit within Australia’s existing financial laws.

While crypto itself is not banned or restricted, ASIC has been refining guidance on when a digital asset or service may be treated like a financial product.

Crypto Tax Rules and Record-Keeping

The Australian Taxation Office (ATO) treats most crypto disposals as capital gains events.

This includes selling XRP for AUD, swapping it for another crypto, or using it to pay for goods or services.

You are expected to keep detailed records of:

- Purchase and sale dates

- AUD values at the time of each transaction

- Transfers between wallets

- Any crypto income, such as staking or rewards

RELATED: 5 Major Companies Quietly Acquiring XRP

Tips for Buying XRP in Australia

Choose the Right Deposit Method

Bank transfers and PayID usually offer the lowest deposit costs and suit buyers who can wait for funds to clear.

Card payments and instant methods credit funds immediately, but they often come with higher fees or wider spreads.

If timing is not critical, slower methods can save money.

Compare Total Trading Costs

Do not focus only on advertised trading fees. Factor in spreads, withdrawal fees, and any platform transfer charges.

An exchange that looks cheap for a single trade may be more expensive once you include the cost of moving XRP off the platform.

Start Small With Your First Transfer

When withdrawing XRP to a new wallet or exchange, send a small test amount first.

This simple step helps confirm the address is correct and reduces the risk of losing funds through an error.

Check Destination Tags Carefully

The XRP Ledger uses destination tags to route funds to the correct account on exchanges.

If a platform provides a tag, copy it exactly.

Missing or incorrect tags and wallet address can delay transfers or make recovery difficult.

Use AUSTRAC-Registered Exchanges

Australian exchanges registered with AUSTRAC support compliant AUD deposits and withdrawals.

They also keep transaction records that help with tax reporting.

Save deposit confirmations and export trade histories regularly.

Match Wallet Type to Your Holding Period

For long-term storage, hardware wallets offer stronger protection.

For smaller balances and regular transfers, non-custodial mobile wallets provide flexibility while keeping you in control of your private keys.

ALSO READ: Is XRP Worth Investing Today?

FAQs

Can Australians Buy XRP?

Yes. Multiple Australian and international exchanges list XRP and accept AUD deposits. Use an AUSTRAC-registered provider for fiat rails.

Is XRP Legal In Australia?

Yes. Australia regulates digital currency exchanges under AML/CTF laws and ASIC guidance covers when digital assets fall under financial services law. Regulation continues to evolve.

What Fees Should I Expect?

Fees vary: instant buys often carry higher spreads or flat premiums; order-book trading uses maker/taker fees that fall with volume. Check each exchange’s published fee schedule before trading.

Do I Need A Destination Tag When Sending XRP?

Often yes when sending to an exchange or a custodial service. The XRP Ledger uses destination tags to route funds to specific user accounts. Always copy the tag exactly.

Can I Use A Hardware Wallet For XRP?

Yes. Major hardware wallets support XRP; check the device’s official compatibility list and buy from an authorised seller.

How Is Crypto Taxed In Australia?

Many crypto transactions trigger CGT events. Keep detailed records of buys, sells, swaps and income and consult a tax adviser for personal advice.

Conclusion

Buying XRP in Australia is simplest when you choose platforms that fit your goals.

Use AUSTRAC-registered exchanges for reliable AUD deposits and clear records, compare total fees before trading, and secure long-term holdings in a private wallet.

Careful transfers and good record-keeping reduce risk and avoid unnecessary costs.

Before you buy XRP, in the next few days we will publish our next members premium crypto alert and reveal some key Cryptocurrencies with explosive potential.